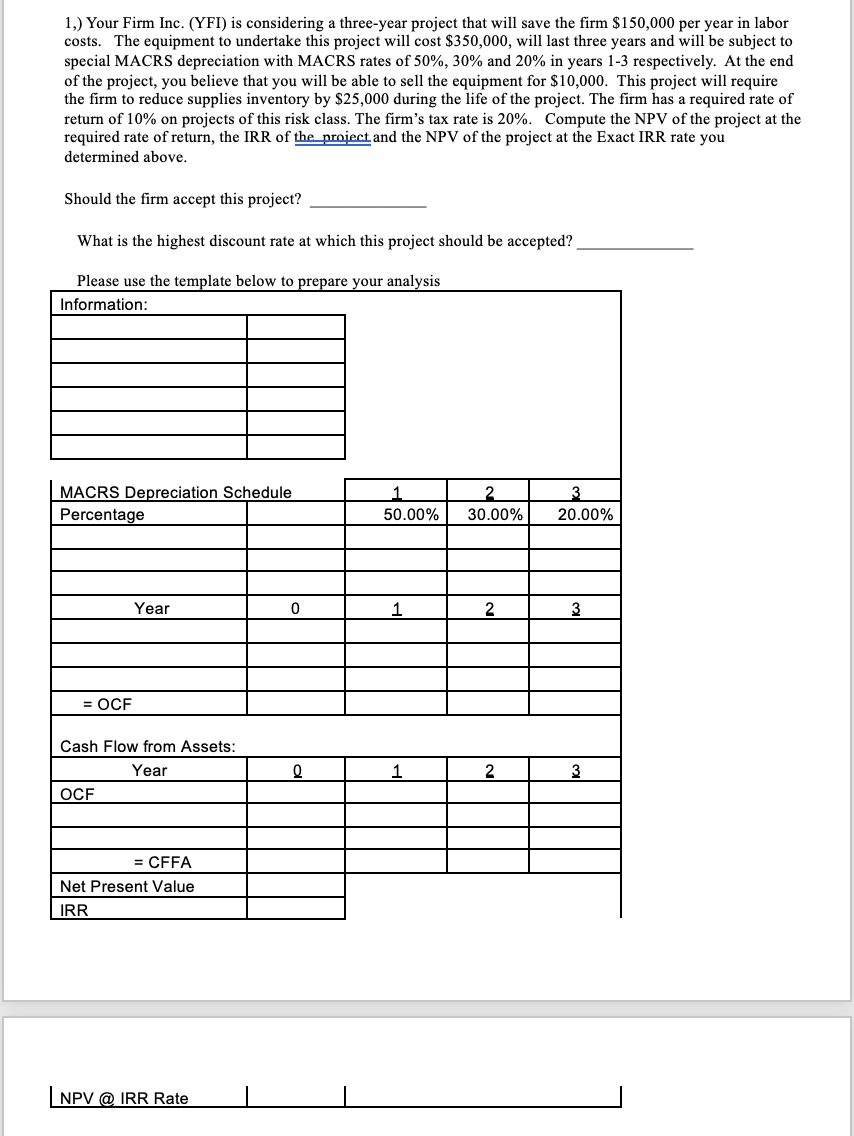

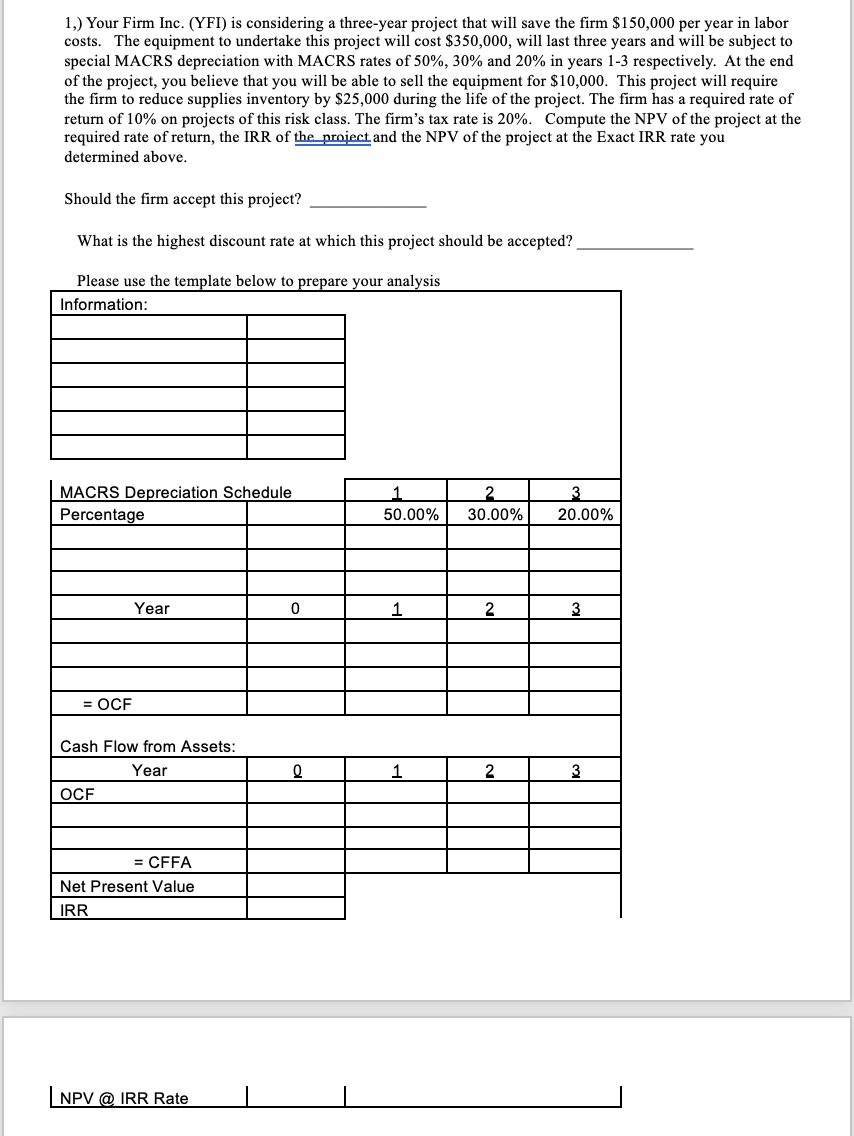

1,) Your Firm Inc. (YFI) is considering a three-year project that will save the firm $150,000 per year in labor costs. The equipment to undertake this project will cost $350,000, will last three years and will be subject to special MACRS depreciation with MACRS rates of 50%, 30% and 20% in years 1-3 respectively. At the end of the project, you believe that you will be able to sell the equipment for $10,000. This project will require the firm to reduce supplies inventory by $25,000 during the life of the project. The firm has a required rate of return of 10% on projects of this risk class. The firm's tax rate is 20%. Compute the NPV of the project at the required rate of return, the IRR of the project and the NPV of the project at the Exact IRR rate you determined above. Should the firm accept this project? What is the highest discount rate at which this project should be accepted? Please use the template below to prepare your analysis Information: MACRS Depreciation Schedule Percentage 2 30.00% 3 20.00% 50.00% Year 0 1 2 3 = OCF Cash Flow from Assets: Year OCF Q 1 2 3 = CFFA Net Present Value IRR NPV @ IRR Rate 1,) Your Firm Inc. (YFI) is considering a three-year project that will save the firm $150,000 per year in labor costs. The equipment to undertake this project will cost $350,000, will last three years and will be subject to special MACRS depreciation with MACRS rates of 50%, 30% and 20% in years 1-3 respectively. At the end of the project, you believe that you will be able to sell the equipment for $10,000. This project will require the firm to reduce supplies inventory by $25,000 during the life of the project. The firm has a required rate of return of 10% on projects of this risk class. The firm's tax rate is 20%. Compute the NPV of the project at the required rate of return, the IRR of the project and the NPV of the project at the Exact IRR rate you determined above. Should the firm accept this project? What is the highest discount rate at which this project should be accepted? Please use the template below to prepare your analysis Information: MACRS Depreciation Schedule Percentage 2 30.00% 3 20.00% 50.00% Year 0 1 2 3 = OCF Cash Flow from Assets: Year OCF Q 1 2 3 = CFFA Net Present Value IRR NPV @ IRR Rate