Question

1.) With a discount rate of 4%, the cash outflow for project A is: 2.) With a discount rate of 8%, the cash outflow for

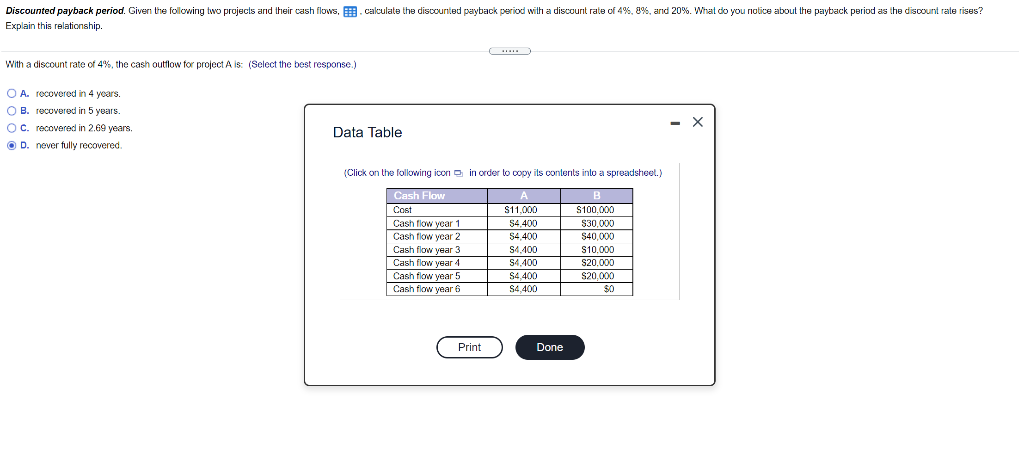

1.) With a discount rate of 4%, the cash outflow for project A is:

2.) With a discount rate of 8%, the cash outflow for project A is:

3.) With a discount rate of 20%, the cash outflow for project A is:

4.) With a discount rate of 4%, the cash outflow for project B is:

5.) With a discount rate of 8%, the cash outflow for project B is:

6.) With a discount rate of 20%, the cash outflow for project B is:

7.) as the discount rate increases, the discounted payback period (1) (blank). The reason is that the future dollars are worth (2) (blank) in present value as the discount rate increases requiring (3) (blank) future dollars to recover the present value of the outlay.

(1) decreases, increases (2) more, less (3) more, less

Discounted payback period. Given the following two projects and their cash flows, calculate the discounted payback period with a discount rate of 4%, 8%, and 20%. What do you notice about the payback period as the discount rate rises? Explain this relationship. With a discount rate of 4%, the cash outflow for project Ais: (Select the best response.) O A recovered in 4 years. O B. recovered in 5 years. OC. recovered in 2.69 years, OD. never fully recovered Data Table (Click on the following icon in order to copy ils contents into a spreadsheet.) Cash Flow Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 S11,000 54 400 54 400 S4.400 S4.400 $4.400 S4 400 B S100.000 $30,000 $40.000 S10.000 S20.000 $20,000 $0 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started