Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Write a short note on three of the following. Each answer should be no longer, than two pages long. (a) In the past,

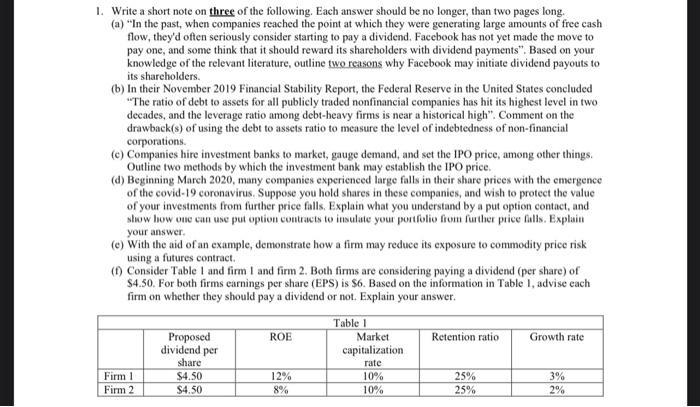

1. Write a short note on three of the following. Each answer should be no longer, than two pages long. (a) "In the past, when companies reached the point at which they were generating large amounts of free cash flow, they'd often seriously consider starting to pay a dividend. Facebook has not yet made the move to pay one, and some think that it should reward its shareholders with dividend payments". Based on your knowledge of the relevant literature, outline two reasons why Facebook may initiate dividend payouts to its shareholders. (b) In their November 2019 Financial Stability Report, the Federal Reserve in the United States concluded "The ratio of debt to assets for all publicly traded nonfinancial companies has hit its highest level in two decades, and the leverage ratio among debt-heavy firms is near a historical high". Comment on the drawback(s) of using the debt to assets ratio to measure the level of indebtedness of non-financial corporations. (c) Companies hire investment banks to market, gauge demand, and set the IPO price, among other things. Outline two methods by which the investment bank may establish the IPO price. (d) Beginning March 2020, many companies experienced large falls in their share prices with the emergence of the covid-19 coronavirus. Suppose you hold shares in these companies, and wish to protect the value of your investments from further price falls. Explain what you understand by a put option contact, and show how one can use put option contracts to insulate your portfolio from further price falls. Explain your answer. (e) With the aid of an example, demonstrate how a firm may reduce its exposure to commodity price risk using a futures contract. (f) Consider Table 1 and firm I and firm 2. Both firms are considering paying a dividend (per share) of $4.50. For both firms earnings per share (EPS) is $6. Based on the information in Table 1, advise each firm on whether they should pay a dividend or not. Explain your answer. Firm 1 Firm 2 Proposed dividend per share $4.50 $4.50 ROE 12% 8% Table 1 Market capitalization rate 10% 10% Retention ratio 25% 25% Growth rate 3% 2%

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepwise calculations for each part a Facebook dividend payout reasons 1 Signaling theo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started