Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You have the opportunity to invest in either of two annuities. Annuity X is an ordinary annuity that makes 5 equal annual payment of

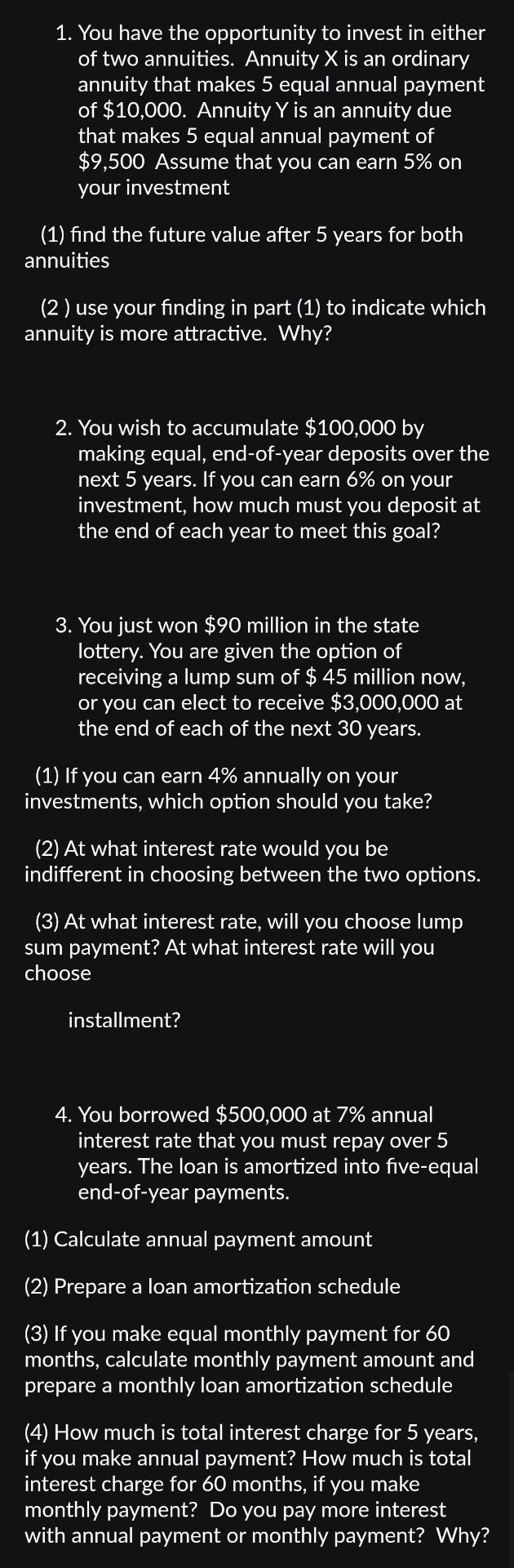

1. You have the opportunity to invest in either of two annuities. Annuity X is an ordinary annuity that makes 5 equal annual payment of $10,000. Annuity Y is an annuity due that makes 5 equal annual payment of $9,500 Assume that you can earn 5% on your investment (1) find the future value after 5 years for both annuities (2) use your finding in part (1) to indicate which annuity is more attractive. Why? 2. You wish to accumulate $100,000 by making equal, end-of-year deposits over the next 5 years. If you can earn 6% on your investment, how much must you deposit at the end of each year to meet this goal? 3. You just won $90 million in the state lottery. You are given the option of receiving a lump sum of $45 million now, or you can elect to receive $3,000,000 at the end of each of the next 30 years. (1) If you can earn 4% annually on your investments, which option should you take? (2) At what interest rate would you be indifferent in choosing between the two options. (3) At what interest rate, will you choose lump sum payment? At what interest rate will you choose installment? 4. You borrowed $500,000 at 7% annual interest rate that you must repay over 5 years. The loan is amortized into five-equal end-of-year payments. (1) Calculate annual payment amount (2) Prepare a loan amortization schedule (3) If you make equal monthly payment for 60 months, calculate monthly payment amount and prepare a monthly loan amortization schedule (4) How much is total interest charge for 5 years, if you make annual payment? How much is total interest charge for 60 months, if you make monthly payment? Do you pay more interest with annual payment or monthly payment? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started