Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You and your spouse just had a baby. Ecstatic with the outstanding education you received at Korea University, you want to send baby

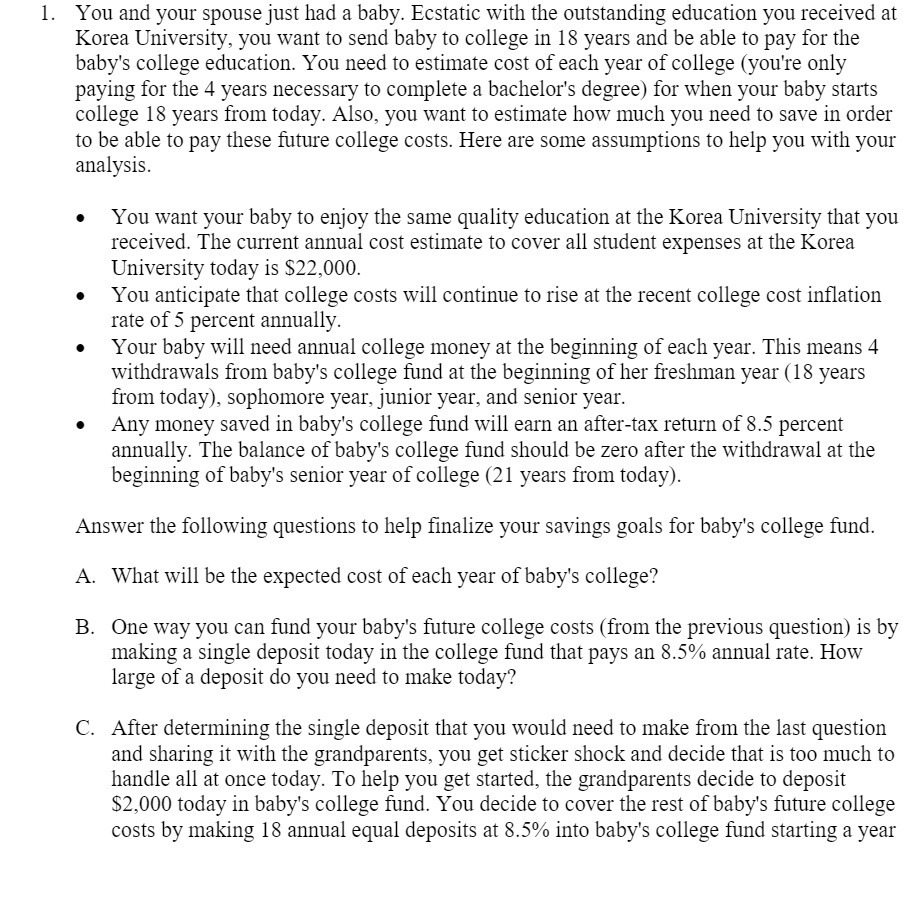

1. You and your spouse just had a baby. Ecstatic with the outstanding education you received at Korea University, you want to send baby to college in 18 years and be able to pay for the baby's college education. You need to estimate cost of each year of college (you're only paying for the 4 years necessary to complete a bachelor's degree) for when your baby starts college 18 years from today. Also, you want to estimate how much you need to save in order to be able to pay these future college costs. Here are some assumptions to help you with your analysis. You want your baby to enjoy the same quality education at the Korea University that you received. The current annual cost estimate to cover all student expenses at the Korea University today is $22,000. You anticipate that college costs will continue to rise at the recent college cost inflation rate of 5 percent annually. Your baby will need annual college money at the beginning of each year. This means 4 withdrawals from baby's college fund at the beginning of her freshman year (18 years from today), sophomore year, junior year, and senior year. Any money saved in baby's college fund will earn an after-tax return of 8.5 percent annually. The balance of baby's college fund should be zero after the withdrawal at the beginning of baby's senior year of college (21 years from today). Answer the following questions to help finalize your savings goals for baby's college fund. A. What will be the expected cost of each year of baby's college? B. One way you can fund your baby's future college costs (from the previous question) is by making a single deposit today in the college fund that pays an 8.5% annual rate. How large of a deposit do you need to make today? C. After determining the single deposit that you would need to make from the last question and sharing it with the grandparents, you get sticker shock and decide that is too much to handle all at once today. To help you get started, the grandparents decide to deposit $2,000 today in baby's college fund. You decide to cover the rest of baby's future college costs by making 18 annual equal deposits at 8.5% into baby's college fund starting a year

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

A Expected cost of each year of college Future cost after 18 years To account for inflation we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started