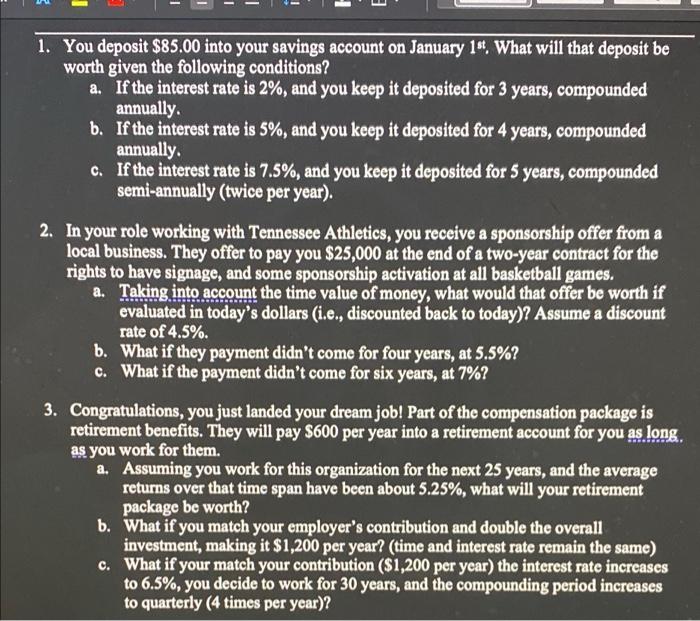

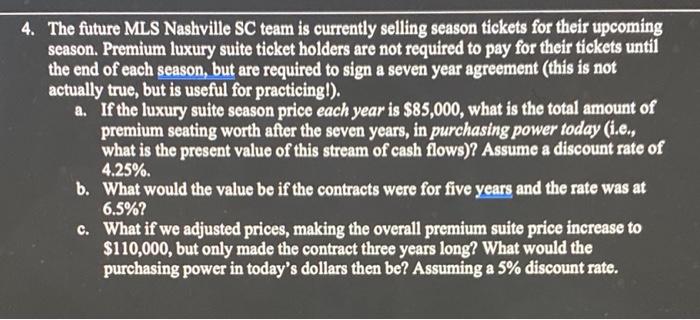

1. You deposit $85.00 into your savings account on January 1st. What will that deposit be worth given the following conditions? a. If the interest rate is 2%, and you keep it deposited for 3 years, compounded annually. b. If the interest rate is 5%, and you keep it deposited for 4 years, compounded annually. c. If the interest rate is 7.5%, and you keep it deposited for 5 years, compounded semi-annually (twice per year). 2. In your role working with Tennessee Athletics, you receive a sponsorship offer from a local business. They offer to pay you $25,000 at the end of a two-year contract for the rights to have signage, and some sponsorship activation at all basketball games. a. Taking into account the time value of money, what would that offer be worth if evaluated in today's dollars (i.e., discounted back to today)? Assume a discount rate of 4.5%. b. What if they payment didn't come for four years, at 5.5%? What if the payment didn't come for six years, at 7%? c. 3. Congratulations, you just landed your dream job! Part of the compensation package is retirement benefits. They will pay $600 per year into a retirement account for you as long. as you work for them. a. Assuming you work for this organization for the next 25 years, and the average returns over that time span have been about 5.25%, what will your retirement package be worth? b. What if you match your employer's contribution and double the overall investment, making it $1,200 per year? (time and interest rate remain the same) c. What if your match your contribution ($1,200 per year) the interest rate increases to 6.5%, you decide to work for 30 years, and the compounding period increases to quarterly (4 times per year)? 4. The future MLS Nashville SC team is currently selling season tickets for their upcoming season. Premium luxury suite ticket holders are not required to pay for their tickets until the end of each season, but are required to sign a seven year agreement (this is not actually true, but is useful for practicing!). a. If the luxury suite season price each year is $85,000, what is the total amount of premium seating worth after the seven years, in purchasing power today (i.e., what is the present value of this stream of cash flows)? Assume a discount rate of 4.25%. b. What would the value be if the contracts were for five years and the rate was at 6.5%? c. What if we adjusted prices, making the overall premium suite price increase to $110,000, but only made the contract three years long? What would the purchasing power in today's dollars then be? Assuming a 5% discount rate