Answered step by step

Verified Expert Solution

Question

1 Approved Answer

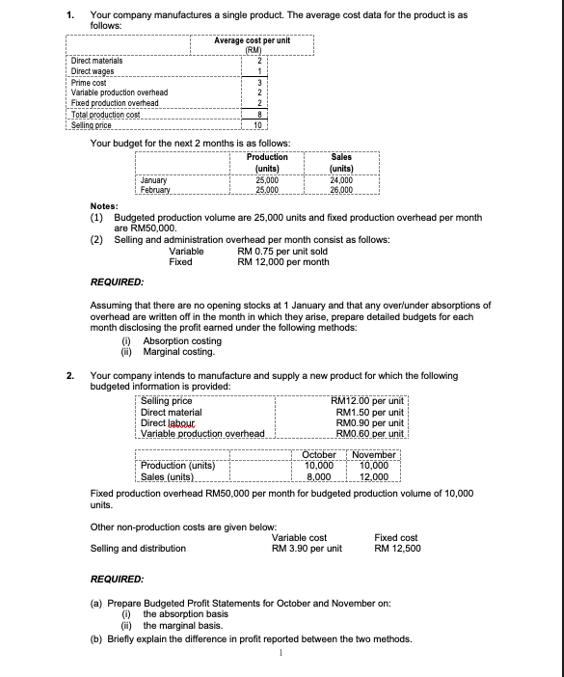

1. Your company manufactures a single product. The average cost data for the product is as follows: Direct materials Direct wages Prime cost Variable

1. Your company manufactures a single product. The average cost data for the product is as follows: Direct materials Direct wages Prime cost Variable production overhead Fixed production overhead Total production cost Selling price 2. January February Average cost per unit (RM) Variable Fixed Your budget for the next 2 months is as follows: Production (units) 25,000 25,000 1 (1) Absorption costing (ii) Marginal costing. 3 2 2 Selling price Direct material 8 Notes: (1) Budgeted production volume are 25,000 units and fixed production overhead per month are RM50,000. (2) Selling and administration overhead per month consist as follows: RM 0.75 per unit sold RM 12,000 per month 10 REQUIRED: Assuming that there are no opening stocks at 1 January and that any over/under absorptions of overhead are written off in the month in which they arise, prepare detailed budgets for each month disclosing the profit earned under the following methods: Production (units) Sales (units) Your company intends to manufacture and supply a new product for which the following budgeted information is provided: Sales (units) 24,000 26,000 Direct labour Variable production overhead Other non-production costs are given below: Selling and distribution RM12.00 per unit RM1.50 per unit RM0.90 per unit RM0.60 per unit October 10,000 8,000 Fixed production overhead RM50,000 per month for budgeted production volume of 10,000 units. November 10,000 12,000 Variable cost RM 3.90 per unit Fixed cost RM 12,500 REQUIRED: (a) Prepare Budgeted Profit Statements for October and November on: (i) the absorption basis (ii) the marginal basis. (b) Briefly explain the difference in profit reported between the two methods.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Budgeted Profit Statements for January and February i Absorption Costing January Sales 25000 units RM10 RM250000 Less Cost of Goods Sold Opening Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started