Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You own right to some oil. You want to decide when to turn on the pump and take the oil out. You can

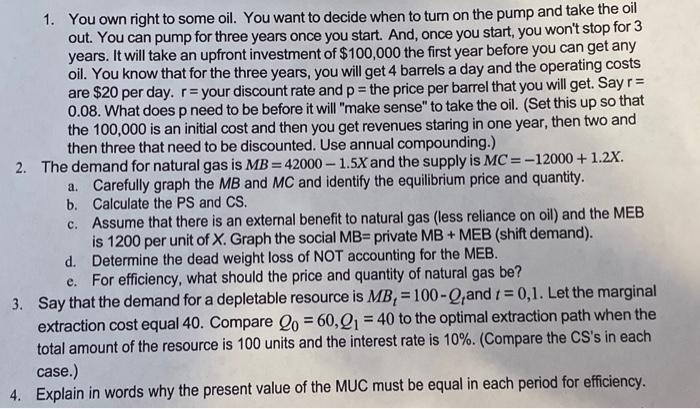

1. You own right to some oil. You want to decide when to turn on the pump and take the oil out. You can pump for three years once you start. And, once you start, you won't stop for 3 years. It will take an upfront investment of $100,000 the first year before you can get any oil. You know that for the three years, you will get 4 barrels a day and the operating costs are $20 per day. r= your discount rate and p = the price per barrel that you will get. Say r= 0.08. What does p need to be before it will "make sense" to take the oil. (Set this up so that the 100,000 is an initial cost and then you get revenues staring in one year, then two and then three that need to be discounted. Use annual compounding.) 2. The demand for natural gas is MB=42000-1.5X and the supply is MC=-12000+ 1.2X. Carefully graph the MB and MC and identify the equilibrium price and quantity. Calculate the PS and CS. a. b. c. Assume that there is an external benefit to natural gas (less reliance on oil) and the MEB is 1200 per unit of X. Graph the social MB= private MB + MEB (shift demand). Determine the dead weight loss of NOT accounting for the MEB. e. For efficiency, what should the price and quantity of natural gas be? 3. Say that the demand for a depletable resource is MB, = 100-Q,and t=0,1. Let the marginal extraction cost equal 40. Compare Q0 = 60,0 = 40 to the optimal extraction path when the total amount of the resource is 100 units and the interest rate is 10%. (Compare the CS's in each case.) 4. Explain in words why the present value of the MUC must be equal in each period for efficiency. d.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine the price per barrel p at which it makes sense to take the oil we need to compare the present value of the net cash flows to the upfront investment cost The net cash flows for the three ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started