Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You designed a new phone case. You can sell your cases for $18. You need to buy a machine to produce the cases.

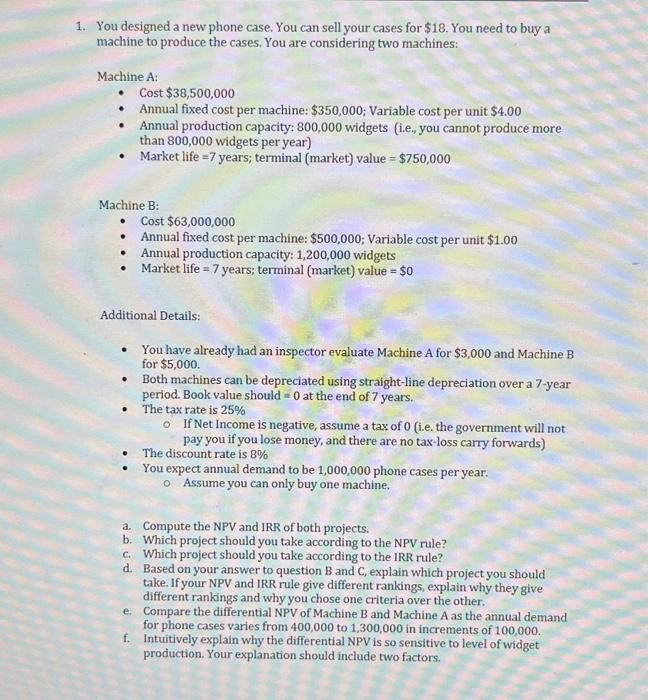

1. You designed a new phone case. You can sell your cases for $18. You need to buy a machine to produce the cases. You are considering two machines: Machine A: Machine B: Cost $38,500,000 Annual fixed cost per machine: $350,000; Variable cost per unit $4.00 Annual production capacity: 800,000 widgets (i.e, you cannot produce more than 800,000 widgets per year) Market life = 7 years; terminal (market) value = $750,000 . . Cost $63,000,000 Annual fixed cost per machine: $500,000; Variable cost per unit $1.00 Annual production capacity: 1,200,000 widgets Market life = 7 years; terminal (market) value = $0 Additional Details: You have already had an inspector evaluate Machine A for $3,000 and Machine B for $5,000. . Both machines can be depreciated using straight-line depreciation over a 7-year period. Book value should = 0 at the end of 7 years. The tax rate is 25% o If Net Income is negative, assume a tax of 0 (i.e. the government will not pay you if you lose money, and there are no tax-loss carry forwards) The discount rate is 8% You expect annual demand to be 1,000,000 phone cases per year. o Assume you can only buy one machine. a. Compute the NPV and IRR of both projects. b. Which project should you take according to the NPV rule? c. Which project should you take according to the IRR rule? d. Based on your answer to question B and C, explain which project you should take. If your NPV and IRR rule give different rankings, explain why they give different rankings and why you chose one criteria over the other. e. Compare the differential NPV of Machine B and Machine A as the annual demand for phone cases varies from 400,000 to 1,300,000 in increments of 100,000. Intuitively explain why the differential NPV is so sensitive to level of widget production. Your explanation should include two factors. f.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the two machines A and B based on the provided information Machine A Cost 38500000 Annual fixed cost per machine 350000 Variable cost per unit 400 Annual production capacity 800000 widget...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started