Answered step by step

Verified Expert Solution

Question

1 Approved Answer

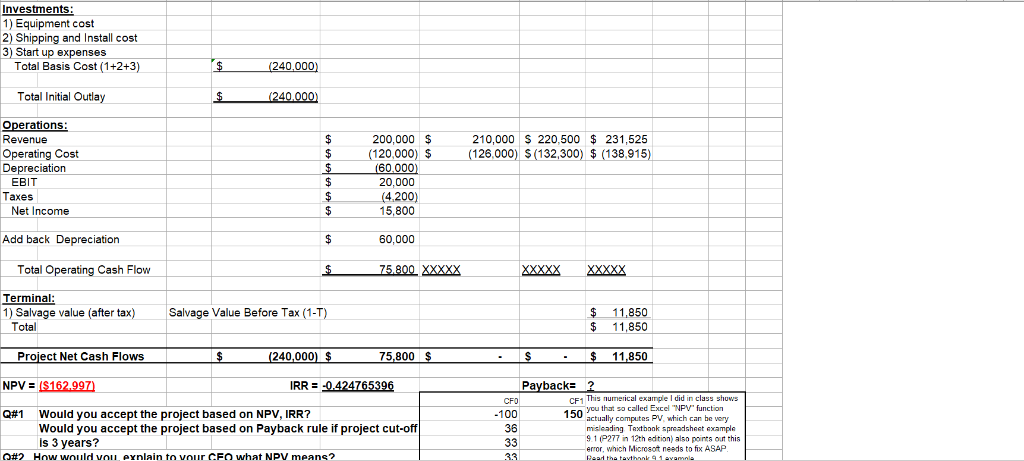

#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years?

#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years?

#2 How would you explain to your CEO what NPV means?

#3 What are advantages and disadvantages of using only Payback method?

Investments 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) Total Initial Outlay Operations: Revenue 200,000 $ 210,000 S 220,500 $ 231,525 $(120,000) $ Operating Cost Depreciation (126,000) S (132,300) $ (138,915) 20,000 EBIT 4,200) 15,800 Taxes Net Income 60,000 Add back Depreciation Total Operating Cash Flow Terminal 1) Salvage value (after tax) Total Salvage Value Before Tax (1 -T $ 11,850 $ 11,850 11,850 Project Net Cash Flows 240,000 75,800 Payback 2 This numerical example I did in class shows ycu that so called Excel "NPV" function 150 100 Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? actually computes PV, which can be wery misleading Taxthonk spreadsheet example 91P277 in 12th edition) also points out this error, which Microsot needs to fix ASAP 36 tha tavthnnk 91

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started