Answered step by step

Verified Expert Solution

Question

1 Approved Answer

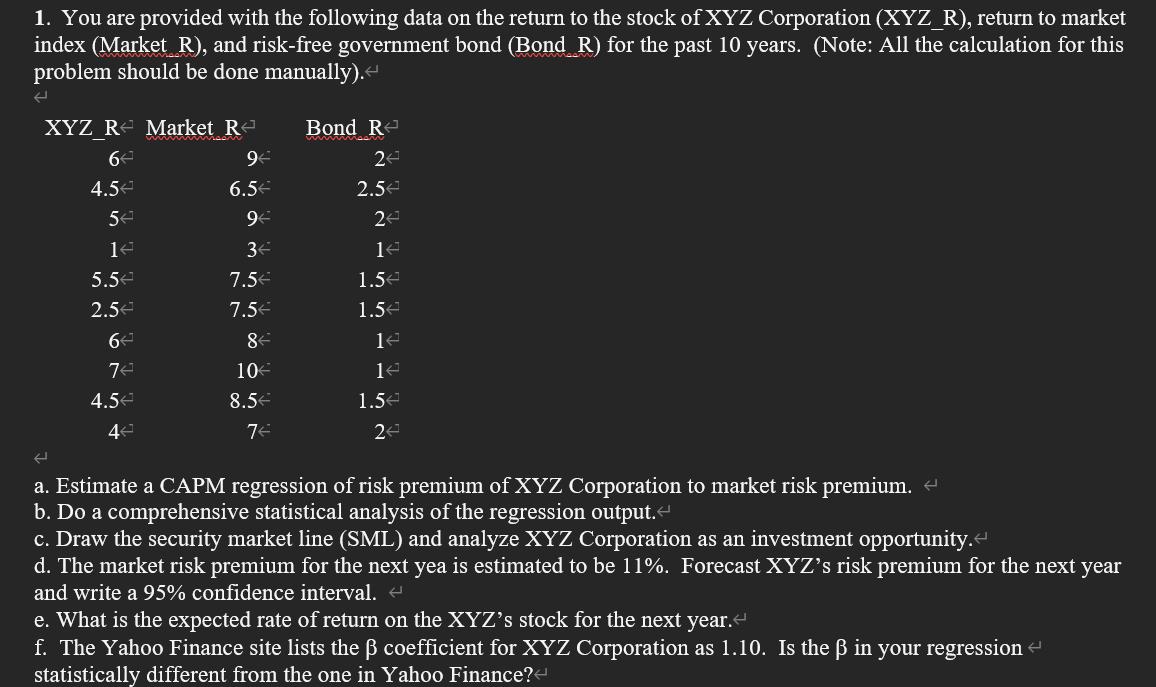

1. You are provided with the following data on the return to the stock of XYZ Corporation (XYZ_R), return to market index (Market R),

1. You are provided with the following data on the return to the stock of XYZ Corporation (XYZ_R), return to market index (Market R), and risk-free government bond (Bond R) for the past 10 years. (Note: All the calculation for this problem should be done manually). < XYZ R Market R 64 4.54 54 14 5.5 2.5 6 74 4.54 44 9 6.5 9 3 < 7.5 7.5 8 10 8.5 74 Bond R 24 2.5 24 14 1.5 1.54 14 14 1.5 24 a. Estimate a CAPM regression of risk premium of XYZ Corporation to market risk premium. 2 b. Do a comprehensive statistical analysis of the regression output. < c. Draw the security market line (SML) and analyze XYZ Corporation as an investment opportunity. < d. The market risk premium for the next yea is estimated to be 11%. Forecast XYZ's risk premium for the next year and write a 95% confidence interval. e. What is the expected rate of return on the XYZ's stock for the next year. < f. The Yahoo Finance site lists the coefficient for XYZ Corporation as 1.10. Is the in your regression statistically different from the one in Yahoo Finance?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started