Answered step by step

Verified Expert Solution

Question

1 Approved Answer

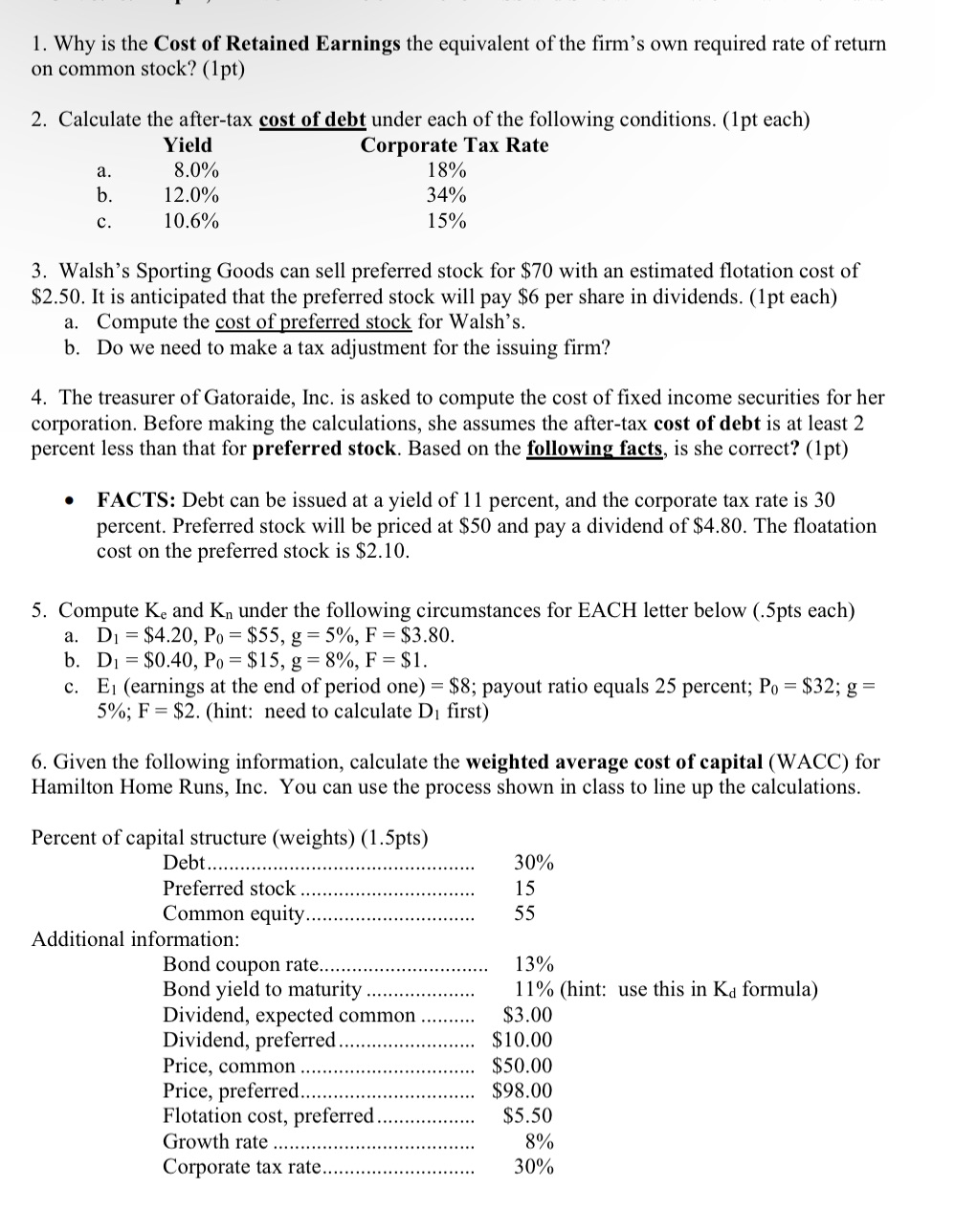

1. Why is the Cost of Retained Earnings the equivalent of the firm's own required rate of return on common stock? (1pt) 2. Calculate

1. Why is the Cost of Retained Earnings the equivalent of the firm's own required rate of return on common stock? (1pt) 2. Calculate the after-tax cost of debt under each of the following conditions. (1pt each) a. Yield 8.0% b. 12.0% C. 10.6% Corporate Tax Rate 18% 34% 15% 3. Walsh's Sporting Goods can sell preferred stock for $70 with an estimated flotation cost of $2.50. It is anticipated that the preferred stock will pay $6 per share in dividends. (1pt each) a. Compute the cost of preferred stock for Walsh's. b. Do we need to make a tax adjustment for the issuing firm? 4. The treasurer of Gatoraide, Inc. is asked to compute the cost of fixed income securities for her corporation. Before making the calculations, she assumes the after-tax cost of debt is at least 2 percent less than that for preferred stock. Based on the following facts, is she correct? (1pt) FACTS: Debt can be issued at a yield of 11 percent, and the corporate tax rate is 30 percent. Preferred stock will be priced at $50 and pay a dividend of $4.80. The floatation cost on the preferred stock is $2.10. 5. Compute Ke and Kn under the following circumstances for EACH letter below (.5pts each) a. D $4.20, Po= $55, g = 5%, F = $3.80. b. D $0.40, Po = $15, g = 8%, F = $1. c. E (earnings at the end of period one) = $8; payout ratio equals 25 percent; Po = $32; g 5%; F = $2. (hint: need to calculate D first) 6. Given the following information, calculate the weighted average cost of capital (WACC) for Hamilton Home Runs, Inc. You can use the process shown in class to line up the calculations. Percent of capital structure (weights) (1.5pts) Debt...... Preferred stock Common equity. 30% 15 55 Additional information: Bond coupon rate.. 13% Bond yield to maturity. Dividend, expected common 11% (hint: use this in Ka formula) $3.00 Dividend, preferred. $10.00 Price, common $50.00 Price, preferred.. $98.00 Flotation cost, preferred. $5.50 Growth rate. 8% Corporate tax rate.. 30%

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 The cost of retained earnings is equivalent to the firms own required rate of return on common stock because retained earnings represent the internally generated funds that could have been distribut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642c1c2df753_974498.pdf

180 KBs PDF File

6642c1c2df753_974498.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started