Answered step by step

Verified Expert Solution

Question

1 Approved Answer

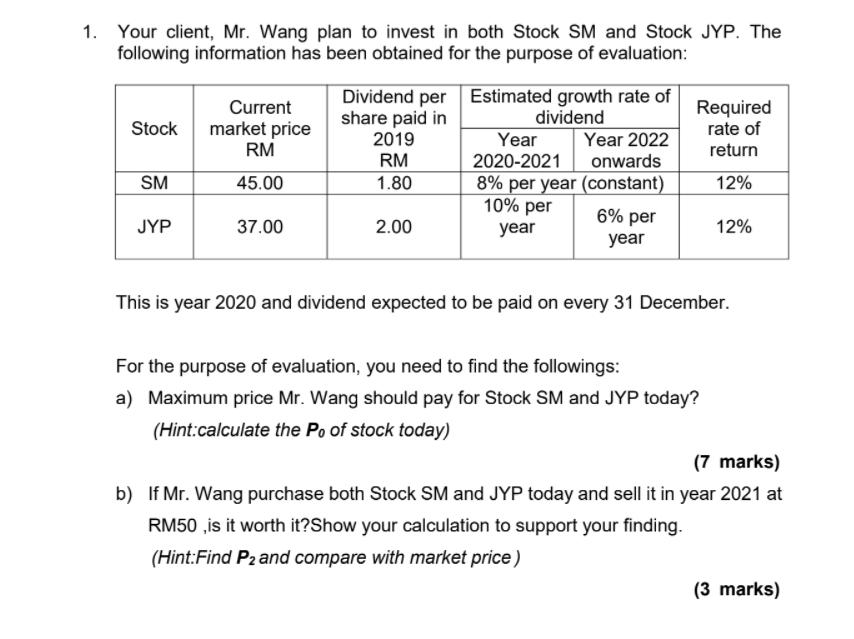

1. Your client, Mr. Wang plan to invest in both Stock SM and Stock JYP. The following information has been obtained for the purpose

1. Your client, Mr. Wang plan to invest in both Stock SM and Stock JYP. The following information has been obtained for the purpose of evaluation: Stock SM JYP Current market price RM 45.00 37.00 Dividend per share paid in 2019 RM 1.80 2.00 Estimated growth rate of dividend Year 2022 onwards 8% per year (constant) 10% per year Year 2020-2021 6% per year Required rate of return 12% 12% This is year 2020 and dividend expected to be paid on every 31 December. For the purpose of evaluation, you need to find the followings: a) Maximum price Mr. Wang should pay for Stock SM and JYP today? (Hint:calculate the Po of stock today) (7 marks) b) If Mr. Wang purchase both Stock SM and JYP today and sell it in year 2021 at RM50,is it worth it?Show your calculation to support your finding. (Hint:Find P2 and compare with market price) (3 marks)

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the maximum price that Mr Wang should pay for Stock SM and JYP today we need to use the dividend discount model The formula for the mod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started