Question

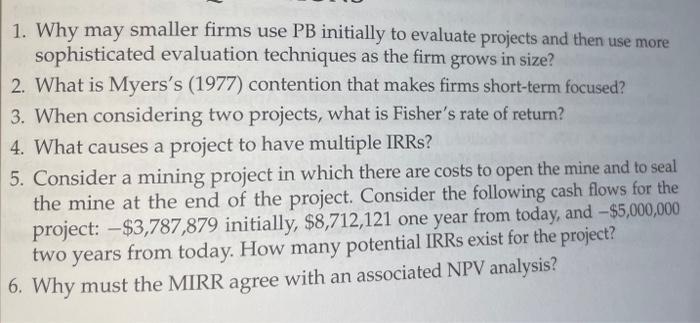

1. Why may smaller firms use PB initially to evaluate projects and then use more sophisticated evaluation techniques as the firm grows in size?

1. Why may smaller firms use PB initially to evaluate projects and then use more sophisticated evaluation techniques as the firm grows in size? 2. What is Myers's (1977) contention that makes firms short-term focused? 3. When considering two projects, what is Fisher's rate of return? 4. What causes a project to have multiple IRRs? 5. Consider a mining project in which there are costs to open the mine and to seal the mine at the end of the project. Consider the following cash flows for the project: -$3,787,879 initially, $8,712,121 one year from today, and -$5,000,000 two years from today. How many potential IRRs exist for the project? 6. Why must the MIRR agree with an associated NPV analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J . chris leach, Ronald w. melicher

4th edition

538478152, 978-0538478151

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App