Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an investment advisor and have been referred the following new client. Rosella is 80 years old and needs to move to an

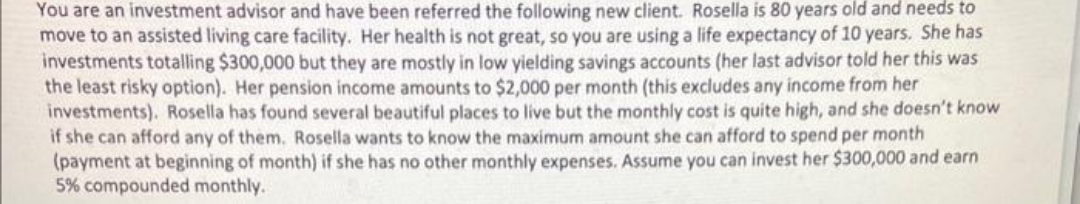

You are an investment advisor and have been referred the following new client. Rosella is 80 years old and needs to move to an assisted living care facility. Her health is not great, so you are using a life expectancy of 10 years. She has investments totalling $300,000 but they are mostly in low yielding savings accounts (her last advisor told her this was the least risky option). Her pension income amounts to $2,000 per month (this excludes any income from her investments). Rosella has found several beautiful places to live but the monthly cost is quite high, and she doesn't know if she can afford any of them. Rosella wants to know the maximum amount she can afford to spend per month (payment at beginning of month) if she has no other monthly expenses. Assume you can invest her $300,000 and earn 5% compounded monthly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Determining Rosellas Affordable Monthly Expenditure Heres how to calculate the maximum amount Rosell...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started