Answered step by step

Verified Expert Solution

Question

1 Approved Answer

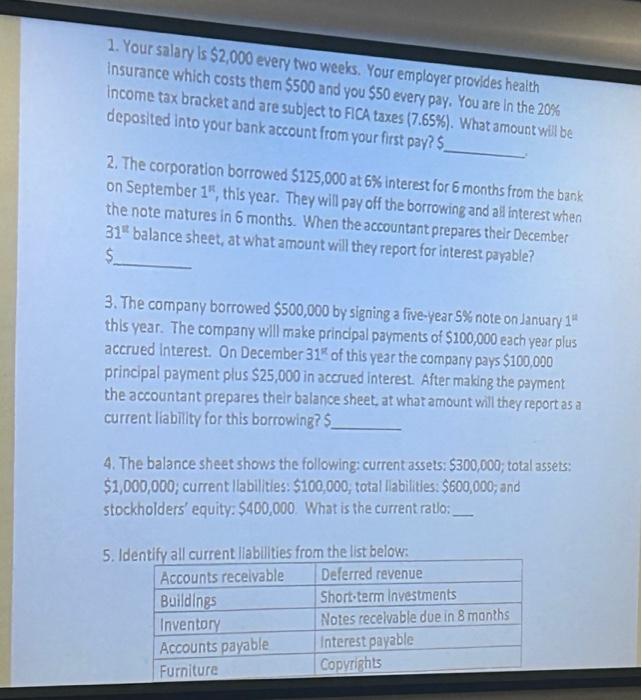

1. Your salary is $2,000 every two weeks. Your employer provides health Insurance which costs them $500 and you $50 every pay. You are in

1. Your salary is $2,000 every two weeks. Your employer provides health Insurance which costs them $500 and you $50 every pay. You are in the 20% income tax bracket and are subject to FICA taxes (7.65%). What amount will be deposited into your bank account from your first pay? $ 2. The corporation borrowed $125,000 at 6% interest for 6 months from the bank on September 1", this year. They will pay off the borrowing and all interest when the note matures in 6 months. When the accountant prepares their December 31 balance sheet, at what amount will they report for interest payable? $ 3. The company borrowed $500,000 by signing a five-year S% note on January 1 this year. The company will make principal payments of $100,000 each year plus accrued Interest. On December 31% of this year the company pays $100,000 principal payment plus $25,000 in accrued interest. After making the payment the accountant prepares their balance sheet, at what amount will they report as a current liability for this borrowing? $ 4. The balance sheet shows the following: current assets: $300,000; total assets: $1,000,000; current llabilities: $100,000; total llabilities: $600,000; and stockholders' equity: $400,000. What is the current ratio: 5. Identify all current liabilities from the list below: Accounts receivable Deferred revenue Buildings Short-term Investments Notes receivable due in 8 months Interest payable Copyrights Inventory Accounts payable Furniture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started