Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) XYZ, Inc. sold 100 widgets to ABC, Inc. on 1/1/18 for $50 per widget on account. The sales agreement allows ACB return widgets that

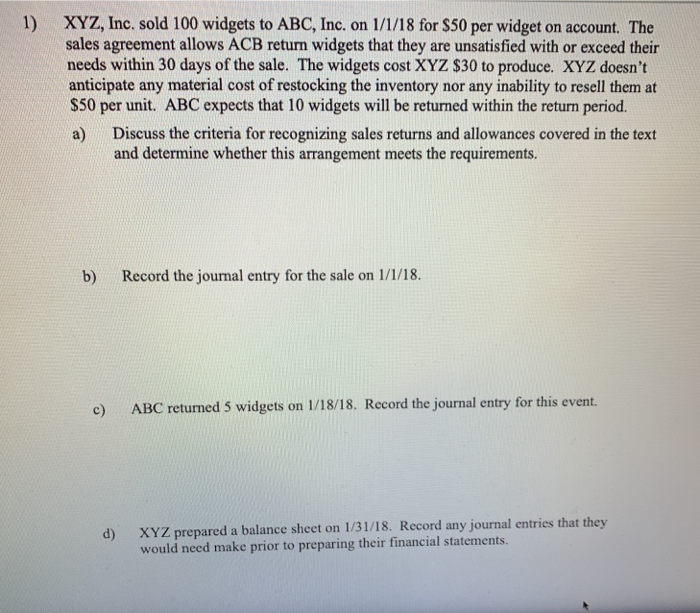

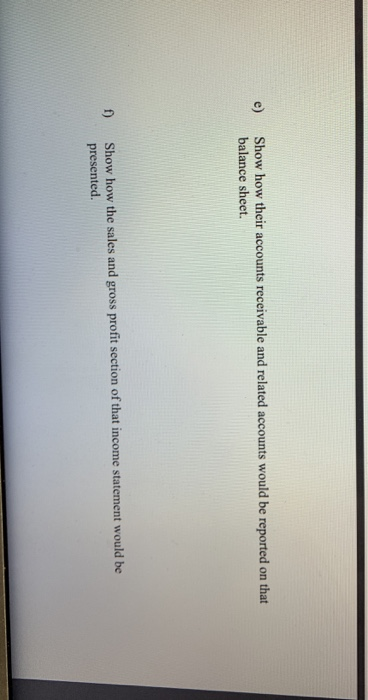

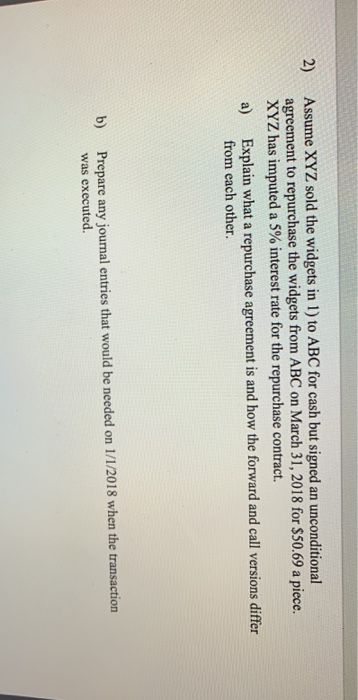

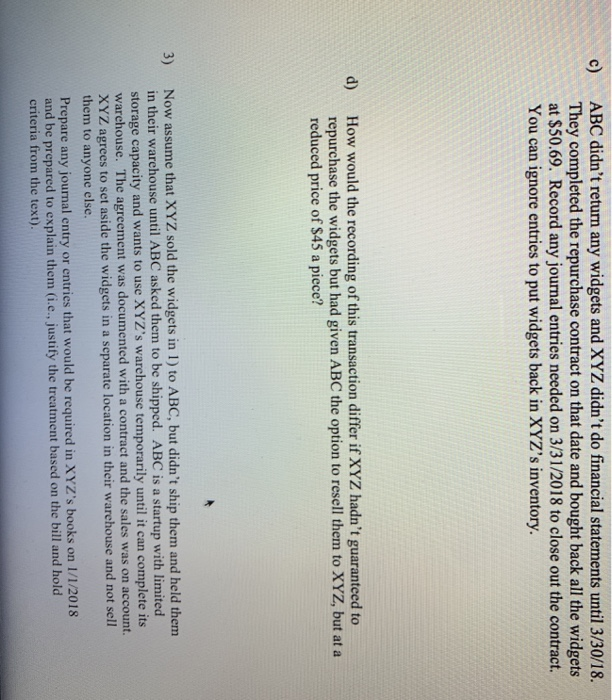

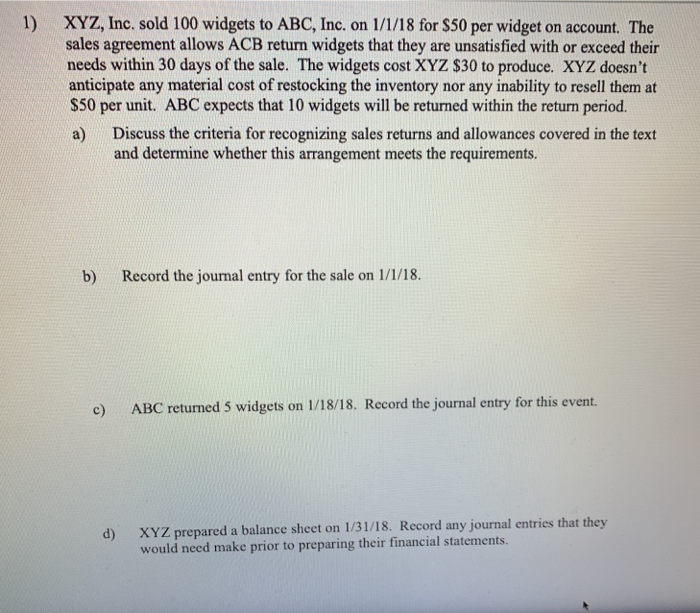

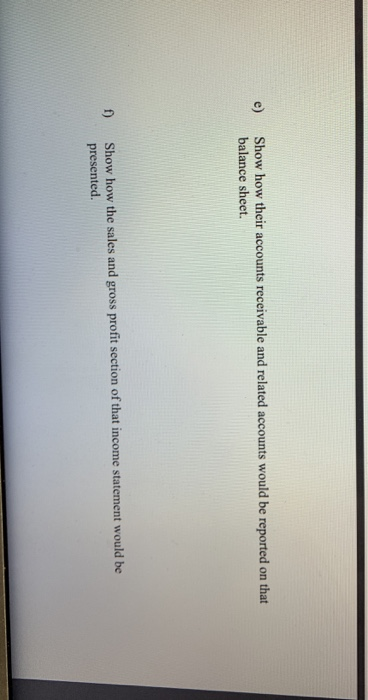

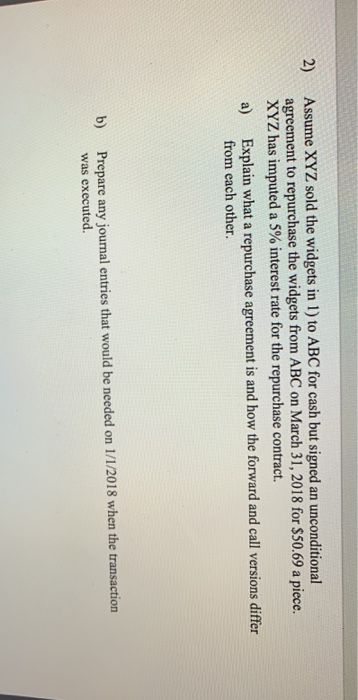

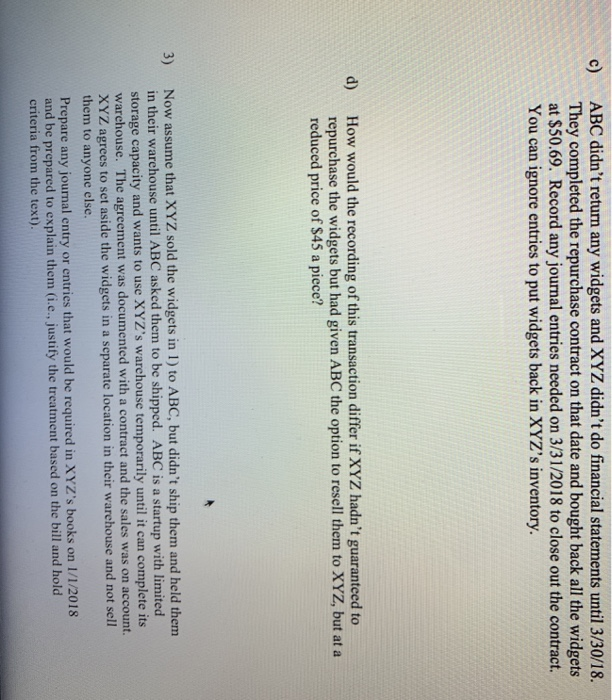

1) XYZ, Inc. sold 100 widgets to ABC, Inc. on 1/1/18 for $50 per widget on account. The sales agreement allows ACB return widgets that they are unsatisfied with or exceed their needs within 30 days of the sale. The widgets cost XYZ $30 to produce. XYZ doesn't anticipate any material cost of restocking the inventory nor any inability to resell them at $50 per unit. ABC expects that 10 widgets will be returned within the return period. a) Discuss the criteria for recognizing sales returns and allowances covered in the text and determine whether this arrangement meets the requirements. b) Record the journal entry for the sale on 1/1/18. c) ABC returned 5 widgets on 1/18/18. Record the journal entry for this event. d) XYZ prepared a balance sheet on 1/31/18. Record any journal entries that they would need make prior to preparing their financial statements. Assume XYZ sold the widgets in 1) to ABC for cash but signed an unconditional agreement to repurchase the widgets from ABC on March 31, 2018 for $50.69 a piece. XYZ has imputed a 5% interest rate for the repurchase contract. a) Explain what a repurchase agreement is and how the forward and call versions differ from each other. b) Prepare any journal entries that would be needed on 1/1/2018 when the transaction was executed. c) ABC didn't return any widgets and XYZ didn't do financial statements until 3/30/18. They completed the repurchase contract on that date and bought back all the widgets at $50.69. Record any journal entries needed on 3/31/2018 to close out the contract. You can ignore entries to put widgets back in XYZ's inventory. d) How would the recording of this transaction differ if XYZ hadn't guaranteed to repurchase the widgets but had given ABC the option to resell them to XYZ, but at a reduced price of $45 a piece? Now assume that XYZ sold the widgets in 1) to ABC, but didn't ship them and held them in their warehouse until ABC asked them to be shipped. ABC is a startup with limited storage capacity and wants to use XYZ's warehouse temporarily until it can complete its warehouse. The agreement was documented with a contract and the sales was on account. XYZ agrees to set aside the widgets in a separate location in their warehouse and not sell them to anyone else. Prepare any journal entry or entries that would be required in XYZ's books on 1/1/2018 and be prepared to explain them (i.e., justify the treatment based on the bill and hold criteria from the text)

1) XYZ, Inc. sold 100 widgets to ABC, Inc. on 1/1/18 for $50 per widget on account. The sales agreement allows ACB return widgets that they are unsatisfied with or exceed their needs within 30 days of the sale. The widgets cost XYZ $30 to produce. XYZ doesn't anticipate any material cost of restocking the inventory nor any inability to resell them at $50 per unit. ABC expects that 10 widgets will be returned within the return period. a) Discuss the criteria for recognizing sales returns and allowances covered in the text and determine whether this arrangement meets the requirements. b) Record the journal entry for the sale on 1/1/18. c) ABC returned 5 widgets on 1/18/18. Record the journal entry for this event. d) XYZ prepared a balance sheet on 1/31/18. Record any journal entries that they would need make prior to preparing their financial statements. Assume XYZ sold the widgets in 1) to ABC for cash but signed an unconditional agreement to repurchase the widgets from ABC on March 31, 2018 for $50.69 a piece. XYZ has imputed a 5% interest rate for the repurchase contract. a) Explain what a repurchase agreement is and how the forward and call versions differ from each other. b) Prepare any journal entries that would be needed on 1/1/2018 when the transaction was executed. c) ABC didn't return any widgets and XYZ didn't do financial statements until 3/30/18. They completed the repurchase contract on that date and bought back all the widgets at $50.69. Record any journal entries needed on 3/31/2018 to close out the contract. You can ignore entries to put widgets back in XYZ's inventory. d) How would the recording of this transaction differ if XYZ hadn't guaranteed to repurchase the widgets but had given ABC the option to resell them to XYZ, but at a reduced price of $45 a piece? Now assume that XYZ sold the widgets in 1) to ABC, but didn't ship them and held them in their warehouse until ABC asked them to be shipped. ABC is a startup with limited storage capacity and wants to use XYZ's warehouse temporarily until it can complete its warehouse. The agreement was documented with a contract and the sales was on account. XYZ agrees to set aside the widgets in a separate location in their warehouse and not sell them to anyone else. Prepare any journal entry or entries that would be required in XYZ's books on 1/1/2018 and be prepared to explain them (i.e., justify the treatment based on the bill and hold criteria from the text)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started