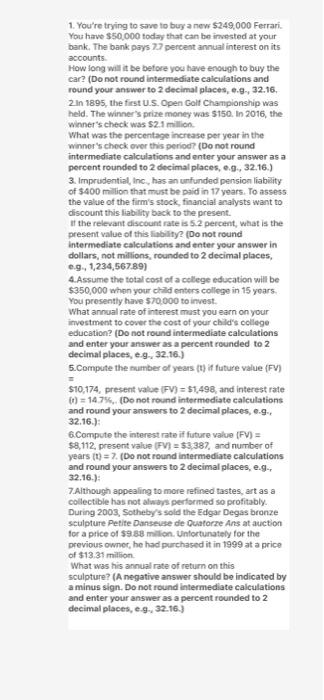

1. You're trying to save to buy a new $249,000 Ferrari You have $50,000 today that can be invested at your bank. The bank pays 27 percent annual interest on its accounts How long will it be before you have enough to buy the car? (Do not round intermediate calculations and round your answer to 2 decimal places, .9., 32.16. 2 in 1895, the first U.S. Open Golf Championship was held. The winner's prize money was 5150. In 2016, the winner's check was $2.1 million What was the percentage increase per year in the Winner's check over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 3. Imprudential, Inc., has an unfunded pension liability of $400 million that must be paid in 17 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. it the relevant discount rate is 52 percent, what is the present value of this liability? (Do not round Intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g. 1,234,56789) 4.Assume the total cost of a college education will be $350,000 when your child enters college in 15 years You presently have 570.000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child's college education? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e... 32.16.) 5.Compute the number of years (1) if future value (FV) $10,174, present value (FV) = $1,498, and interest rate 1) = 1475 (Do not round intermediate calculations and round your answers to 2 decimal places, e... 32.16.): 6.Compute the interest rate if future value (FV) = $8,112, present value (FV= $3,387, and number of years (1)=2. (Do not round intermediate calculations and round your answers to 2 decimal places, e.... 32.16.): 7. Although appealing to more refined tastes, art as a collectible has not always performed so profitably. During 2003, Sotheby's sold the Edgar Degas bronze sculpture Petite Danseuse de Ouatorze Ars at auction for a price of $9.88 million. Unfortunately for the previous owner, he had purchased it in 1999 at a price of $13.31 million What was his annual rate of return on this sculpture? (A negative answer should be indicated by a minus sign. Do not found intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e... 32.16.)