Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data

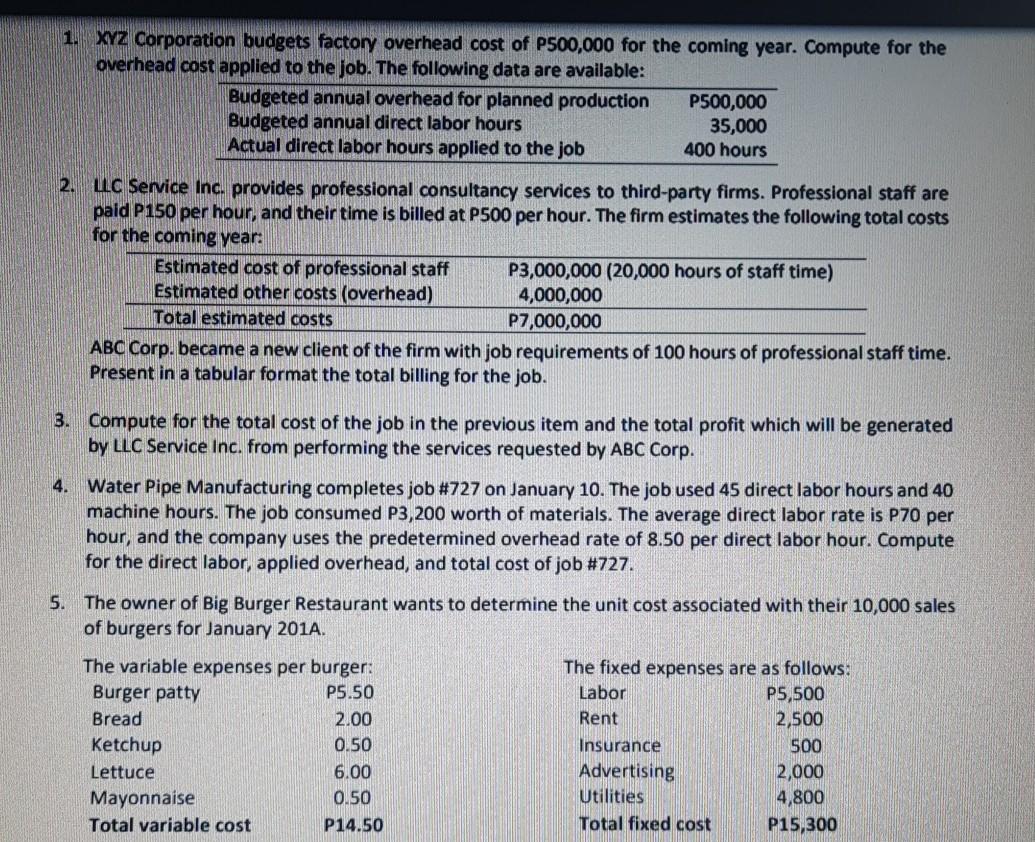

1. XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data are available: Budgeted annual overhead for planned production P500,000 Budgeted annual direct labor hours 35,000 Actual direct labor hours applied to the job 400 hours 2. UC Service Inc. provides professional consultancy services to third-party firms. Professional staff are paid P150 per hour, and their time is billed at P500 per hour. The firm estimates the following total costs for the coming year: Estimated cost of professional staff P3,000,000 (20,000 hours of staff time) Estimated other costs (overhead) 4,000,000 Total estimated costs P7,000,000 ABC Corp. became a new client of the firm with job requirements of 100 hours of professional staff time. Present in a tabular format the total billing for the job. 3. Compute for the total cost of the job in the previous item and the total profit which will be generated by LLC Service Inc. from performing the services requested by ABC Corp. 4. Water Pipe Manufacturing completes job #727 on January 10. The job used 45 direct labor hours and 40 machine hours. The job consumed P3,200 worth of materials. The average direct labor rate is P70 per hour, and the company uses the predetermined overhead rate of 8.50 per direct labor hour. Compute for the direct labor, applied overhead, and total cost of job #727. 5. The owner of Big Burger Restaurant wants to determine the unit cost associated with their 10,000 sales of burgers for January 201A. The variable expenses per burger: The fixed expenses are as follows: Burger patty P5.50 Labor P5,500 Bread 2.00 Rent 2,500 Ketchup 0.50 Insurance 500 Lettuce 6.00 Advertising 2,000 Mayonnaise 0.50 Utilities 4,800 Total variable cost P14.50 Total fixed cost P15,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started