Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 You are considering two mutually exclusive investments of different durations. Assume your Minimum Acceptable Rate of Return is 7%. INVESTMENT Christmas trees Timber

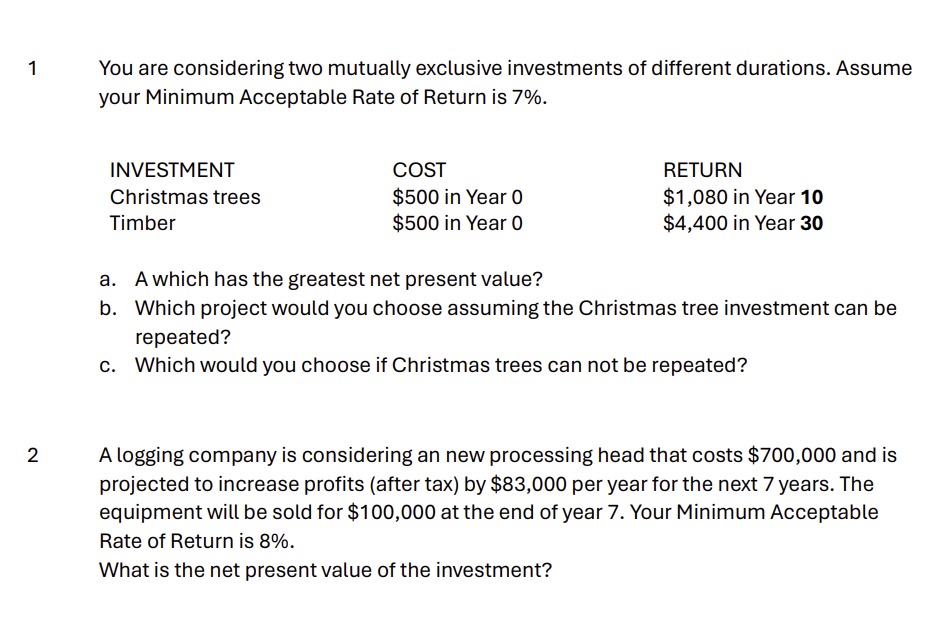

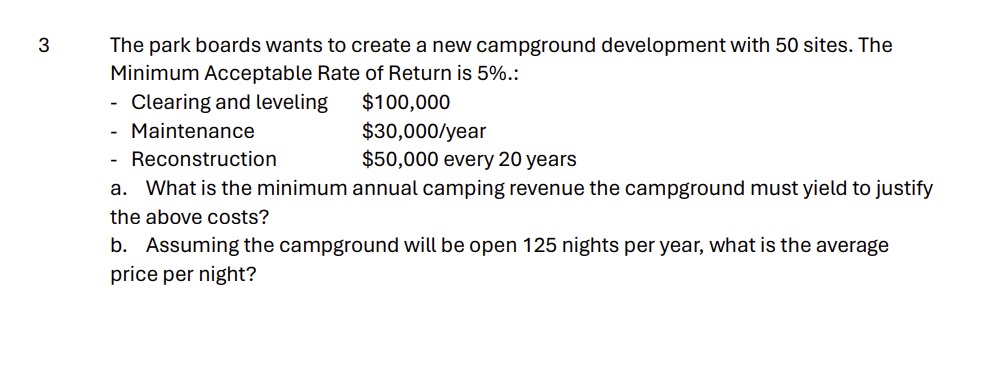

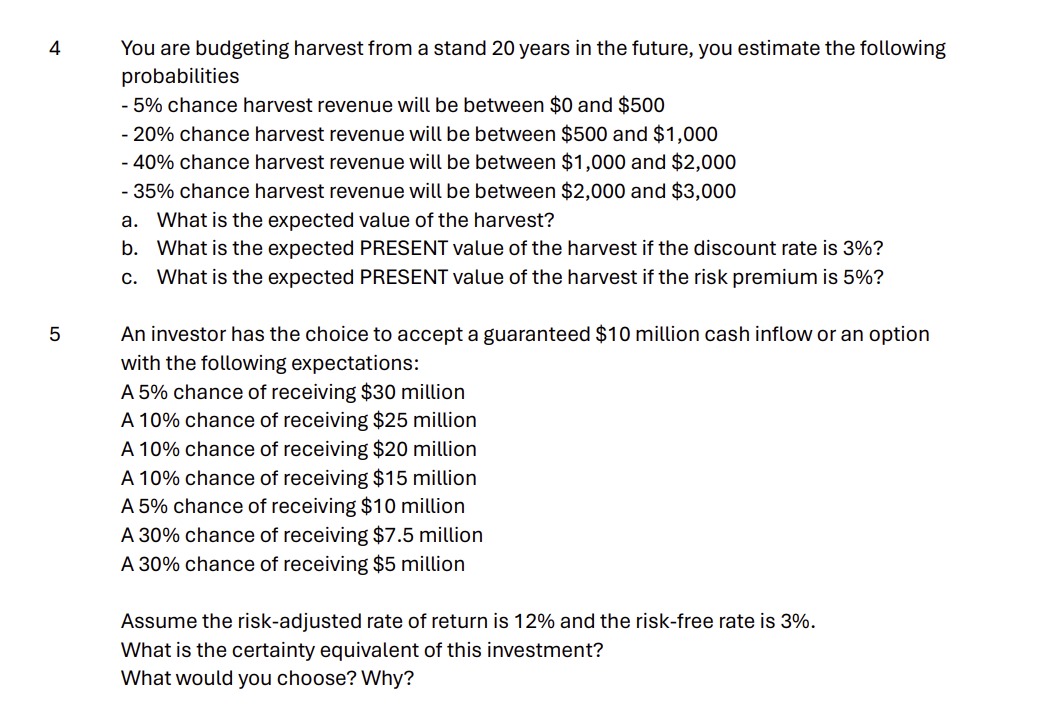

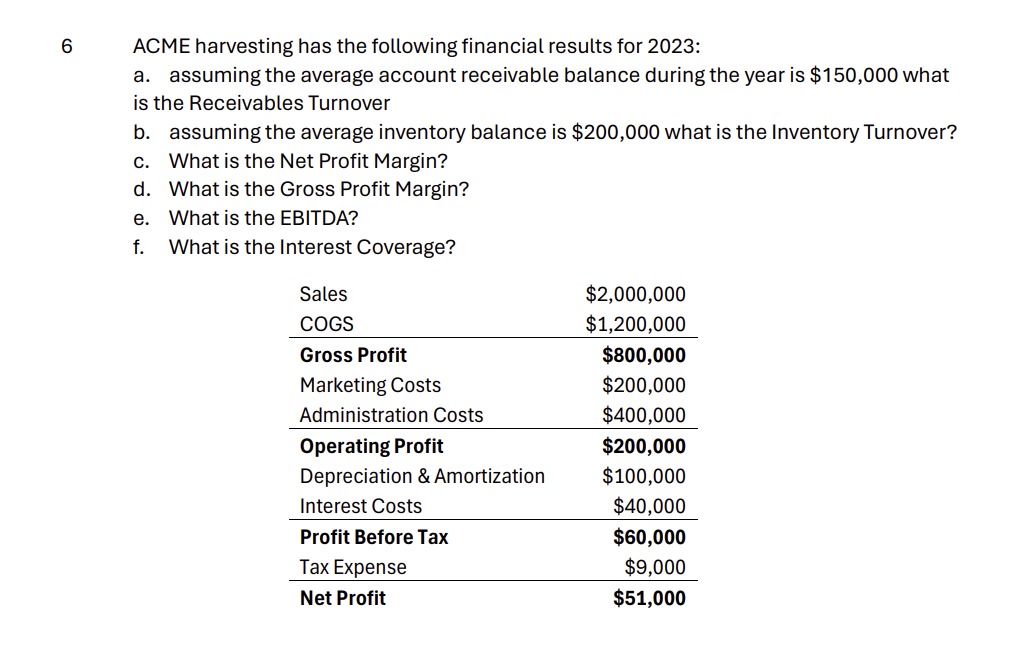

1 You are considering two mutually exclusive investments of different durations. Assume your Minimum Acceptable Rate of Return is 7%. INVESTMENT Christmas trees Timber COST RETURN $500 in Year 0 $500 in Year 0 $1,080 in Year 10 $4,400 in Year 30 a. A which has the greatest net present value? b. Which project would you choose assuming the Christmas tree investment can be repeated? c. Which would you choose if Christmas trees can not be repeated? 2 A logging company is considering an new processing head that costs $700,000 and is projected to increase profits (after tax) by $83,000 per year for the next 7 years. The equipment will be sold for $100,000 at the end of year 7. Your Minimum Acceptable Rate of Return is 8%. What is the net present value of the investment? 3 The park boards wants to create a new campground development with 50 sites. The Minimum Acceptable Rate of Return is 5%.: - Clearing and leveling - Maintenance - Reconstruction $100,000 $30,000/year $50,000 every 20 years a. What is the minimum annual camping revenue the campground must yield to justify the above costs? b. Assuming the campground will be open 125 nights per year, what is the average price per night? 4 5 You are budgeting harvest from a stand 20 years in the future, you estimate the following probabilities - 5% chance harvest revenue will be between $0 and $500 - 20% chance harvest revenue will be between $500 and $1,000 - 40% chance harvest revenue will be between $1,000 and $2,000 - 35% chance harvest revenue will be between $2,000 and $3,000 a. What is the expected value of the harvest? b. What is the expected PRESENT value of the harvest if the discount rate is 3%? c. What is the expected PRESENT value of the harvest if the risk premium is 5%? An investor has the choice to accept a guaranteed $10 million cash inflow or an option with the following expectations: A 5% chance of receiving $30 million A 10% chance of receiving $25 million A 10% chance of receiving $20 million A 10% chance of receiving $15 million A 5% chance of receiving $10 million A 30% chance of receiving $7.5 million A 30% chance of receiving $5 million Assume the risk-adjusted rate of return is 12% and the risk-free rate is 3%. What is the certainty equivalent of this investment? What would you choose? Why? 6 ACME harvesting has the following financial results for 2023: a. assuming the average account receivable balance during the year is $150,000 what is the Receivables Turnover b. assuming the average inventory balance is $200,000 what is the Inventory Turnover? c. What is the Net Profit Margin? d. What is the Gross Profit Margin? e. What is the EBITDA? f. What is the Interest Coverage? Sales $2,000,000 COGS $1,200,000 Gross Profit $800,000 Marketing Costs $200,000 Administration Costs $400,000 Operating Profit $200,000 Depreciation & Amortization $100,000 Interest Costs $40,000 Profit Before Tax $60,000 Tax Expense $9,000 Net Profit $51,000 7 The stand has 10,000 board feet (10 MBF) per hectare. The average stumpage price is $100/MBF, or $1,000 per hectare total value. The Annual volume growth is 0.5 MBF/year. The Rate of real price increase 6%/year. Should the landowner harvest now or wait 10 years? 8 9 10 10 A landowner has been contacted by a pulpmill looking for wood. He has 50 hectares of trees on his property. The property currently yields 150 m3 per hectare. The pulpmill has offered him $10/m3 to harvest the wood this year. You know from past timber sales that you can get $18/m3 from the neighbouring sawmill. However, it will be 20 years before the stand reaches the diameter required by the sawmill. The annual growth rate is 1.5 m3/ha. You estimate the rate of real price increase will be 5%/year. Should the landowner harvest now or wait 20 years? Applying fertilizer to the above stand will increase the annual growth rate to 4 m3/ha. The cost of the fertilizer is $5000 per hectare. The stand will reach minimum diameter for class 1 sawlogs for harvest in 5 years after the fertilizer is applied. The sawmill is currently paying you $15/m3 for sawlogs. If you wait another 10 years the diameter will be in size class II and the mill pays $25/m3. For larger diameter logs. The rate of price increase will be 5% per year. a. Should the landowner invest in fertilizing his property? b. Should the landowner harvest in 5 years or wait 15 years for the trees to reach the larger size class? There are over 5 million traffic accidents in the USA every year. Applying what we learned in the videos we watched last class what would you suggest as a strategy to reduce the number of accidents?

Step by Step Solution

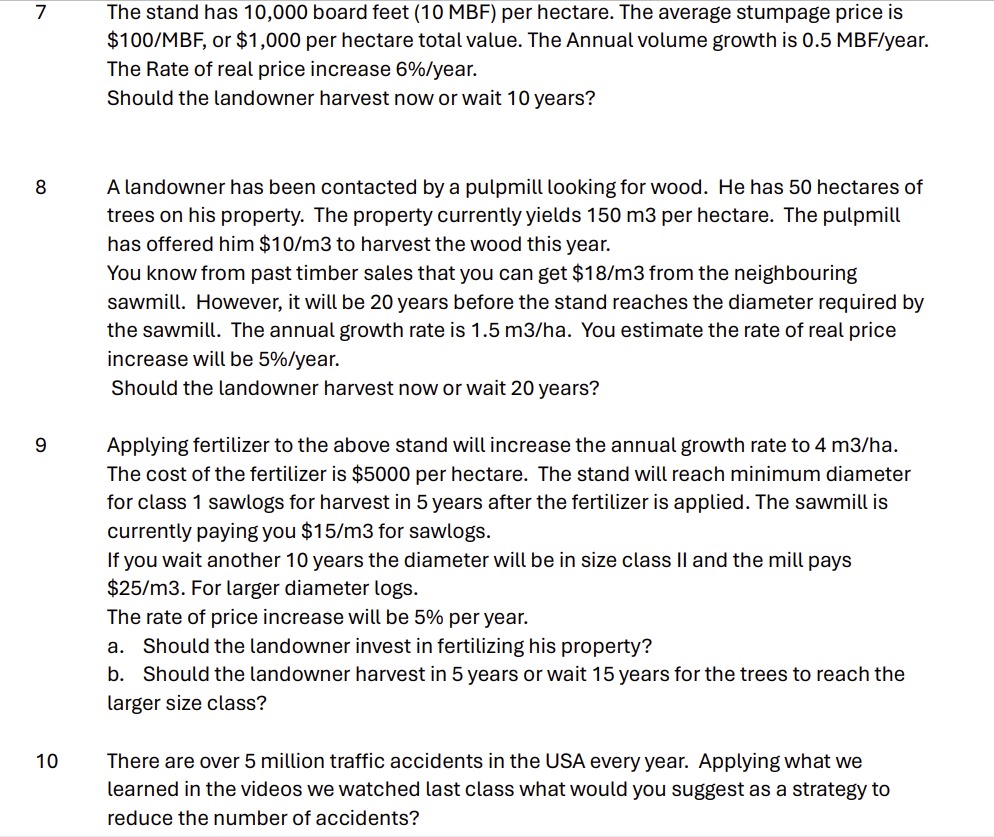

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started