Answered step by step

Verified Expert Solution

Question

1 Approved Answer

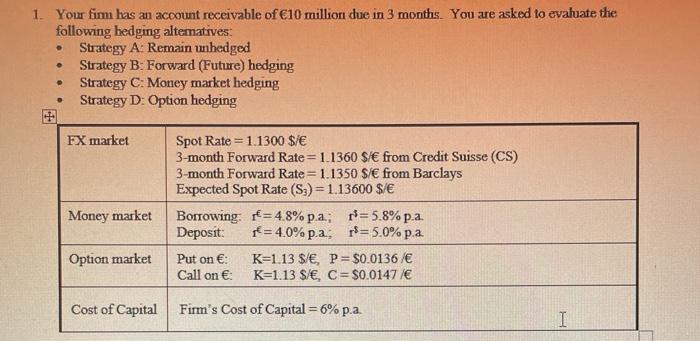

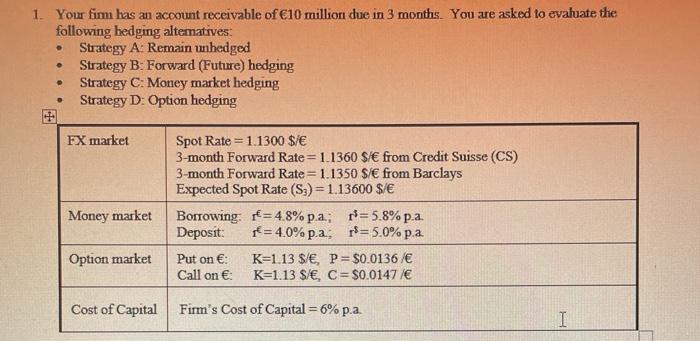

1. Your firm has an account receivable of 10 million due in 3 months. You are asked to evaluate the following hedging alteratives: Strategy A:

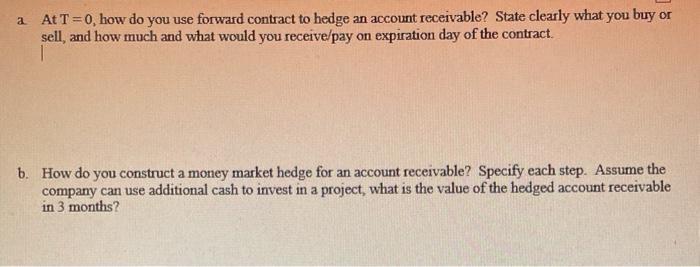

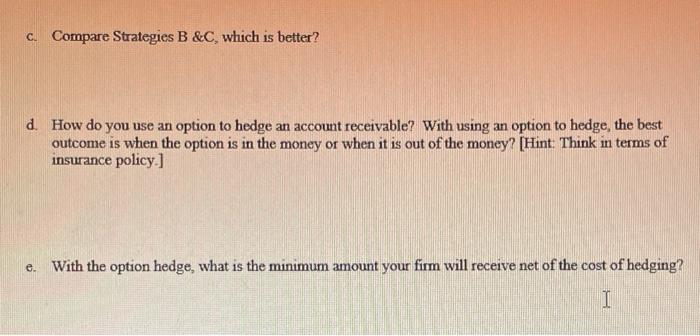

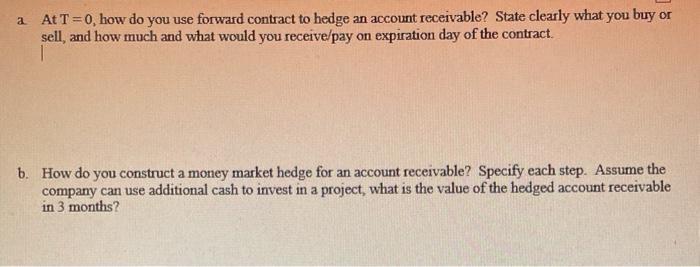

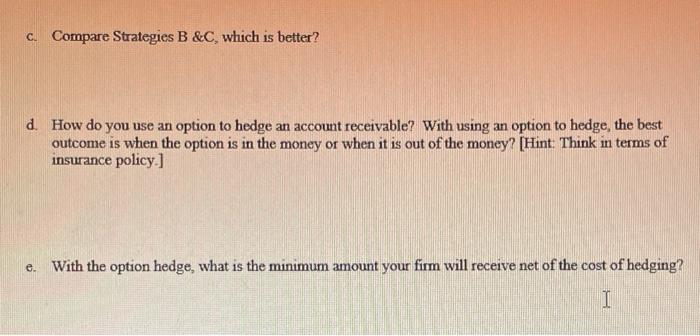

1. Your firm has an account receivable of 10 million due in 3 months. You are asked to evaluate the following hedging alteratives: Strategy A: Remain whedged Strategy B: Forward (Future) hedging Strategy C: Money market hedging Strategy D: Option hedging FX market Spot Rate = 1.1300 $/ 3-month Forward Rate=1.1360 $ from Credit Suisse (CS) 3-month Forward Rate = 1.1350 $/ from Barclays Expected Spot Rate (S3) = 1.13600 $/ Borrowing. = 4.8%p.a; p=5.8%p.a. Deposit: r = 4.0% p.a; =5.0%p.a. Put on : K=1.13 $/, P= $0.0136/ Call on : K=1.13 $/, C= $0.0147/ Money market Option market Cost of Capital Firm's Cost of Capital = 6% p.a. I a At T =0, how do you use forward contract to hedge an account receivable? State clearly what you buy or sell, and how much and what would you receive/pay on expiration day of the contract. 6. How do you construct a money market hedge for an account receivable? Specify each step. Assume the company can use additional cash to invest in a project, what is the value of the hedged account receivable in 3 months C. Compare Strategies B &C, which is better? d. How do you use an option to hedge an account receivable? With using an option to hedge, the best outcome is when the option is in the money or when it is out of the money? [HintThink in terms of insurance policy.] e. With the option hedge, what is the minimum amount your firm will receive net of the cost of hedging? 1 f Complete the following table on value profile of the 3 strategies. Amount Received in 3 Months' Time in dollars) Strategy B Strategy C Strategy A Strategy D Spot Rate (3 months Later) 1.1100 S/ 1.1200 S/E 1.1300 S/ 1.1400 1.1500 S/E & Plot the value profile of each of the hedging strategies and Strategy A on the same graph. I Specify on the graph the range over which option hedging is preferred to the forward hedging Specify on the graph the range over which option hedging is preferred to the unhedged position. 1 11

1. Your firm has an account receivable of 10 million due in 3 months. You are asked to evaluate the following hedging alteratives: Strategy A: Remain whedged Strategy B: Forward (Future) hedging Strategy C: Money market hedging Strategy D: Option hedging FX market Spot Rate = 1.1300 $/ 3-month Forward Rate=1.1360 $ from Credit Suisse (CS) 3-month Forward Rate = 1.1350 $/ from Barclays Expected Spot Rate (S3) = 1.13600 $/ Borrowing. = 4.8%p.a; p=5.8%p.a. Deposit: r = 4.0% p.a; =5.0%p.a. Put on : K=1.13 $/, P= $0.0136/ Call on : K=1.13 $/, C= $0.0147/ Money market Option market Cost of Capital Firm's Cost of Capital = 6% p.a. I a At T =0, how do you use forward contract to hedge an account receivable? State clearly what you buy or sell, and how much and what would you receive/pay on expiration day of the contract. 6. How do you construct a money market hedge for an account receivable? Specify each step. Assume the company can use additional cash to invest in a project, what is the value of the hedged account receivable in 3 months C. Compare Strategies B &C, which is better? d. How do you use an option to hedge an account receivable? With using an option to hedge, the best outcome is when the option is in the money or when it is out of the money? [HintThink in terms of insurance policy.] e. With the option hedge, what is the minimum amount your firm will receive net of the cost of hedging? 1 f Complete the following table on value profile of the 3 strategies. Amount Received in 3 Months' Time in dollars) Strategy B Strategy C Strategy A Strategy D Spot Rate (3 months Later) 1.1100 S/ 1.1200 S/E 1.1300 S/ 1.1400 1.1500 S/E & Plot the value profile of each of the hedging strategies and Strategy A on the same graph. I Specify on the graph the range over which option hedging is preferred to the forward hedging Specify on the graph the range over which option hedging is preferred to the unhedged position. 1 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started