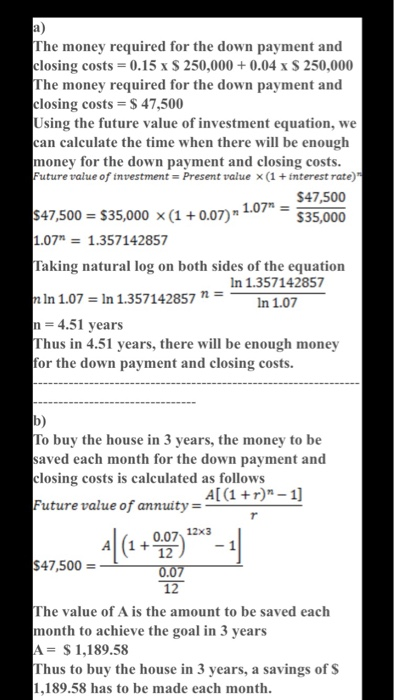

1. You are planning to buy a new house. You currently have 535,000 and your bank told you that you would need a 15% down payment plus an additional 4% in closing costs. If the house that you want to buy costs $250,000 and you can make a 7% annual return on your 2 Investment, determine the following: fixed rate of 4.5% 6 c) Assume that three years later the house still has the same price and that you can get a 15-year mortgage from your bank 71. What are the monthly payments on the loan? 82How much will you have to pay the bank each year? 9 3. What is the total interest over the term of the loan? 10 4. How much do you pay on interest and principal the first monthly payment? 11 How much in the 50th month? (Hint: Also use the IPMT and PPMT functions) The money required for the down payment and closing costs = 0.15 x $ 250,000+ 0.04 x S 250,000 The money required for the down payment and closing costs = $ 47,500 Using the future value of investment equation, we can calculate the time when there will be enough money for the down payment and closing costs. Future value of investment = Present value x (1 + interest rate) $47,500 $47,500 = $35,000 x (1 + 0.07) 1.07" = 530 $35,000 1.07" = 1.357142857 Taking natural log on both sides of the equation In 1.357142857 m In 1.07 = In 1.357142857 n = In 1.07 n = 4.51 years Thus in 4.51 years, there will be enough money for the down payment and closing costs. b) To buy the house in 3 years, the money to be saved each month for the down payment and closing costs is calculated as follows Future value of annuity - A[(1+r)" - 1] $ 47,500 = The value of A is the amount to be saved each month to achieve the goal in 3 years A= $ 1,189.58 Thus to buy the house in 3 years, a savings of $ 1,189.58 has to be made each month. 1. You are planning to buy a new house. You currently have 535,000 and your bank told you that you would need a 15% down payment plus an additional 4% in closing costs. If the house that you want to buy costs $250,000 and you can make a 7% annual return on your 2 Investment, determine the following: fixed rate of 4.5% 6 c) Assume that three years later the house still has the same price and that you can get a 15-year mortgage from your bank 71. What are the monthly payments on the loan? 82How much will you have to pay the bank each year? 9 3. What is the total interest over the term of the loan? 10 4. How much do you pay on interest and principal the first monthly payment? 11 How much in the 50th month? (Hint: Also use the IPMT and PPMT functions) The money required for the down payment and closing costs = 0.15 x $ 250,000+ 0.04 x S 250,000 The money required for the down payment and closing costs = $ 47,500 Using the future value of investment equation, we can calculate the time when there will be enough money for the down payment and closing costs. Future value of investment = Present value x (1 + interest rate) $47,500 $47,500 = $35,000 x (1 + 0.07) 1.07" = 530 $35,000 1.07" = 1.357142857 Taking natural log on both sides of the equation In 1.357142857 m In 1.07 = In 1.357142857 n = In 1.07 n = 4.51 years Thus in 4.51 years, there will be enough money for the down payment and closing costs. b) To buy the house in 3 years, the money to be saved each month for the down payment and closing costs is calculated as follows Future value of annuity - A[(1+r)" - 1] $ 47,500 = The value of A is the amount to be saved each month to achieve the goal in 3 years A= $ 1,189.58 Thus to buy the house in 3 years, a savings of $ 1,189.58 has to be made each month