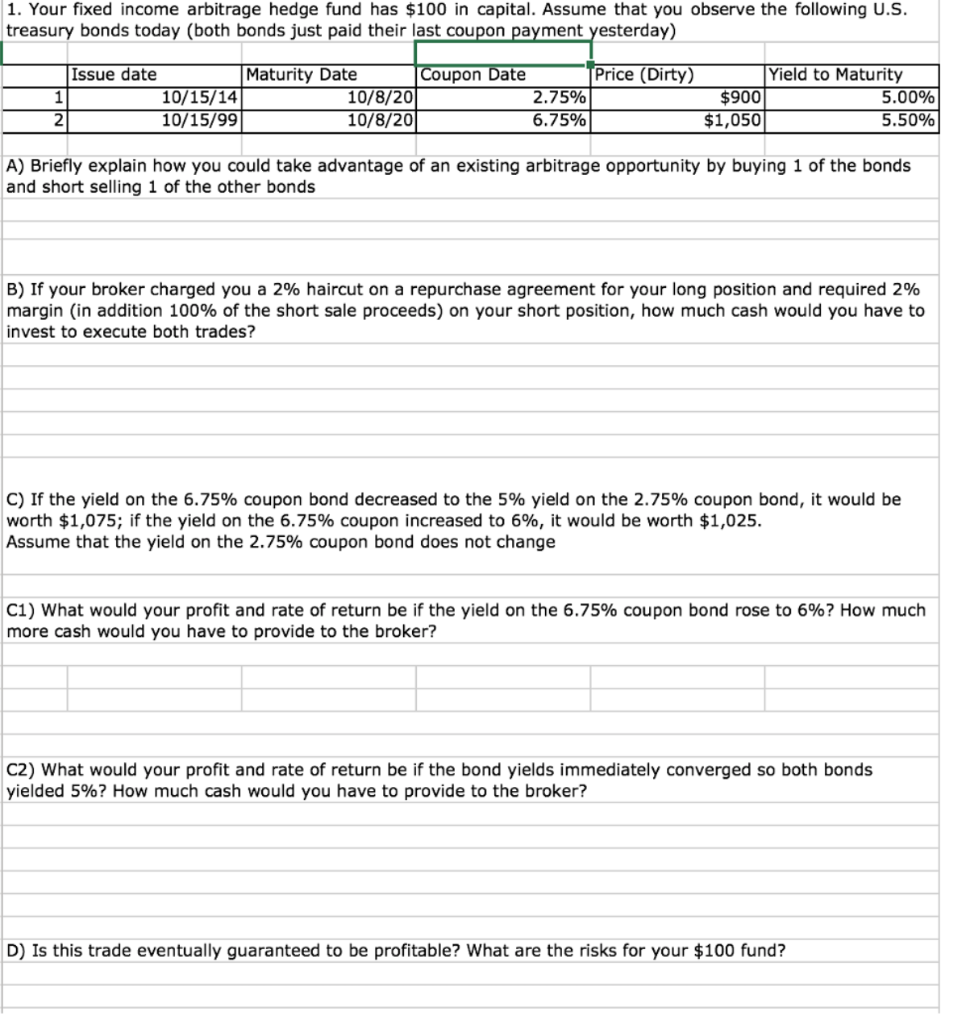

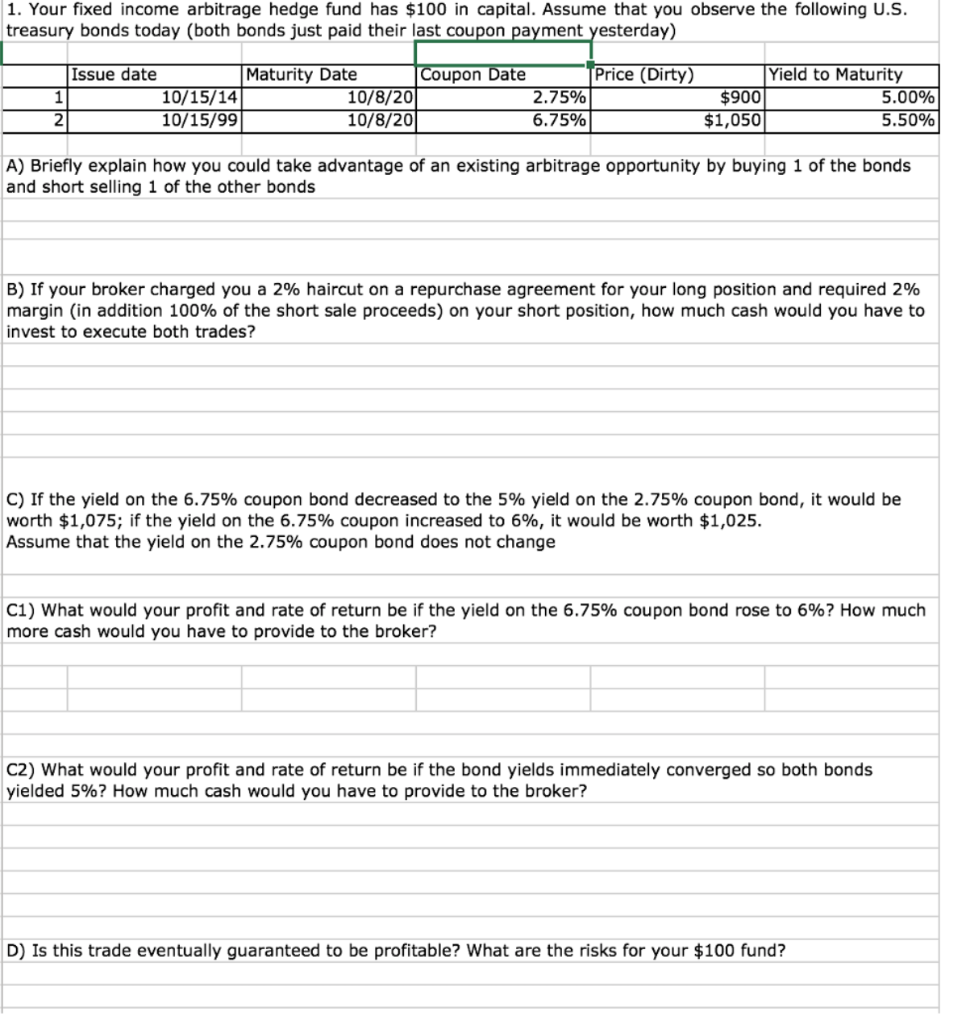

1. Your fixed income arbitrage hedge fund has $100 in capital. Assume that you observe the following U.S. treasury bonds today (both bonds just paid their last coupon payment yesterday) Price (Dirty) Issue date Maturity Date Coupon Date 10/15/14 10/8/201 2.75% 10/15/99 10/8/ 20 6 .75% $900 $1,050 Yield to Maturity 5.00% 5.50% A) Briefly explain how you could take advantage of an existing arbitrage opportunity by buying 1 of the bonds and short selling 1 of the other bonds B) If your broker charged you a 2% haircut on a repurchase agreement for your long position and required 2% margin (in addition 100% of the short sale proceeds) on your short position, how much cash would you have to invest to execute both trades? C) If the yield on the 6.75% coupon bond decreased to the 5% yield on the 2.75% coupon bond, it would be worth $1,075; if the yield on the 6.75% coupon increased to 6%, it would be worth $1,025. Assume that the yield on the 2.75% coupon bond does not change C1) What would your profit and rate of return be if the yield on the 6.75% coupon bond rose to 6%? How much more cash would you have to provide to the broker? C2) What would your profit and rate of return be if the bond yields immediately converged so both bonds yielded 5%? How much cash would you have to provide to the broker? D) Is this trade eventually guaranteed to be profitable? What are the risks for your $100 fund? 1. Your fixed income arbitrage hedge fund has $100 in capital. Assume that you observe the following U.S. treasury bonds today (both bonds just paid their last coupon payment yesterday) Price (Dirty) Issue date Maturity Date Coupon Date 10/15/14 10/8/201 2.75% 10/15/99 10/8/ 20 6 .75% $900 $1,050 Yield to Maturity 5.00% 5.50% A) Briefly explain how you could take advantage of an existing arbitrage opportunity by buying 1 of the bonds and short selling 1 of the other bonds B) If your broker charged you a 2% haircut on a repurchase agreement for your long position and required 2% margin (in addition 100% of the short sale proceeds) on your short position, how much cash would you have to invest to execute both trades? C) If the yield on the 6.75% coupon bond decreased to the 5% yield on the 2.75% coupon bond, it would be worth $1,075; if the yield on the 6.75% coupon increased to 6%, it would be worth $1,025. Assume that the yield on the 2.75% coupon bond does not change C1) What would your profit and rate of return be if the yield on the 6.75% coupon bond rose to 6%? How much more cash would you have to provide to the broker? C2) What would your profit and rate of return be if the bond yields immediately converged so both bonds yielded 5%? How much cash would you have to provide to the broker? D) Is this trade eventually guaranteed to be profitable? What are the risks for your $100 fund