Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You wish to purchase a $300,000 home. Putting 20% down, you will borrow $240,000 at 6.0%, with monthly payments for 30 years. How

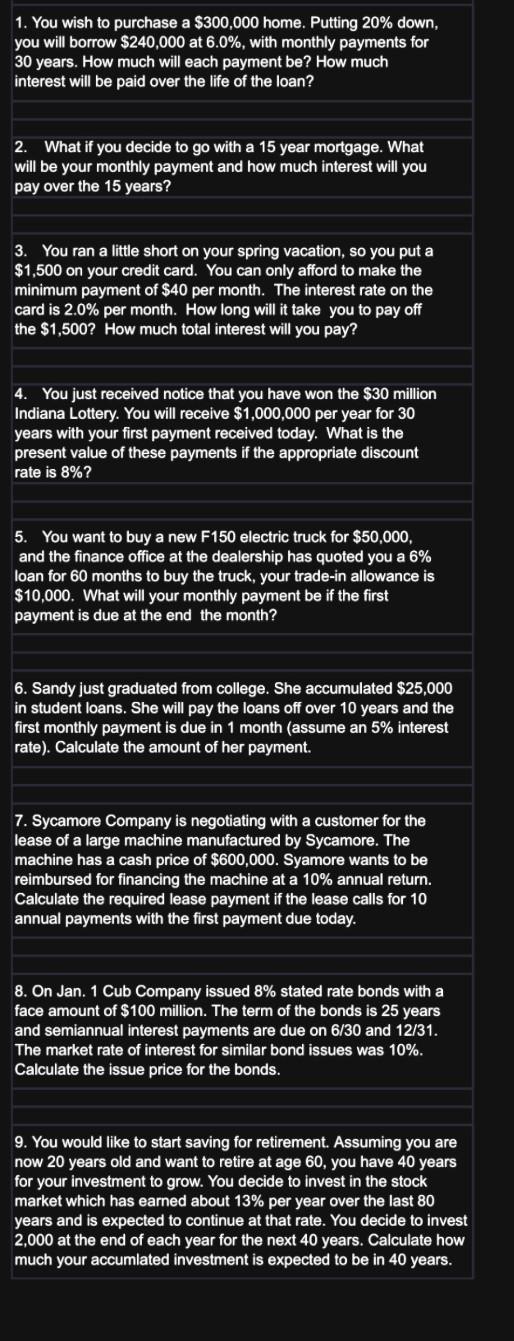

1. You wish to purchase a $300,000 home. Putting 20% down, you will borrow $240,000 at 6.0%, with monthly payments for 30 years. How much will each payment be? How much interest will be paid over the life of the loan? 2. What if you decide to go with a 15 year mortgage. What will be your monthly payment and how much interest will you pay over the 15 years? 3. You ran a little short on your spring vacation, so you put a $1,500 on your credit card. You can only afford to make the minimum payment of $40 per month. The interest rate on the card is 2.0% per month. How long will it take you to pay off the $1,500? How much total interest will you pay? 4. You just received notice that you have won the $30 million Indiana Lottery. You will receive $1,000,000 per year for 30 years with your first payment received today. What is the present value of these payments if the appropriate discount rate is 8%? 5. You want to buy a new F150 electric truck for $50,000, and the finance office at the dealership has quoted you a 6% loan for 60 months to buy the truck, your trade-in allowance is $10,000. What will your monthly payment be if the first payment is due at the end the month? 6. Sandy just graduated from college. She accumulated $25,000 in student loans. She will pay the loans off over 10 years and the first monthly payment is due in 1 month (assume an 5% interest rate). Calculate the amount of her payment. 7. Sycamore Company is negotiating with a customer for the lease of a large machine manufactured by Sycamore. The machine has a cash price of $600,000. Syamore wants to be reimbursed for financing the machine at a 10% annual return. Calculate the required lease payment if the lease calls for 10 annual payments with the first payment due today. 8. On Jan. 1 Cub Company issued 8% stated rate bonds with a face amount of $100 million. The term of the bonds is 25 years and semiannual interest payments are due on 6/30 and 12/31. The market rate of interest for similar bond issues was 10%. Calculate the issue price for the bonds. 9. You would like to start saving for retirement. Assuming you are now 20 years old and want to retire at age 60, you have 40 years for your investment to grow. You decide to invest in the stock market which has earned about 13% per year over the last 80 years and is expected to continue at that rate. You decide to invest 2,000 at the end of each year for the next 40 years. Calculate how much your accumlated investment is expected to be in 40 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started