Answered step by step

Verified Expert Solution

Question

1 Approved Answer

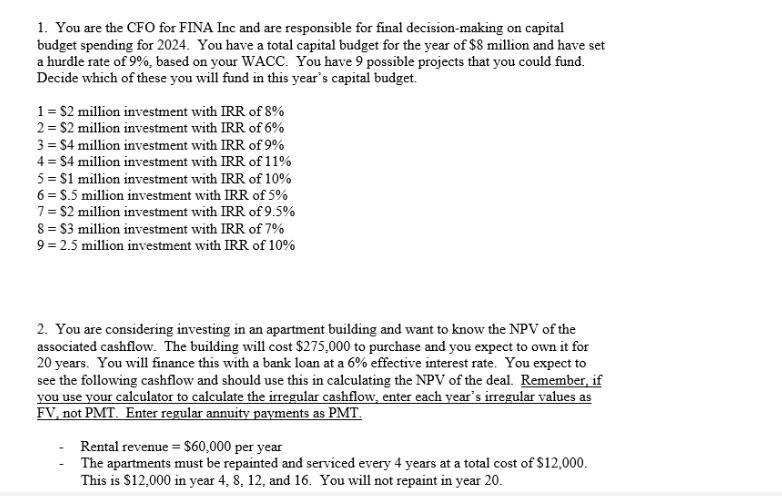

1. You are the CFO for FINA Inc and are responsible for final decision-making on capital budget spending for 2024. You have a total

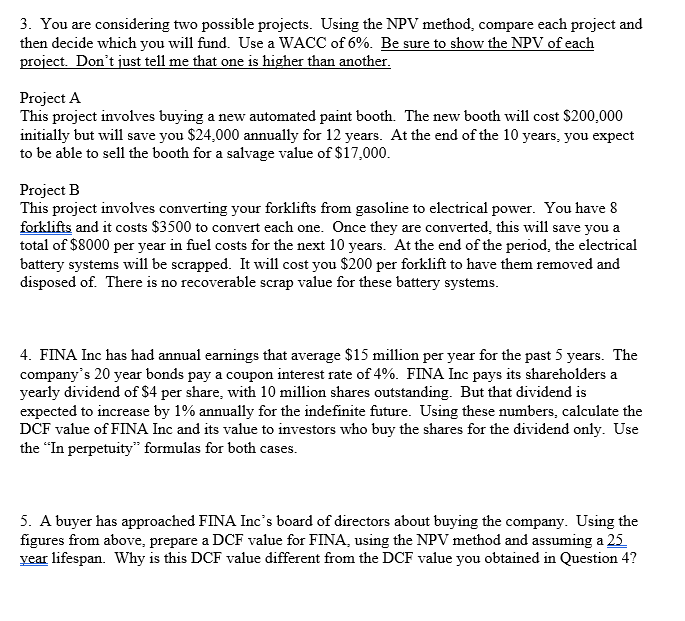

1. You are the CFO for FINA Inc and are responsible for final decision-making on capital budget spending for 2024. You have a total capital budget for the year of $8 million and have set a hurdle rate of 9%, based on your WACC. You have 9 possible projects that you could fund. Decide which of these you will fund in this year's capital budget. 1 = $2 million investment with IRR of 8% 2=$2 million investment with IRR of 6% 3=$4 million investment with IRR of 9% 4 = $4 million investment with IRR of 11% 5 $1 million investment with IRR of 10% 6 $.5 million investment with IRR of 5% 7=$2 million investment with IRR of 9.5% 8 $3 million investment with IRR of 7% 9=2.5 million investment with IRR of 10% 2. You are considering investing in an apartment building and want to know the NPV of the associated cashflow. The building will cost $275,000 to purchase and you expect to own it for 20 years. You will finance this with a bank loan at a 6% effective interest rate. You expect to see the following cashflow and should use this in calculating the NPV of the deal. Remember, if you use your calculator to calculate the irregular cashflow, enter each year's irregular values as FV, not PMT. Enter regular annuity payments as PMT. Rental revenue $60,000 per year The apartments must be repainted and serviced every 4 years at a total cost of $12,000. This is $12,000 in year 4, 8, 12, and 16. You will not repaint in year 20. 3. You are considering two possible projects. Using the NPV method, compare each project and then decide which you will fund. Use a WACC of 6%. Be sure to show the NPV of each project. Don't just tell me that one is higher than another. Project A This project involves buying a new automated paint booth. The new booth will cost $200,000 initially but will save you $24,000 annually for 12 years. At the end of the 10 years, you expect to be able to sell the booth for a salvage value of $17,000. Project B This project involves converting your forklifts from gasoline to electrical power. You have 8 forklifts and it costs $3500 to convert each one. Once they are converted, this will save you a total of $8000 per year in fuel costs for the next 10 years. At the end of the period, the electrical battery systems will be scrapped. It will cost you $200 per forklift to have them removed and disposed of. There is no recoverable scrap value for these battery systems. 4. FINA Inc has had annual earnings that average $15 million per year for the past 5 years. The company's 20 year bonds pay a coupon interest rate of 4%. FINA Inc pays its shareholders a yearly dividend of $4 per share, with 10 million shares outstanding. But that dividend is expected to increase by 1% annually for the indefinite future. Using these numbers, calculate the DCF value of FINA Inc and its value to investors who buy the shares for the dividend only. Use the "In perpetuity" formulas for both cases. 5. A buyer has approached FINA Inc's board of directors about buying the company. Using the figures from above, prepare a DCF value for FINA, using the NPV method and assuming a 25 year lifespan. Why is this DCF value different from the DCF value you obtained in Question 4?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To determine which projects to fund based on the 8 million capital budget and a 9 hurdle rate we can evaluate each projects Net Present Value NPV NP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started