Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1/ You have two different assets (investments). Asset A (perpetuity) will pay you $1,000 in one year, $1,000 in two years, $1,000 in three

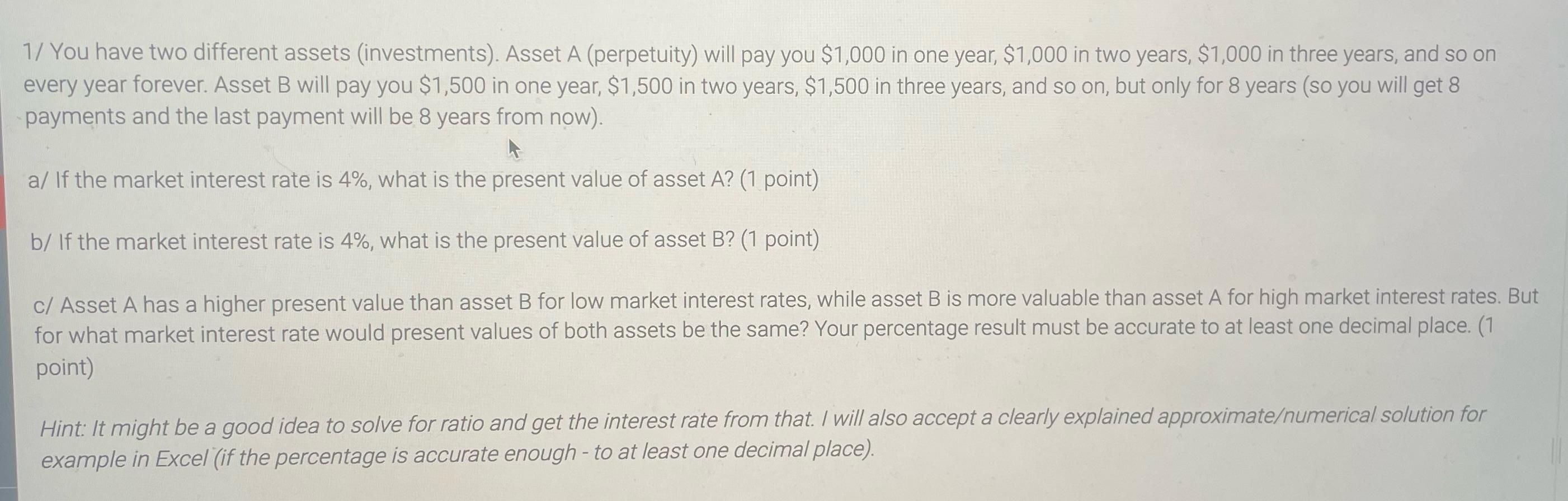

1/ You have two different assets (investments). Asset A (perpetuity) will pay you $1,000 in one year, $1,000 in two years, $1,000 in three years, and so on every year forever. Asset B will pay you $1,500 in one year, $1,500 in two years, $1,500 in three years, and so on, but only for 8 years (so you will get 8 payments and the last payment will be 8 years from now). a/ If the market interest rate is 4%, what is the present value of asset A? (1 point) b/ If the market interest rate is 4%, what is the present value of asset B? (1 point) c/ Asset A has a higher present value than asset B for low market interest rates, while asset B is more valuable than asset A for high market interest rates. But for what market interest rate would present values of both assets be the same? Your percentage result must be accurate to at least one decimal place. (1 point) Hint: It might be a good idea to solve for ratio and get the interest rate from that. I will also accept a clearly explained approximate/numerical solution for example in Excel (if the percentage is accurate enough - to at least one decimal place).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the present value of Asset A which is a perpetuity we can use the formula for the pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started