Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Xerox preferred stock pays an 8.25% dividend on a $50 par value. Suppose our required rate of return on Xerox preferred stock is

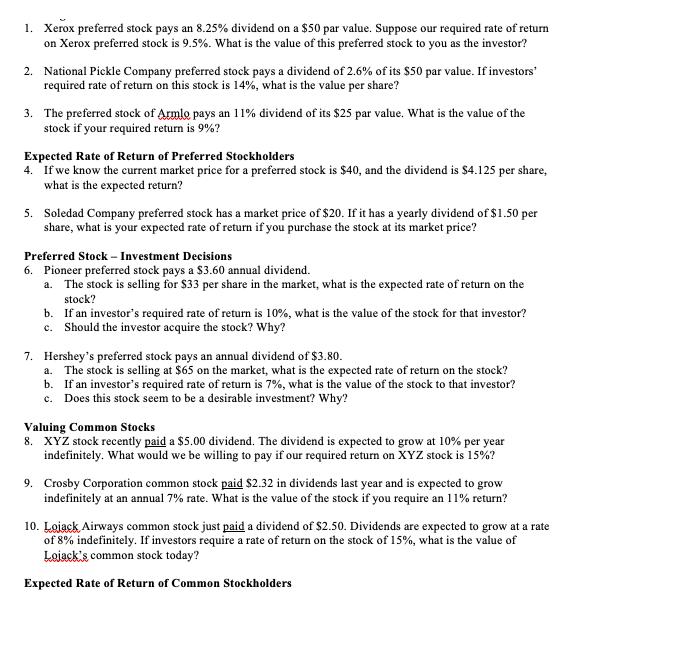

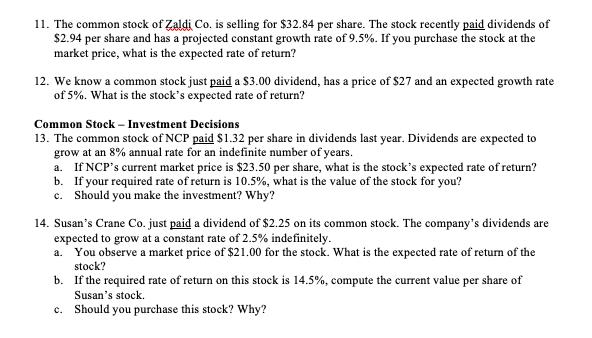

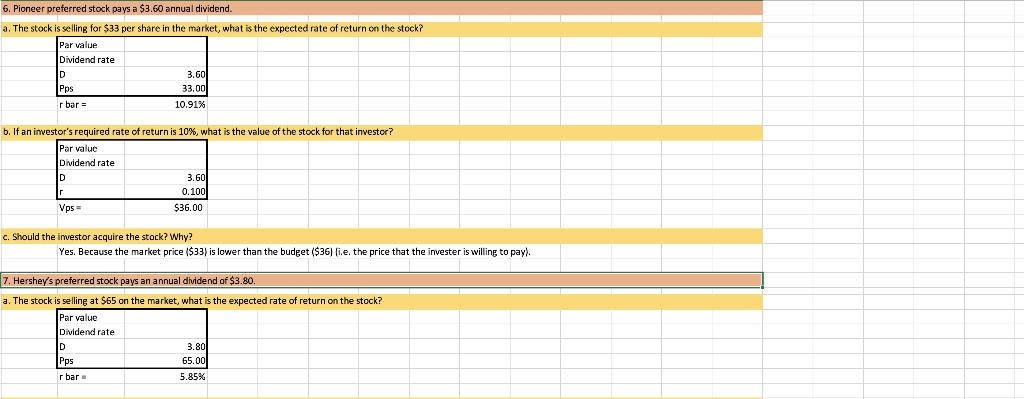

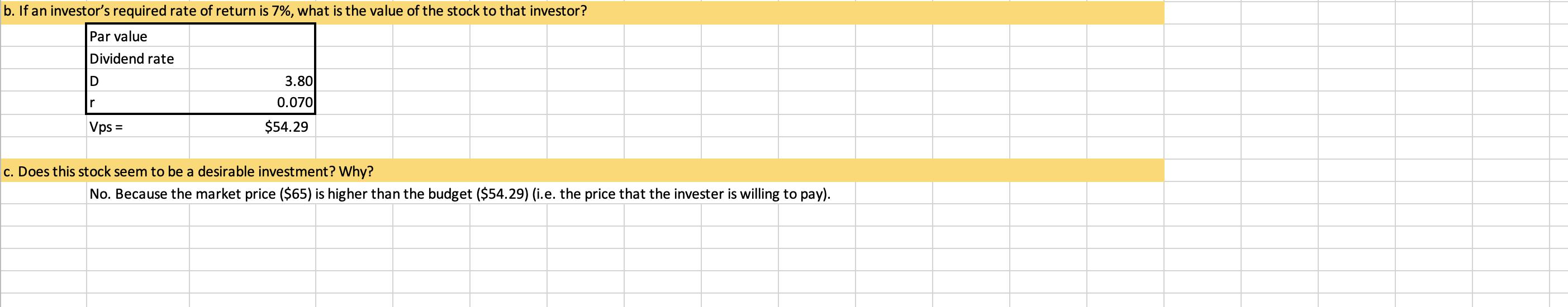

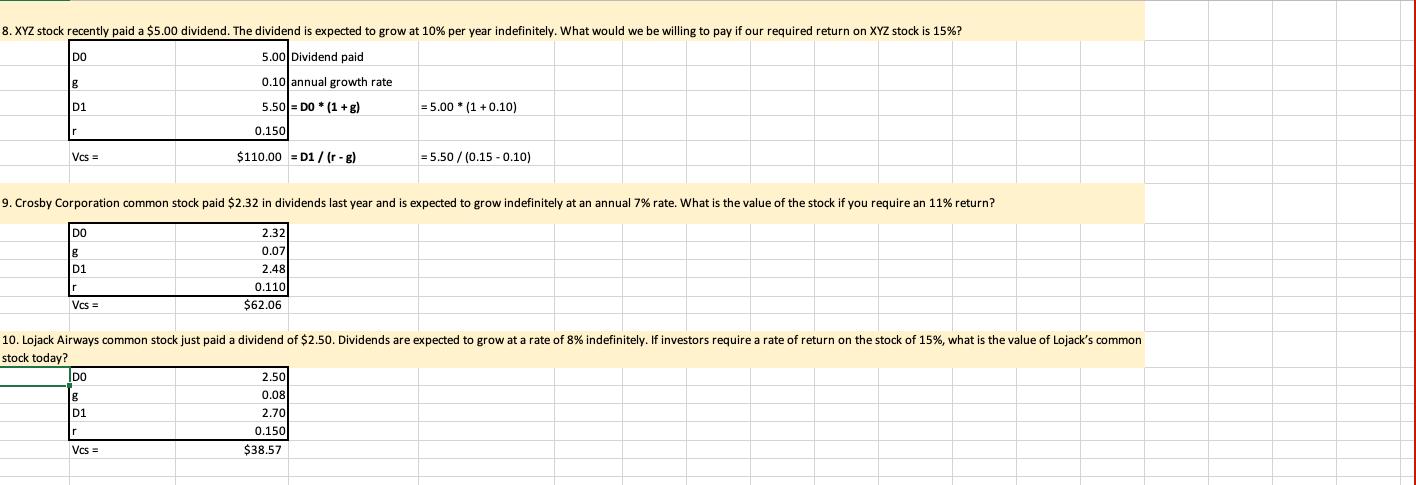

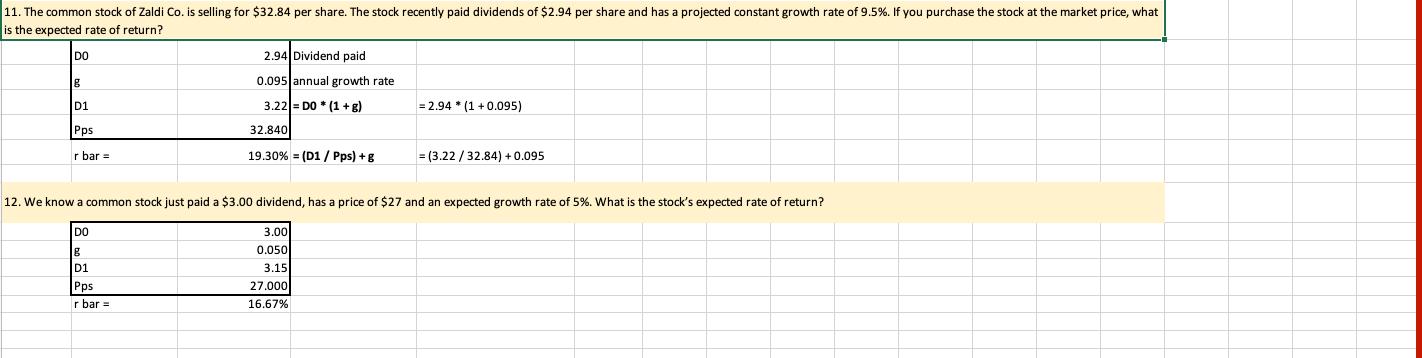

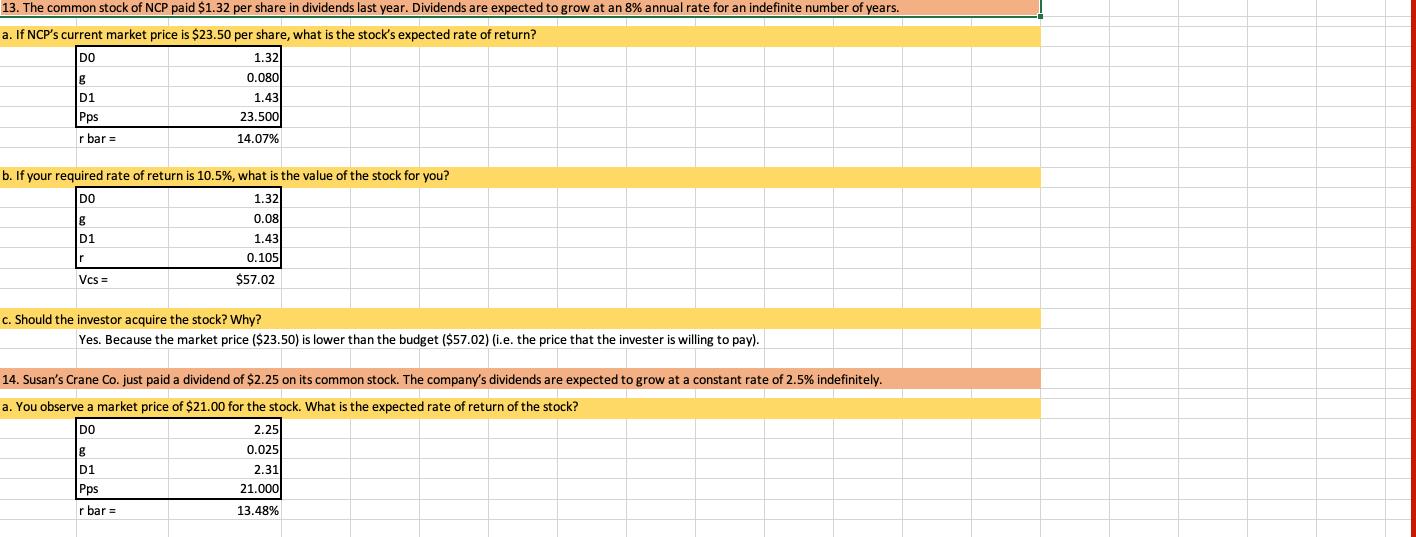

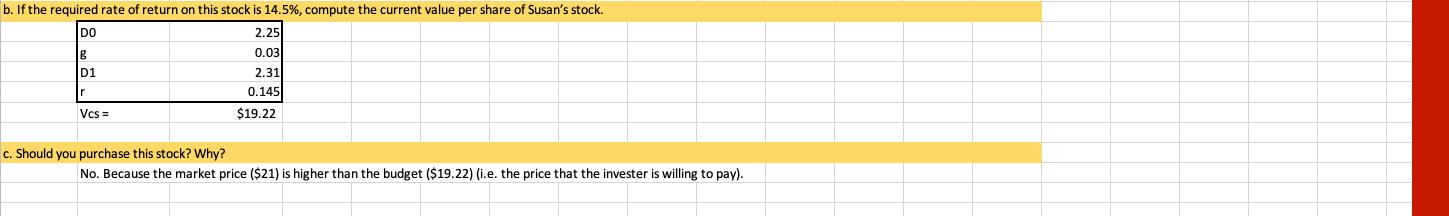

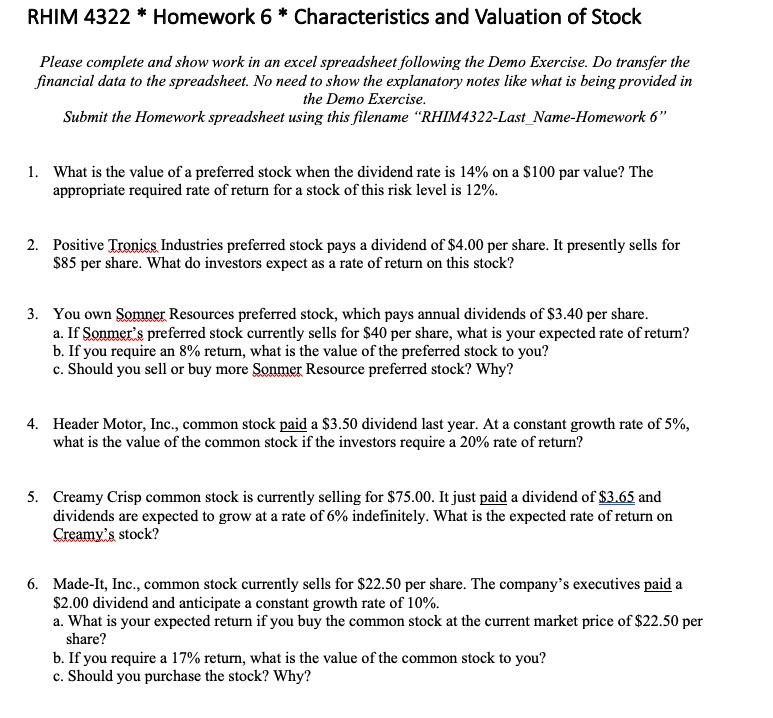

1. Xerox preferred stock pays an 8.25% dividend on a $50 par value. Suppose our required rate of return on Xerox preferred stock is 9.5%. What is the value of this preferred stock to you as the investor? 2. National Pickle Company preferred stock pays a dividend of 2.6% of its $50 par value. If investors' required rate of return on this stock is 14%, what is the value per share? 3. The preferred stock of Armlo pays an 11% dividend of its $25 par value. What is the value of the stock if your required return is 9%? Expected Rate of Return of Preferred Stockholders 4. If we know the current market price for a preferred stock is $40, and the dividend is $4.125 per share, what is the expected return? 5. Soledad Company preferred stock has a market price of $20. If it has a yearly dividend of $1.50 per share, what is your expected rate of return if you purchase the stock at its market price? Preferred Stock - Investment Decisions 6. Pioneer preferred stock pays a $3.60 annual dividend. a. The stock is selling for $33 per share in the market, what is the expected rate of return on the stock? b. If an investor's required rate of return is 10%, what is the value of the stock for that investor? c. Should the investor acquire the stock? Why? 7. Hershey's preferred stock pays an annual dividend of $3.80. a. The stock is selling at $65 on the market, what is the expected rate of return on the stock? b. If an investor's required rate of return is 7%, what is the value of the stock to that investor? c. Does this stock seem to be a desirable investment? Why? Valuing Common Stocks 8. XYZ stock recently paid a $5.00 dividend. The dividend is expected to grow at 10% per year indefinitely. What would we be willing to pay if our required return on XYZ stock is 15%? 9. Crosby Corporation common stock paid $2.32 in dividends last year and is expected to grow indefinitely at an annual 7% rate. What is the value of the stock if you require an 11% return? 10. Lojack Airways common stock just paid a dividend of $2.50. Dividends are expected to grow at a rate of 8% indefinitely. If investors require a rate of return on the stock of 15%, what is the value of Lojack's common stock today? Expected Rate of Return of Common Stockholders 11. The common stock of Zaldi Co. is selling for $32.84 per share. The stock recently paid dividends of $2.94 per share and has a projected constant growth rate of 9.5%. If you purchase the stock at the market price, what is the expected rate of return? 12. We know a common stock just paid a $3.00 dividend, has a price of $27 and an expected growth rate of 5%. What is the stock's expected rate of return? Common Stock - Investment Decisions 13. The common stock of NCP paid $1.32 per share in dividends last year. Dividends are expected to grow at an 8% annual rate for an indefinite number of years. a. If NCP's current market price is $23.50 per share, what is the stock's expected rate of return? b. If your required rate of return is 10.5%, what is the value of the stock for you? c. Should you make the investment? Why? 14. Susan's Crane Co. just paid a dividend of $2.25 on its common stock. The company's dividends are expected to grow at a constant rate of 2.5% indefinitely. a. You observe a market price of $21.00 for the stock. What is the expected rate of return of the stock? b. If the required rate of return on this stock is 14.5%, compute the current value per share of Susan's stock. c. Should you purchase this stock? Why? 1. Xerox preferred stock pays an 8.25% dividend on a $50 par value. Suppose our required rate of return on Xerox preferred stock is 9.5%. What is the value of this preferred stock to you as the investor? Par value 50 Dividend rate D r Vps = Par value Dividend rate D r Vps = 2. National Pickle Company preferred stock pays a dividend of 2.6% of its $50 par value. If investors' required rate of return on this stock is 14%, what is the value per share? 0.0825 4.125 - Par value * Dividend rate 0.095 $43.42 = D/r D r Vps = Valuing PS 50 0.026 1.30 0.140 $9.29 = 50*0.0825 3. The preferred stock of Armlo pays an 11% dividend of its $25 par value. What is the value of the stock if your required return is 9%? Par value Dividend rate 25 0.11 2.75 0.090 = 4.125/0.095 $30.56 = 4.125 Expected Rate of Return PS Investment Decisions PS Valuing CS Expected Rate of Return CS Investment Decisions CS + 4. If we know the current market price for a preferred stock is $40, and the dividend is $4.125 per share, what is the expected return? Par value Dividend rate D Pps r bar = D Pps r bar = 4.125 No need to calculate D 40.00 5. Soledad Company preferred stock has a market price of $20. If it has a yearly dividend of $1.50 per share, what is your expected rate of return if you purchase the stock at its market price? Par value Dividend rate Valuing PS 10.31% = D/ Pps 1.50 20.00 7.50% = 4.125/40 Expected Rate of Return PS Investment Decisions PS Valuing CS Expected Rate of Return CS Investment Decisions CS + 6. Pioneer preferred stock pays a $3.60 annual dividend. a. The stock is selling for $33 per share in the market, what is the expected rate of return on the stock? Par value Dividend rate D Pps r bar = b. If an investor's required rate of return is 10%, what is the value of the stock for that investor? Par value Dividend rate D r Vps = 3.60 33.00 10.91% 3.60 0.100 $36.00 c. Should the investor acquire the stock? Why? D Pps r bar= Yes. Because the market price ($33) is lower than the budget ($36) (i.e. the price that the invester is willing to pay). 7. Hershey's preferred stock pays an annual dividend of $3.80. a. The stock is selling at $65 on the market, what is the expected rate of return on the stock? Par value Dividend rate 3.80 65.00 5.85% b. If an investor's required rate of return is 7%, what is the value of the stock to that investor? Par value Dividend rate D r Vps = 3.80 0.070 $54.29 c. Does this stock seem to be a desirable investment? Why? No. Because the market price ($65) is higher than the budget ($54.29) (i.e. the price that the invester is willing to pay). 8. XYZ stock recently paid a $5.00 dividend. The dividend is expected to grow at 10% per year indefinitely. What would we be willing to pay if our required return on XYZ stock is 15%? 5.00 Dividend paid 0.10 annual growth rate 5.50 DO*(1+g) 0.150 DO g D1 r Vcs= DO g D1 r Vcs= 9. Crosby Corporation common stock paid $2.32 in dividends last year and is expected to grow indefinitely at an annual 7% rate. What is the value of the stock if you require an 11% return? 2.32 0.07 2.48 0.110 DO g D1 $110.00 D1/(r-g) r Vcs= $62.06 10. Lojack Airways common stock just paid a dividend of $2.50. Dividends are expected to grow at a rate of 8% indefinitely. If investors require a rate of return on the stock of 15%, what is the value of Lojack's common stock today? 5.00 (1 +0.10) 2.50 0.08 2.70 0.150 = 5.50 / (0.15-0.10) $38.57 11. The common stock of Zaldi Co. is selling for $32.84 per share. The stock recently paid dividends of $2.94 per share and has a projected constant growth rate of 9.5%. If you purchase the stock at the market price, what is the expected rate of return? DO g D1 Pps r bar = DO g D1 2.94 Dividend paid 0.095 annual growth rate 3.22 DO*(1 + g) 32.840 19.30% = ( D1 / Pps) +g Pps r bar = 12. We know a common stock just paid a $3.00 dividend, has a price of $27 and an expected growth rate of 5%. What is the stock's expected rate of return? 3.00 0.050 3.15 = 2.94 (1+0.095) 27.000 16.67% = (3.22/32.84) + 0.095 13. The common stock of NCP paid $1.32 per share in dividends last year. Dividends are expected to grow at an 8% annual rate for an indefinite number of years. a. If NCP's current market price is $23.50 per share, what is the stock's expected rate of return? DO 1.32 0.080 g D1 Pps 1.43 23.500 14.07% r bar = b. If your required rate of return is 10.5%, what is the value of the stock for you? DO 1.32 0.08 1.43 0.105 $57.02 g D1 r Vcs= c. Should the investor acquire the stock? Why? Yes. Because the market price ($23.50) is lower than the budget ($57.02) (i.e. the price that the invester is willing to pay). 14. Susan's Crane Co. just paid a dividend of $2.25 on its common stock. The company's dividends are expected to grow at a constant rate of 2.5% indefinitely. a. You observe a market price of $21.00 for the stock. What is the expected rate of return of the stock? DO g D1 Pps r bar = 2.25 0.025 2.31 21.000 13.48% b. If the required rate of return on this stock is 14.5%, compute the current value per share of Susan's stock. 2.25 0.03 2.31 0.145 $19.22 DO g D1 Vcs= c. Should you purchase this stock? Why? No. Because the market price ($21) is higher than the budget ($19.22) (i.e. the price that the invester is willing to pay). RHIM 4322 * Homework 6 * Characteristics and Valuation of Stock Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the financial data to the spreadsheet. No need to show the explanatory notes like what is being provided in the Demo Exercise. Submit the Homework spreadsheet using this filename "RHIM4322-Last Name-Homework 6" 1. What is the value of a preferred stock when the dividend rate is 14% on a $100 par value? The appropriate required rate of return for a stock of this risk level is 12%. 2. Positive Tronics Industries preferred stock pays a dividend of $4.00 per share. It presently sells for $85 per share. What do investors expect as a rate of return on this stock? 3. You own Somner Resources preferred stock, which pays annual dividends of $3.40 per share. a. If Sonmer's preferred stock currently sells for $40 per share, what is your expected rate of return? b. If you require an 8% return, what is the value of the preferred stock to you? c. Should you sell or buy more Sonmer Resource preferred stock? Why? 4. Header Motor, Inc., common stock paid a $3.50 dividend last year. At a constant growth rate of 5%, what is the value of the common stock if the investors require a 20% rate of return? 5. Creamy Crisp common stock is currently selling for $75.00. It just paid a dividend of $3.65 and dividends are expected to grow at a rate of 6% indefinitely. What is the expected rate of return on Creamy's stock? 6. Made-It, Inc., common stock currently sells for $22.50 per share. The company's executives paid a $2.00 dividend and anticipate a constant growth rate of 10%. a. What is your expected return if you buy the common stock at the current market price of $22.50 per share? b. If you require a 17% return, what is the value of the common stock to you? c. Should you purchase the stock? Why?

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started