Answered step by step

Verified Expert Solution

Question

1 Approved Answer

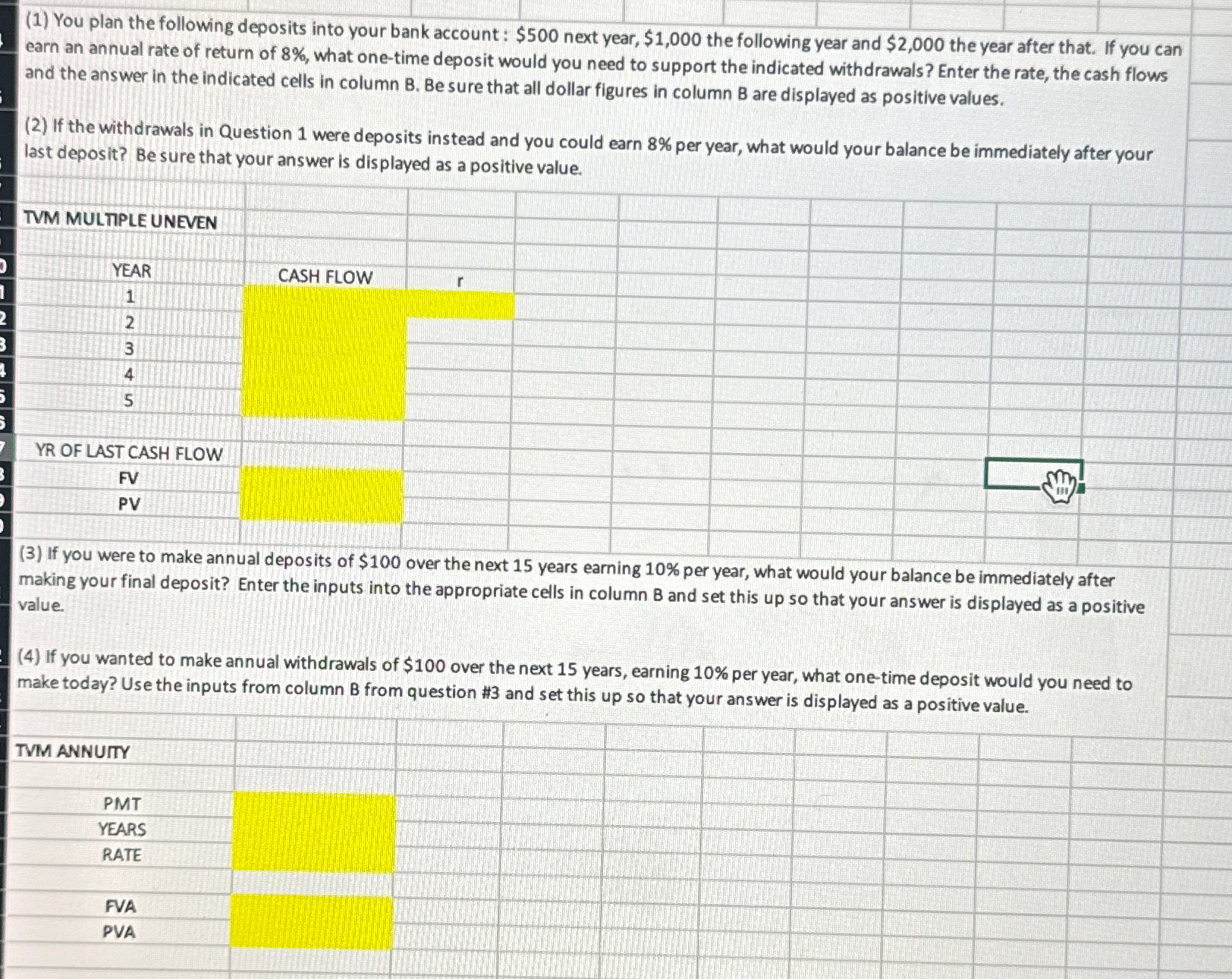

( 1 ) You plan the following deposits into your bank account: $ 5 0 0 next year, $ 1 , 0 0 0 the

You plan the following deposits into your bank account: $ next year, $ the following year and $ the year after that. If you can earn an annual rate of return of what onetime deposit would you need to support the indicated withdrawals? Enter the rate, the cash flows and the answer in the indicated cells in column B Be sure that all dollar figures in column B are displayed as positive values.

If the withdrawals in Question were deposits instead and you could earn per year, what would your balance be immediately after your last deposit? Be sure that your answer is displayed as a positive value.

TVM MULTPLE UNEVEN value.

If you wanted to make annual withdrawals of $ over the next years, earning per year, what onetime deposit would you need to make today? Use the inputs from column B from question # and set this up so that your answer is displayed as a positive value.

TVM ANNUITY

PMT

YEARS

RATE

FVA

PVA

Please solve these steps using excel because i need to enter in the correct formulas in the yellow boxes. Thank you so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started