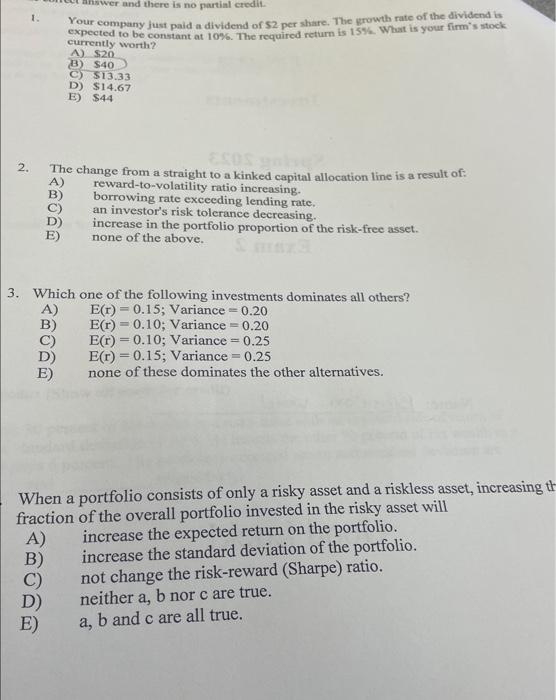

1. Your company just paid a dividend of $2 per share. The growth rate of the dividend is expected to be constant at 10%. The required return is 15%. What is your firm's stock currently worth? A) $20 C) 513.33 D) $14.67 E) $44 2. The change from a straight to a kinked capital allocation line is a result of: A) reward-to-volatility ratio increasing. B) borrowing rate exceeding lending rate. C) an investor's risk tolerance decreasing. D) increase in the portfolio proportion of the risk-free asset. E) none of the above. 3. Which one of the following investments dominates all others? A) E(r)=0.15; Variance =0.20 B) E(r)=0.10; Variance =0.20 C) E(r)=0.10; Variance =0.25 D) E(r)=0.15; Variance =0.25 E) none of these dominates the other alternatives. When a portfolio consists of only a risky asset and a riskless asset, increasing fraction of the overall portfolio invested in the risky asset will A) increase the expected return on the portfolio. B) increase the standard deviation of the portfolio. C) not change the risk-reward (Sharpe) ratio. D) neither a,b nor c are true. E) a, b and c are all true. 1. Your company just paid a dividend of $2 per share. The growth rate of the dividend is expected to be constant at 10%. The required return is 15%. What is your firm's stock currently worth? A) $20 C) 513.33 D) $14.67 E) $44 2. The change from a straight to a kinked capital allocation line is a result of: A) reward-to-volatility ratio increasing. B) borrowing rate exceeding lending rate. C) an investor's risk tolerance decreasing. D) increase in the portfolio proportion of the risk-free asset. E) none of the above. 3. Which one of the following investments dominates all others? A) E(r)=0.15; Variance =0.20 B) E(r)=0.10; Variance =0.20 C) E(r)=0.10; Variance =0.25 D) E(r)=0.15; Variance =0.25 E) none of these dominates the other alternatives. When a portfolio consists of only a risky asset and a riskless asset, increasing fraction of the overall portfolio invested in the risky asset will A) increase the expected return on the portfolio. B) increase the standard deviation of the portfolio. C) not change the risk-reward (Sharpe) ratio. D) neither a,b nor c are true. E) a, b and c are all true