Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You want to enter into an agreement to physically sell WTI crude oil at a set price of $60.00 per barrel today for

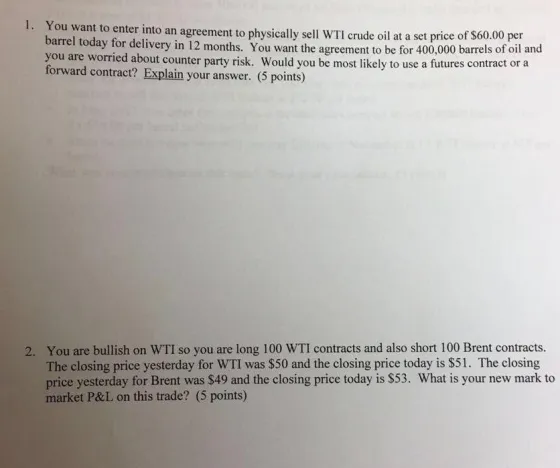

1. You want to enter into an agreement to physically sell WTI crude oil at a set price of $60.00 per barrel today for delivery in 12 months. You want the agreement to be for 400,000 barrels of oil and you are worried about counter party risk. Would you be most likely to use a futures contract or a forward contract? Explain your answer. (5 points) 2. You are bullish on WTI so you are long 100 WTI contracts and also short 100 Brent contracts. The closing price yesterday for WTI was $50 and the closing price today is $51. The closing price yesterday for Brent was $49 and the closing price today is $53. What is your new mark to market P&L on this trade? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 In this scenario you would be most likely to use a futures contract rather than a forward contract A futures contract is a standardized agreement traded on an exchange where the buyer agrees to purc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started