Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You have a 10% coupon bond with a principal of $100 and maturity 3 years. Compute the price of the bond if you

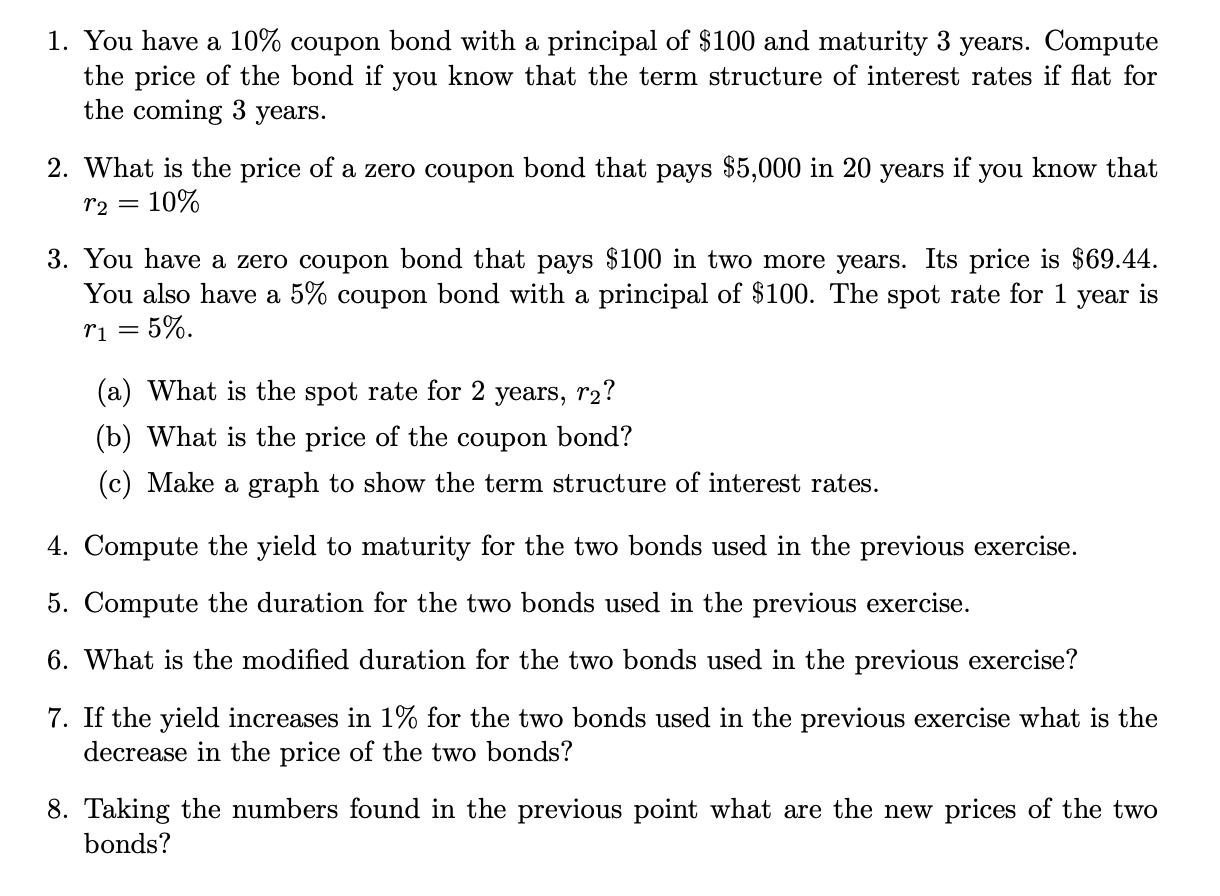

1. You have a 10% coupon bond with a principal of $100 and maturity 3 years. Compute the price of the bond if you know that the term structure of interest rates if flat for the coming 3 years. 2. What is the price of a zero coupon bond that pays $5,000 in 20 years if you know that r2 = 10% 3. You have a zero coupon bond that pays $100 in two more years. Its price is $69.44. You also have a 5% coupon bond with a principal of $100. The spot rate for 1 year is r1 = 5%. (a) What is the spot rate for 2 years, r? (b) What is the price of the coupon bond? (c) Make a graph to show the term structure of interest rates. 4. Compute the yield to maturity for the two bonds used in the previous exercise. 5. Compute the duration for the two bonds used in the previous exercise. 6. What is the modified duration for the two bonds used in the previous exercise? 7. If the yield increases in 1% for the two bonds used in the previous exercise what is the decrease in the price of the two bonds? 8. Taking the numbers found in the previous point what are the new prices of the two bonds?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

These are complex financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started