Question

1) You are given the historical annual returns on stock in two companies Zeniba and Yubaba. Calculate the average (mean) return and standard deviation of

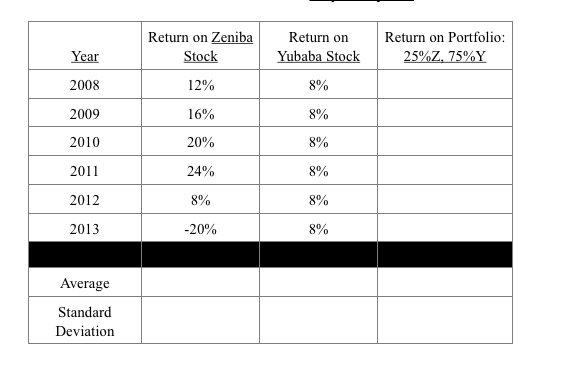

1) You are given the historical annual returns on stock in two companies Zeniba and Yubaba. Calculate the average (mean) return and standard deviation of the returns for each company. Now assume that you create a portfolio consisting of 25% Zeniba and 75% Yubaba. What would the return on the portfolio have been in each year? What would have been the average return on the portfolio? What would have been the standard deviation of the portfolio returns? Would diversification have reduced risk in this case? Why or why n case? Why or why not

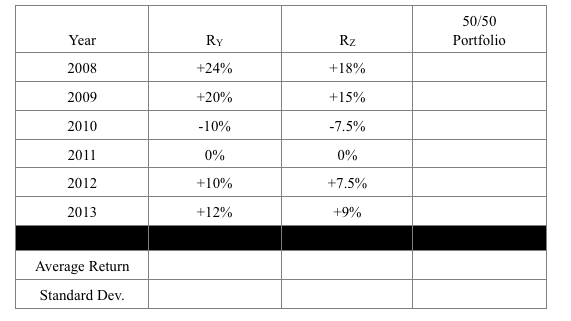

2) The table below contains a sample of annual rate of return data for the stocks of the Yubaba and Zeniba companies. Calculate the average return, and the standard deviation of the annual returns, for each stock. Now assume a portfolio containing 50% investment in Yubaba stock and 50% investment in Zeniba stock is created for this period. What is the return on the portfolio each year? What is the average return, and the standard deviation of the annual returns, for the portfolio? Does diversification reduce risk in this case? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started