Question

1. You are a recent MBA graduate and were hired by the company as a business consultant. Your objective is to identify areas for improvement.

1. You are a recent MBA graduate and were hired by the company as a business consultant. Your objective is to identify areas for improvement. Present three business recommendations to management and state how this will impact the company's financial statements.

2. Why did company management think it was necessary to install an ABC system? Do you agree with their reasoning? Explain your answer.

3. Evaluate and recommend changes to the organizations cost drivers. State how this influences cost accounting results and business decision capabilities.

4. Is job order or process costing a viable option for the company. Why or why not?

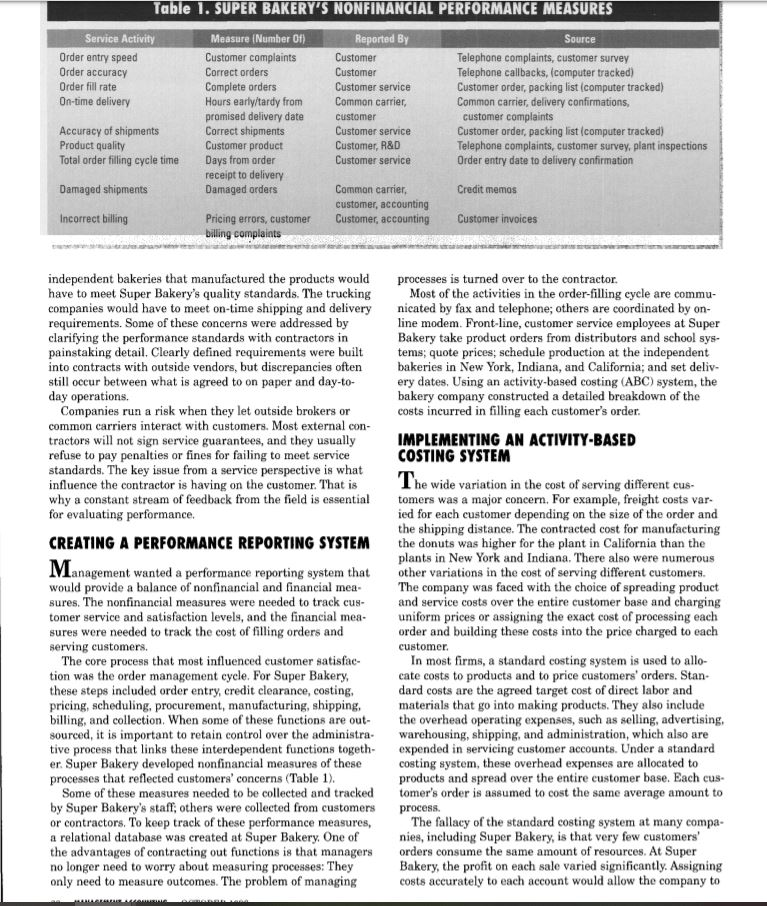

SUPERSTOCK Super Bakery, Inc., has been developed on the lines of a virtu- al corporation. This company, which was formed by former Pittsburgh Steelers' running back Franco Harris in 1983, is a sup- plier of donuts and other baked goods to the institutional food market. For the past 12 years, it has been gaining market share and establishing a firm foothold in the highly competitive institu- tional baked goods market. Instead of creating a large multifunctional organization to administer the business, the management of Super Bakery outsourced selling to a network of independent brokers and con- tracted out manufacturing, ware- housing, and shipping. Four regional sales managers guide and assist the independent bro- kers. A small office staff processes orders and handles credit and collections. Super Bakery handles strategic planning, marketing, R&D, and finance/accounting in-house, and Fran- co Harris hired a master baker to develop new products. The company also purchases ingredients and formulates and pro- duces its own dough. Super Bakery's major challenge has been to coordinate and control the various functional activities performed out- side the company by brokers and contractors. This challenge consists of a twofold problem of controlling the quality of ser- vice provided to customers and controlling the cost of these services Managers and employees at Super Bakery devel- oped a performance reporting and activity-based costing sys- tem that helped the company maintain control over out- sourced functions. BY TIM R.V DAVIS AND BRUCE L. DARLING, CMA Certificate of Merit na virtual corporation only the core, strategic functions of the business are performed inside the company. The remaining support activities are outsourced to a network of external companies that specialize in each function. These firms form functional alliances to manufacture products or provide services for customers. The virtual corporation posi- tions itself at the center of these relationships and serves as the catalyst that draws these cooperating companies together and organizes how the work will flow. The goal is to extract the maximum value-added from these partnerships while making the minimum investment in permanent staff, fixed assets, and working capital.! 18 MANAGEMENT ACCOUNTING OCTOBER 1996 management opts to outsource business functions, it can cre- ate serious difficulties. The loss of control of these functions and the problems of coordinating activities need to be consid- ered carefully. The service aspects of a manufacturing busi- ness sometimes may be more important, strategically, than the production aspects. Super Bakery was able to control product quality by supplying the dough, which contained its unique product formulations, to manufacturers. The contract- ed bakeries simply add water to the mix and follow the bak- ing instructions. The service elements of the business presented greater variability and risk. Management carefully researched which service activities were most important to customers before CUSTOMER SUPER BAKERY SERVICES SUPER BAKERY'S STRATEGIES When Super Bakery entered the institutional food busi- ness in the early '80s, the senior managers knew they faced an uphill battle. The market was mature with little growth in the baked goods segment. Members of the management team, however, had extensive experience in the institutional food business Marketing strategies and policies were devel- oped that followed standard industry practices closely. The first four years were disappointing for the company Penetrating the institutional food market proved more chal- lenging than management had thought, probably because Super Bakery followed industry practices too closely. Cus- tomers were not given any reason to buy from Super Bakery When management started questioning industry practices and began developing unique strategies and tactics, sales began to take off. First, Super Bakery targeted the school system segment of the institutional food market, which has been in a state of decline because of funding pressures and increasing govern- ment health requirements. Management felt that this cus- tomer segment was poorly served. The company pioneered "low-calorie, vitamin-enriched donuts that tasted delicious and met USDA guidelines." This strategy helped Super Bak- ery to grow annual sales while the sales of conventional, high-fat donuts were declining. Second, Super Bakery avoided the local market restric- tions of most fresh baked goods by refrigerating the product, vacuum sealing it, and distributing it nationally, a strategy that allowed Super Bakery to build a national presence in what was formerly a fragmented industry. Third, Super Bakery developed numerous ways of serving and supporting its customers such as distributors and school systems. They included helping customers obtain lower prices by acquiring government-supported commodities flour, butter, and fruit), cooperating with noncompeting sup- pliers by providing complete prepackaged meals to schools, and helping distributors reduce inventory carrying costs and avoid stockouts through reliable, just-in-time delivery. Fourth, Super Bakery reduced capital investment and overhead expense by contracting out major functions of the business. Super Bakery does not manufacture, sell, or dis- tribute its products. It is a virtual corporation. These strategies have helped Super Bakery grow annual sales at an average rate of 20% to 30% for the past eight years. In 1994, sales reached $8.5 million with a staff of nine full-time employees--a very high rate of productivity per employee. Operating profits have been twice the industry average, and the company also enjoys a very high return on equity and return on net assets. These superior levels of per formance can be expected in companies that reduce their investment in payroll expenses and fixed assets, but there also are risks in implementing the lean structure of a virtual corporation BREAKING OUT SERVICE ACTIVITIES IN A VIRTUAL CORPORATION The first decision a virtual corporation's managers need to make is which aspects of corporate activity must be per formed in-house and which jobs can be contracted out. When MANAGEMENT ACCOUNTING OCTOBER 1996 Convenient Accurate order entry order Knowledgeable scheduling customer assistance Pricing and trade Promotional credit support Warehousing Accurate and storage order filling On-time Performance delivery bonding Accurate billing deciding which functions to contract out. Super Bakery's product is just one component of the mix of benefits that are provided to customers. There are other important services for customers (see figure), most of which are part of the order management process. The order management cycle had the biggest influence on customer satisfaction Management believed that all of these activities did not have to be per- formed by Super Bakery, but the company had to be able to control and coordinate these services. Upstream activities tend to drive the downstream activi- ties in a process. Upstream activities such as order entry. pricing, and scheduling drive downstream activities such as production, order picking, packing, and delivery. Manage- ment wanted to control the upstream planning activities as well as the coordination of each customer's order. Manage- ment also wanted to control billing and collections. It decided that selling production, warehousing, and shipping could be contracted out if management retained overall control over the planning and tracking of these activities in the order management process Relationships with outside brokers, manufacturers, and trucking companies could make or break the company because they stand between the company and its customers. The brokers in the different parts of the country would have to do an effective job of promoting and selling the company's products to distributors and school systems. The various 20 Table 1. SUPER BAKERY'S NONFINANCIAL PERFORMANCE MEASURES Service Activity Order entry speed Order accuracy Order fill rate On-time delivery Measure (Number Of) Customer complaints Correct orders Complete orders Hours early/tardy from promised delivery date Correct shipments Customer product Days from order receipt to delivery Damaged orders Reported By Customer Customer Customer service Common carrier, customer Customer service Customer, R&D Customer service Source Telephone complaints, customer survey Telephone callbacks, (computer tracked) Customer order, packing list (computer tracked) Common carrier, delivery confirmations, customer complaints Customer order, packing list (computer tracked) Telephone complaints, customer survey, plant inspections Order entry date to delivery confirmation Accuracy of shipments Product quality Total order filling cycle time Damaged shipments Credit memos Common carrier customer, accounting Customer, accounting Incorrect billing Customer invoices Pricing errors, customer billing complaints independent bakeries that manufactured the products would have to meet Super Bakery's quality standards. The trucking companies would have to meet on-time shipping and delivery requirements. Some of these concerns were addressed by clarifying the performance standards with contractors in painstaking detail. Clearly defined requirements were built into contracts with outside vendors, but discrepancies often still occur between what is agreed to on paper and day-to- day operations. Companies run a risk when they let outside brokers or common carriers interact with customers. Most external con- tractors will not sign service guarantees, and they usually refuse to pay penalties or fines for failing to meet service standards. The key issue from a service perspective is what influence the contractor is having on the customer. That is why a constant stream of feedback from the field is essential for evaluating performance. CREATING A PERFORMANCE REPORTING SYSTEM Management wanted a performance reporting system that would provide a balance of nonfinancial and financial mea- sures. The nonfinancial measures were needed to track cus- tomer service and satisfaction levels, and the financial mea- sures were needed to track the cost of filling orders and serving customers. The core process that most influenced customer satisfac- tion was the order management cycle. For Super Bakery, these steps included order entry, credit clearance, costing, pricing, scheduling, procurement, manufacturing, shipping, billing, and collection. When some of these functions are out- sourced, it is important to retain control over the administra tive process that links these interdependent functions togeth- er. Super Bakery developed nonfinancial measures of these processes that reflected customers' concerns (Table 1). Some of these measures needed to be collected and tracked by Super Bakery's staff, others were collected from customers or contractors. To keep track of these performance measures, a relational database was created at Super Bakery. One of the advantages of contracting out functions is that managers no longer need to worry about measuring processes: They only need to measure outcomes. The problem of managing processes is turned over to the contractor. Most of the activities in the order-filling cycle are commu- nicated by fax and telephone; others are coordinated by on- line modem. Front-line, customer service employees at Super Bakery take product orders from distributors and school sys- tems; quote prices, schedule production at the independent bakeries in New York, Indiana, and California; and set deliv- ery dates. Using an activity-based costing (ABC) system, the bakery company constructed a detailed breakdown of the costs incurred in filling each customer's order. IMPLEMENTING AN ACTIVITY-BASED COSTING SYSTEM The wide variation in the cost of serving different cus- tomers was a major concern. For example, freight costs var- ied for each customer depending on the size of the order and the shipping distance. The contracted cost for manufacturing the donuts was higher for the plant in California than the plants in New York and Indiana. There also were numerous other variations in the cost of serving different customers. The company was faced with the choice of spreading product and service costs over the entire customer base and charging uniform prices or assigning the exact cost of processing each order and building these costs into the price charged to each customer In most firms, a standard costing system is used to allo- cate costs to products and to price customers' orders. Stan- dard costs are the agreed target cost of direct labor and materials that go into making products. They also include the overhead operating expenses, such as selling, advertising, warehousing, shipping, and administration, which also are expended in servicing customer accounts. Under a standard costing system, these overhead expenses are allocated to products and spread over the entire customer base. Each cus- tomer's order is assumed to cost the same average amount to process. The fallacy of the standard costing system at many compa- nies, including Super Bakery, is that very few customers' orders consume the same amount of resources. At Super Bakery, the profit on each sale varied significantly. Assigning costs accurately to each account would allow the company to Someone in your company is still typing G/L numbers into a spreadsheet. Stop it! assess the profitabilty of different cus- tomers. Making customers pay for what they received is also a fairer arrangement. Few companies recover the exact cost and expenses of serving customers in the sales price charged. In many businesses, profitable accounts subsidize unprofitable ones, and management is none the wiser. In order to track costs more closely, man agement made the investment in a more sophisticated information and accounting system The management of Super Bakery decided to install a detailed ABC sys- tem, first, because it would allow man- agement to track the profitability of each customer's account and, second, because it would allow management to track the performance of outside con- tractors more closely. One of the main differences between Super Bakery's ABC system and other manufacturers' ABC systems is that the main focus is placed on capturing costs by customer order rather than by product. Overhead service expenses tend to be high and variable, while contracted manufacturing costs were fixed. With most ABC systems, the con- sumption of costs is either directly recorded as costs occur (e.g. specific freight charges) or recorded indirectly by means of a cost driver. When a cost driver is used as the basis for assign- ing costs, management still is using an allocation method. It is an estimated cost, not the actual cost. Well-chosen cost drivers, however, usually are supe- rior to traditional standard cost bases for allocating costs, such as percent of direct labor or percent of total sales, For instance, under a standard cost system many companies allocate order handling charges on a percent of sales basis. In other words, the greater the value of the sales order, the higher the order handling costs that will be charged to the customer. The problem with this standard cost accounting practice is that the amount of time and expense spent processing an order usu- ally is the same whether the order is for 200 or 2,000 cases. The cost driver is not the number of cases ordered but the number of separate sales orders that have to be processed. In this age of just-in-time delivery, many compa- nies would prefer to place a lot of small orders rather than book one large F9 It is a tedious error prone F9 also provides tools to activity. And entirely unnecessary. explore your G/L, drill down But, you say, spreadsheets are the multiple tiers to your G/L best place to do financial reporting, transactions, prepare consolidations F9 seamlessly integrates and more. your G/L with your spreadsheet F9 even lets you create and (Excel, Lotus 1-2-3, or Quattro Pro): edit budgets in a spreadsheet no macros, no imports, no exports, and write them back to the G/L! With F9 you can create reports of any size or complexity, and never type another G/L balance into a spreadsheet. F9 is the perfect tool for financial reporting. Create a single period income statement. With a "the future of click of the mouse, you can go to a financial reporting multi period comparative income statement or any financial report 800-663-8663 x 332 you can imagine. And with a little more effort, you can create a F9 works all these systems: complete Eis, with buttons, and AMS! Abacus Accounting "hot Charts" that change Champion FlexiFinancials automatically when the data does. Great Plains Accounting Macola And the best part is, if you know ***S/90 Evolution 2 Open Systras how to use a spreadsheet, you RealWorld already know 95% of what you F9 Universal will work with any acounting need to know in order to use F9. Business Works Data Pro Accounting Ro SBT Solomon system on a PC, minior mainframe. Call for detail CostRevenue Activity Center Product cost Freight and storage Brokerage (selling) Advertising Promotion Trade shows (local) Trade shows Inational Samples Bonds Discounts Interest Order department Sales management Raw product Research and development Revenue (price) Broken Out By Product Order Order Product Product Customer Product Customer Customer Order Customer Order Customer Product Product Product Direct/Allocated Direct Direct Direct Allocation Direct Allocation Allocation Direct Allocation Direct Direct Allocation Allocation Direct Allocation Direct Measure/Cost Driver Contracted per case price for each product line Actual freight and storage costs per order Flat 5% of sales Percent of advertising budget by projected cases sold Actual cost by product line Actual cost divided by projected cases sold Budgeted cost divided by projected cases sold Actual cost per case Percent of projected cases sold Actual discount per order Per payment history cost of capital) Budgeted (historicall cost allocated per order Budgeted cost allocated by time spent in each territory Per product case by formula Budgeted cost allocated by time for each product line Accumulated costs plus targeted profit margin for each product line order. By assigning costs based on the number of orders that have to be processed, instead of by the dollar value of the order, a much more accurate cost of order processing can be calculated for each customer. At Super Bakery, actual costs are captured and assigned directly to a customer's account whenever possible. Some of these charges are based on the historical cost of serving par. ticular customers. Over the years, Super Bakery has accumu- lated a great deal of cost information on serving different customers. Cost drivers are used to assign costs when the historical cost is unavailable or direct costing is impractical or impossible. In some cases, these costs are based on an esti- mated percentage of the budget. A listing of Super Bakery's cost/revenue centers and cost drivers for filling customer orders and assigning costs is pro- vided in Table 2. By accurately capturing and accumulating these costs, management can calculate the true costs of pro- cessing each order and servicing a particular customer's account. Super Bakery is able to price orders accurately, recoup the costs of serving its customer, and feel confident that a targeted amount of profit is being earned. The cost information needed to be available to customer service employees on easily accessible computer screens or templates. Customer service employees have to be able to compute the cost of filling orders, quote accurate prices, and communicate dependable delivery dates. The development of such a system required some experimentation. Front-line employees provided their feedback and suggestions on how the information could be presented on the computer screen in a more convenient form. If costs are broken out and assigned accurately when they are incurred, they can be manipulated in a number of differ- ent ways to evaluate the profitability and performance of dif- ferent components of the business. Through the use of a rela. tional database, Super Bakery's management is able to examine costs by product, customer, order, broker, territory, department, manufacturer, and common carrier. It uses responsibility centers and cost centers to assign costs in interdepartmental transactions. The company divides up the 24 MANAGEMENT ACCOUNTING OCTOBER 1996 functions it performs or contracts out and assigns them to several responsibility centers: marketing, R&D, production, and office and finance. These responsibility centers are fur- ther subdivided into various subcenters such as sales, accounting, information systems, order processing, customer service, and so on. Given the company's small staff, some employees wear several different hats in performing these in-house functions. Each responsibility center has its own profit-and-loss statement, and internal charges are made between them for work that is performed by one department on behalf of another. This procedure does not include formal invoicing and payment, but journal entries are made on the books in order to assign costs to the user of the service. Out- sourced functions are treated as separate, arm's-length responsibility centers. Virtual corporations that outsource functions need a detailed information system for controlling costs and evalu- ating the profit on each sale. Such a system is especially important when expenditures on these functions are in the hands of outside contractors. An ABC system can be used to control the behavior of contractors. The examples that follow show how the management of Super Bakery controls contrac- tors' spending of the company's resources. CONTROLLING CONTRACTORS WITH ABM In virtual corporations, a great deal of money is spent on service functions that are performed by an outside company In other words, more of the company's budget is outsourced an arrangement that can result in abuses. External contrac- tors operate with considerably more freedom than company employees. They do not operate under the direct supervision of company management. External contractors-salespeople, trucking firms, warehouse companies, information service companies, and payroll services--sometimes operate very inefficiently, They can make decisions that make their own jobs easier but squander company resources; therefore, con- trols need to be imposed on spending. Independent sales brokers sell Super Bakery's products 31 132 throughout the United States, and these interest charges for carrying a particular brokers also represent a variety of noncom- customer's account. These interest charges, peting companies and products. The inde- based on Super Bakery's cost of capital, are pendent sales brokers have looser ties to figured into the price that is quoted to cus- the company than any of the outside con- tomers for future orders. If the customer tractors. The regional sales managers demonstrates that it can pay within Super mainly judge the performance of brokers Bakery's net 30 terms, these charges are from the feedback they receive in sales dropped. reports of orders booked. The brokers, who Brokers also have access to customers' are on straight commission, sometimes use files and can see which customers have not free samples, price discounts, and advertis- paid their last invoice. They know that new ing allowances to push deals through with orders will not be accepted until previous distributors. These incentives are supposed invoices have been paid. Brokers do not to be used to increase the size of customers' receive commission checks until customers orders so that the profit from the orders have paid their invoices. For this reason, bro- exceeds the additional selling expense. kers have an incentive to follow up with Super Bakery's regional sales managers overdue customers, which reduces Super look carefully at the cost of servicing each Bakery's collections' problems. account and whether to approve brokers' In some instances, delays in the receipt of requests for promotional allowances. They Franco Harris payments occur because school systems only are able to access an electronic file contain- cut checks on a particular day each month. If ing the volume and value of each customer's sales, past pro this day is missed, vendors must wait until the same day the motional allowances, and servicing costs (credit history, ship next month to get paid. Here it is critical to get in step with ping costs, etc.). On some occasions, promotional allowances the customer's billing and payables cycle. For the larger requested by brokers have exceeded the contribution margin accounts, Super Bakery's front-line service employees place a on the account. The management information and activity. call to the customer's payables clerk a few days prior to the based costing systems are used to evaluate the profitability day when checks are printed to make sure the invoice is of each account and whether to approve a broker's requests accurate and can be paid on time. for promotional allowances. Shipping performance and freight costs are another area of VIRTUAL ADVANTAGES critical importance. There is a tremendous amount of varia- tion in the quality and cost of service provided by different During the rapid growth of Super Bakery, management's trucking companies. Over the years, Super Bakery has used major concern has been making sure that staff and expenses 12 different common carriers. Today it uses three companies do not grow more rapidly than sales revenues and profits. that offer the company the best rates and service in different For Super Bakery the advantage of contracting out manufac- parts of the country. turing is that it obviates the need for investment in plant, Most common carriers have regularly scheduled routes equipment, and factory personnel. It also eliminates concerns and stops in particular locations. For instance, they may of capacity utilization and meeting minimum breakeven pro- deliver in Raleigh, N.C., on Tuesdays, and Hartford, Conn., duction levels. on Thursdays. Many common carriers will deliver full trailer Arm's-length relationships with external contractors may loads any day of the week, but they will not deliver less than sometimes give companies greater control over the perfor- trailer loads, unless it is a scheduled stop, without charging a mance and cost of certain functions than when these func- price premium. A lot of Super Bakery's business consists of tions are handled internally. Moreover, contracted costs often less than trailer load shipments. Super Bakery must consoli are fixed rather than variable. If the costs exceed a set date shipments to particular locations to make up full trailer amount, the contractor must absorb the loss. Management loads or conform to the common carriers' schedule for less can withhold payment of invoices from contractors who than trailer load shipments, Management and employees exceed agreed prices for manufacturing, warehousing, or must monitor the shipping performance and freight costs of shipping. Nevertheless, when sales, manufacturing, and dis- the different carriers carefully. They need to make sure that tribution are outsourced, the performance of brokers and they are not overcharged for different shipments. Super Bak contractors must be monitored. A well-designed performance ery uses historical customer information to calculate the reporting and costing system is needed to evaluate their per exact cost of transporting a specified number and type of formance and control expenses. The systems put in place at donuts to a particular location. In this way, actual freight can Super Bakery provide useful guidelines for other virtual be built into the price charged to the customer for each order. corporations. Any variances in these shipping charges are taken up with the common carriers. Tim R.V. Davis i professor of management and director of international Another instance where Super Bakery uses historical cost business programs at Cleveland State University Bruce L. Darling, CMA, ia the controller of Super Bakery, Inc., and information is in the control of overdue receivables. As shown Prestige American Foods, Cleveland office. He is a member of Cleveland in Table 2, Super Bakery keeps extensive information on East Chapter, through which this article was submitted each customer's payment history and the average number of days invoices are past due. This information is used to assess See "The Virtual Carporation," Business Wook, February 3, 1993, McGraw Hill, Inc., New York, NY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started