Question

1- You purchase a T-Bill which is selling at a discount of 12 TL. The maturity of this T-Bill is 255 days. Calculate the simple

1- You purchase a T-Bill which is selling at a discount of 12 TL. The maturity of this T-Bill is 255 days. Calculate the simple yield and compounded yield of this T-Bill? (Par value: 100 TL)

2- An investor considers to invest 100 000 TL for the next year. This investor has 3 options. The first option is to buy a government bond that sells 100 TL. The par value of this government bond is also 100 TL and the remaining maturity is 1 year. This government bonds %20 annual coupon interest. The second option is to buy a commercial paper which sells 2200 TL discount. The par value is 10 000 TL and the maturity is 1 year. The other alternative is to invest in a common stock for a year. The current market price of the common stock is 6 TL per share and 1 year target price estimation of the market analysts is 8.2 TL on average for this share. Which option or options would you invest in and why? Show your answer mathematically.

3-Firm A distributed dividends to its shareholders for the current year according to the payout ratio of 35%. Net profit was 40 million TL. Total shares are 10 million . The dividends are expected to grow at a constant rate of %12 in the following years. Find the fundamental price per share according to Gordon Model if the Turkey 10 year benchmark government bond in TL yields at %14 and the risk premium is %6. If one share of firm A is selling at 20 TL in Borsa Istanbul, would you invest in this stock ? Is it undervalued or overpriced ?

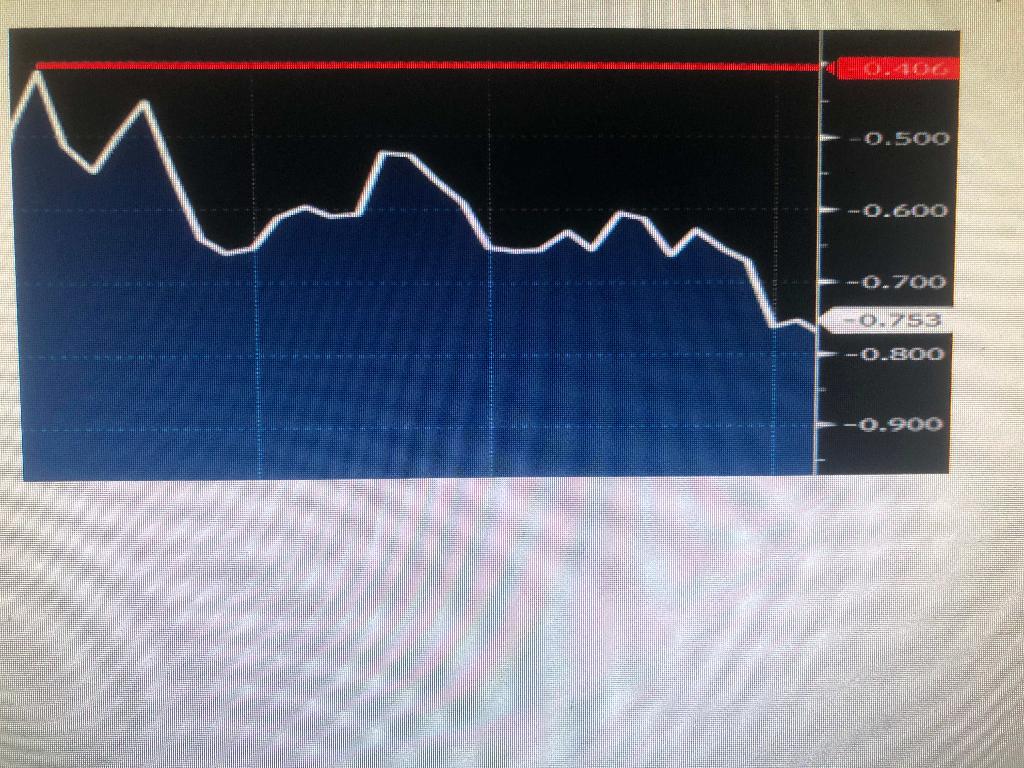

4- The graph below is the yield chart of 5 year German Government Bond in Euros. As it is seen from the chart; 5 year German government bond was trading at yield of 0.40% 1 month ago. The current yield to maturity is 0.75%. If you purchase this bond now and hold it to maturity, would you make a profit or loss? How much profit or loss would you make in terms of annulized yield? Can you make profit if you trade with this bond during 1 month? Explain briefly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started