Answered step by step

Verified Expert Solution

Question

1 Approved Answer

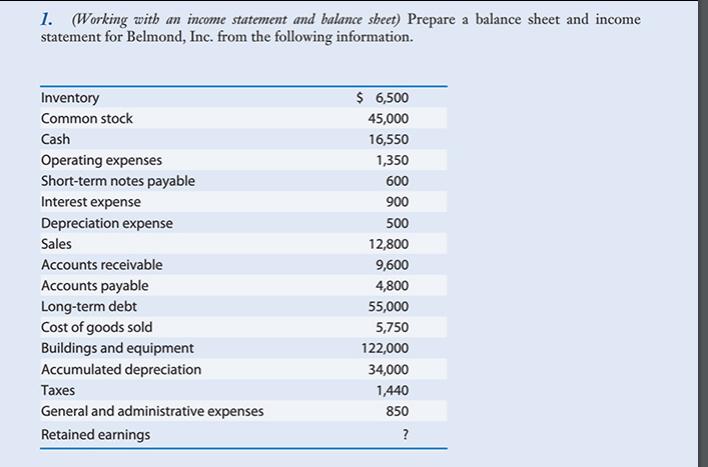

1. (Working with an income statement and balance sheet) Prepare a balance sheet and income statement for Belmond, Inc. from the following information. Inventory

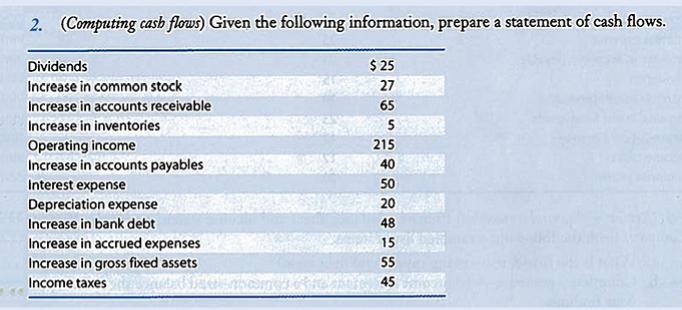

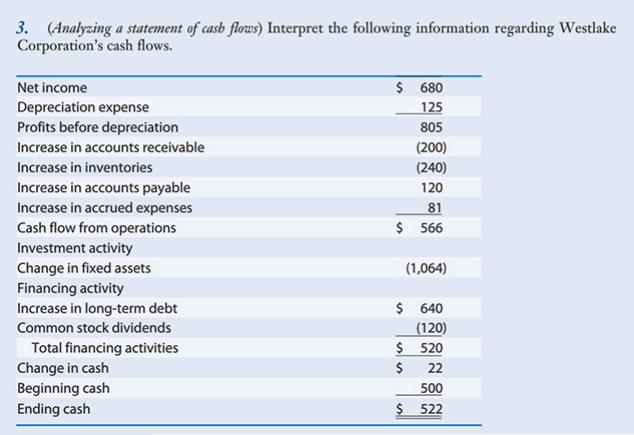

1. (Working with an income statement and balance sheet) Prepare a balance sheet and income statement for Belmond, Inc. from the following information. Inventory $ 6,500 Common stock 45,000 Cash 16,550 1,350 Operating expenses Short-term notes payable 600 Interest expense 900 Depreciation expense 500 Sales 12,800 Accounts receivable 9,600 4,800 Accounts payable Long-term debt 55,000 Cost of goods sold 5,750 Buildings and equipment 122,000 Accumulated depreciation 34,000 Taxes 1,440 General and administrative expenses 850 Retained earnings ? 2. (Computing cash flows) Given the following information, prepare a statement of cash flows. Dividends $25 Increase in common stock 27 Increase in accounts receivable 65 5 Increase in inventories Operating income 215 40 Increase in accounts payables Interest expense 50 20 Depreciation expense Increase in bank debt 48 Increase in accrued expenses Increase in gross fixed assets Income taxes A 15 55 mones chic 45 200097 3. (Analyzing a statement of cash flows) Interpret the following information regarding Westlake Corporation's cash flows. Net income $ 680 Depreciation expense 125 Profits before depreciation 805 Increase in accounts receivable (200) Increase in inventories (240) Increase in accounts payable 120 Increase in accrued expenses 81 $ 566 Cash flow from operations Investment activity Change in fixed assets Financing activity (1,064) Increase in long-term debt $ 640 Common stock dividends (120) Total financing activities $ 520 Change in cash $ 22 Beginning cash 500 Ending cash $ 522

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare a balance sheet and income statement for Belmond Inc Prepare a trial balance to figure out the missing retained earnings balance In this case retained earnings is calculated by deducting the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

628caa61578e7_18904.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started