Question

1) You have been hired by Drs. Dewey, Cheetham and Howe to help with NPV analysis for a replacement project. These three New Haven radiologists

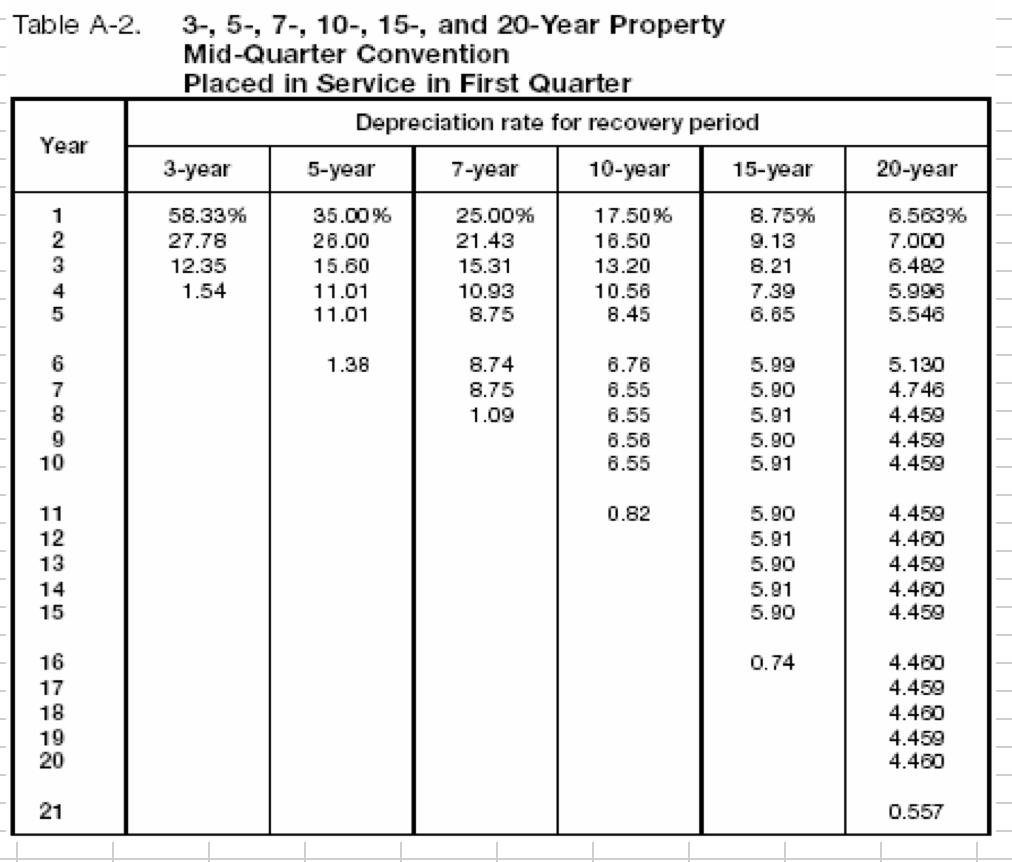

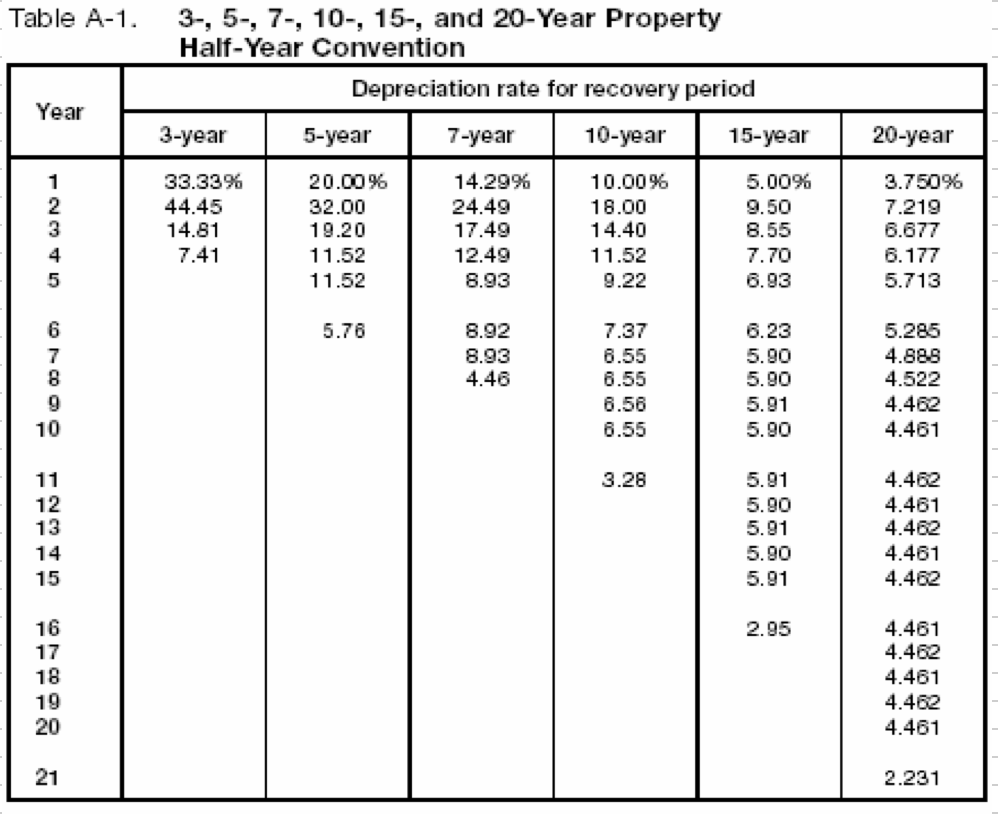

1) You have been hired by Drs. Dewey, Cheetham and Howe to help with NPV analysis for a replacement project. These three New Haven radiologists need to replace their existing, aging X-Ray equipment with new imaging equipment. They have calculated all the necessary figures but are unsure about how to account for the sale of their old machine. The original depreciation basis of the old machine is $200,000 and the accumulated depreciation follows the 5 year MACRS. They sold the old machine after the 4th year for $85,000 cash. Assume a tax rate for the company is 40 percent. a) What is the net cash flow from the sale of the old equipment? Is this an inflow or an outflow? b) Assume the new imaging equipment costs $400,000 and they do not expect a change in net working capital. Calculate the incremental cash flow for t0. c) Assume they could only sell the old equipment for $5,000. Recalculate parts b-d. d) Like risk investments have a return of 10%. What is the NPV in total if they sold the old machine for $5,000 and operated the new machine for 6 years, using 5 year MACRS depreciation, and had 6 years of $150,000 incremental cash flows with no change in net working capital, no salvage value and no additional expenses?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started