Answered step by step

Verified Expert Solution

Question

1 Approved Answer

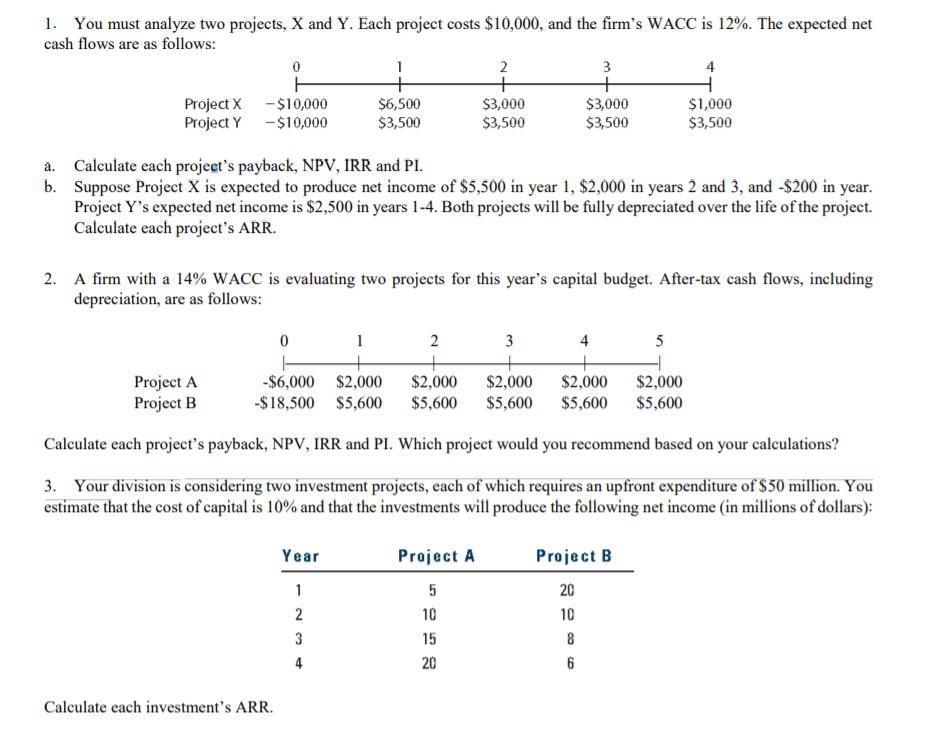

1. You must analyze two projects, X and Y. Each project costs $10,000, and the firm's WACC is 12%. The expected net cash flows

1. You must analyze two projects, X and Y. Each project costs $10,000, and the firm's WACC is 12%. The expected net cash flows are as follows: Project X Project Y -$10,000 -$10,000 0 a. Calculate each project's payback, NPV, IRR and PI. b. 0 Calculate each investment's ARR. 1 $6,500 $3,500 Year 1 1 23 Suppose Project X is expected to produce net income of $5,500 in year 1, $2,000 in years 2 and 3, and -$200 in year. Project Y's expected net income is $2,500 in years 1-4. Both projects will be fully depreciated over the life of the project. Calculate each project's ARR. 2. A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 2 2 $3,000 $3,500 Project A 5 10 15 20 3 3 $3,000 $3,500 Project A Project B -$6,000 $2,000 $2,000 $2,000 $2,000 $2,000 -$18,500 $5,600 $5,600 $5,600 $5,600 $5,600 Calculate each project's payback, NPV, IRR and PI. Which project would you recommend based on your calculations? 3. Your division is considering two investment projects, each of which requires an upfront expenditure of $50 million. You estimate that the cost of capital is 10% and that the investments will produce the following net income (in millions of dollars): 4 8 6 4 Project B 20 10 $1,000 $3,500 5

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1a Project X Payback period 4 years 10000650030003000 NPV 1199 usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started