Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Your firm is considering investing $40 million to develop new technology to enhance the sales of your existing products. The expected NPV from

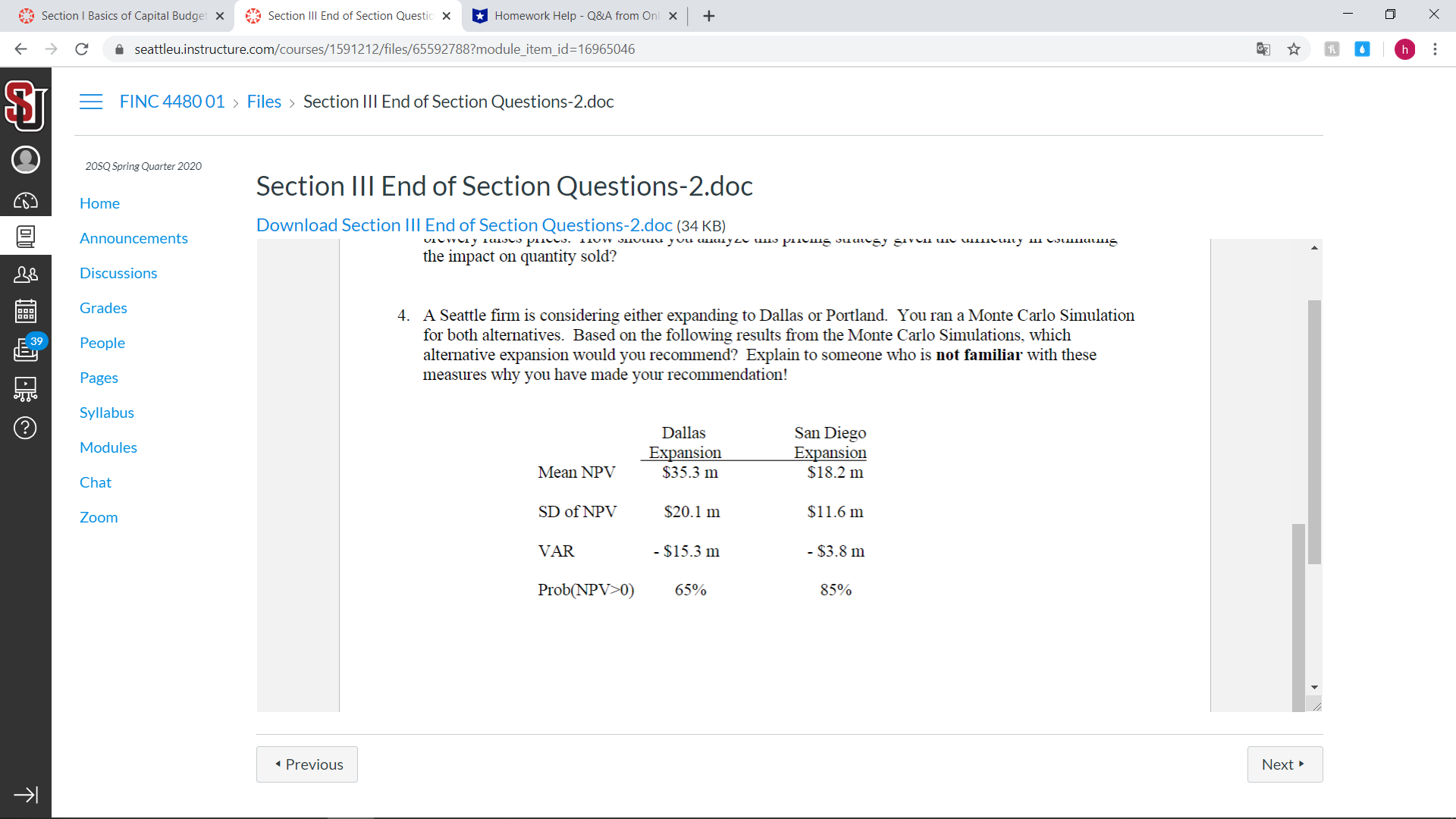

1. Your firm is considering investing $40 million to develop new technology to enhance the sales of your existing products. The expected NPV from this investment equals $1.7 million and it was reported that the breakeven level of investment dollars into the development of this new technology is $42 million. Based on this breakeven analysis, would you invest the $40 million to develop the new technology? Explain! 2. (5 points) Your firm is considering building a warehouse outside of San Diego to distribute your products in the southwest region of the country. Given the recent fires in southern California, your firm's risk manager has suggested that you adjust your analysis of this investment to consider this risk. How would you adjust your analysis to consider the risk of fire? Would you increase the discount? Would you apply a certain risk assessment tool? Explain! 3. A local brewery is considering raising the prices of the food they sell in hopes of increasing the cash flows that the firm generates from their operations (to increase firm value). You have been tasked with the evaluation of this pricing decision. The brewery's food manager is uncomfortable with providing a specific estimate of the expected percentage decrease in the quantity of food sold if the brewery raises prices. How should you analyze this pricing strategy given the difficulty in estimating the impact on quantity sold? K Section I Basics of Capital Budget X Section III End of Section Questio X Homework Help - Q&A from Onl x + J seattleu.instructure.com/courses/1591212/files/65592788?module_item_id=16965046 FINC 4480 01 > Files > Section III End of Section Questions-2.doc 201 13 20SQ Spring Quarter 2020 Home Announcements Discussions Grades People Pages Syllabus Section III End of Section Questions-2.doc Download Section III End of Section Questions-2.doc (34 KB) Brewery fases prices. How you analyze the prong sumugy given the county in Counting the impact on quantity sold? 4. A Seattle firm is considering either expanding to Dallas or Portland. You ran a Monte Carlo Simulation for both alternatives. Based on the following results from the Monte Carlo Simulations, which alternative expansion would you recommend? Explain to someone who is not familiar with these measures why you have made your recommendation! Modules Chat Zoom Previous Mean NPV Dallas Expansion $35.3 m SD of NPV $20.1 m VAR - $15.3 m Prob(NPV>0) 65% San Diego Expansion $18.2 m $11.6 m - $3.8 m 85% Next h

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Based on the breakeven analysis the breakeven level of investment for the new technology is 42 million meaning that below this investment level the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started