(1) XYZ Corporation operates multiple divisions each of which operates a separate and distinct business line. On June 1, 2019, it distributes the assets

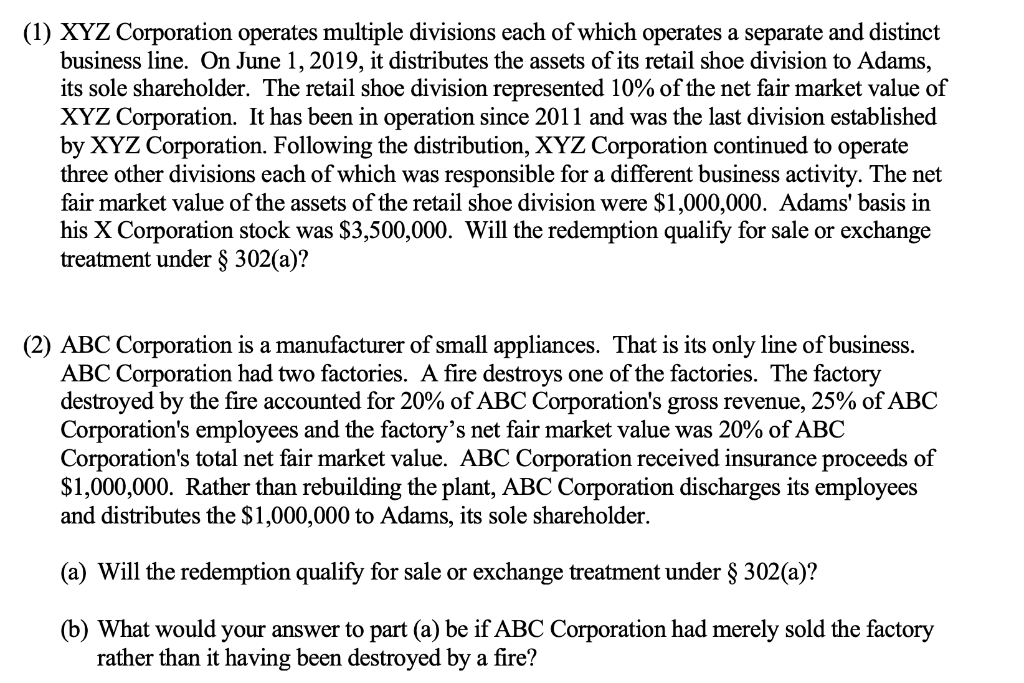

(1) XYZ Corporation operates multiple divisions each of which operates a separate and distinct business line. On June 1, 2019, it distributes the assets of its retail shoe division to Adams, its sole shareholder. The retail shoe division represented 10% of the net fair market value of XYZ Corporation. It has been in operation since 2011 and was the last division established by XYZ Corporation. Following the distribution, XYZ Corporation continued to operate three other divisions each of which was responsible for a different business activity. The net fair market value of the assets of the retail shoe division were $1,000,000. Adams' basis in his X Corporation stock was $3,500,000. Will the redemption qualify for sale or exchange treatment under 302(a)? (2) ABC Corporation is a manufacturer of small appliances. That is its only line of business. ABC Corporation had two factories. A fire destroys one of the factories. The factory destroyed by the fire accounted for 20% of ABC Corporation's gross revenue, 25% of ABC Corporation's employees and the factory's net fair market value was 20% of ABC Corporation's total net fair market value. ABC Corporation received insurance proceeds of $1,000,000. Rather than rebuilding the plant, ABC Corporation discharges its employees and distributes the $1,000,000 to Adams, its sole shareholder. (a) Will the redemption qualify for sale or exchange treatment under 302(a)? (b) What would your answer to part (a) be if ABC Corporation had merely sold the factory rather than it having been destroyed by a fire?

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 In order for the distribution to qualify for sale or exchange treatment under 302a the distributio...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started