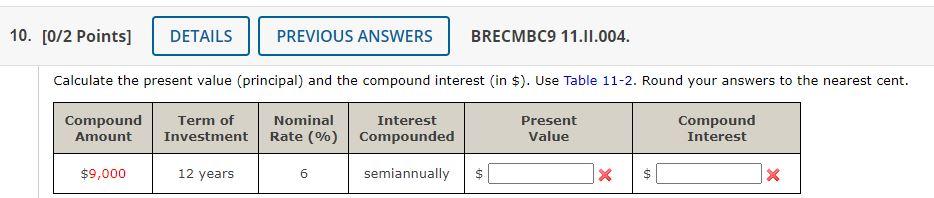

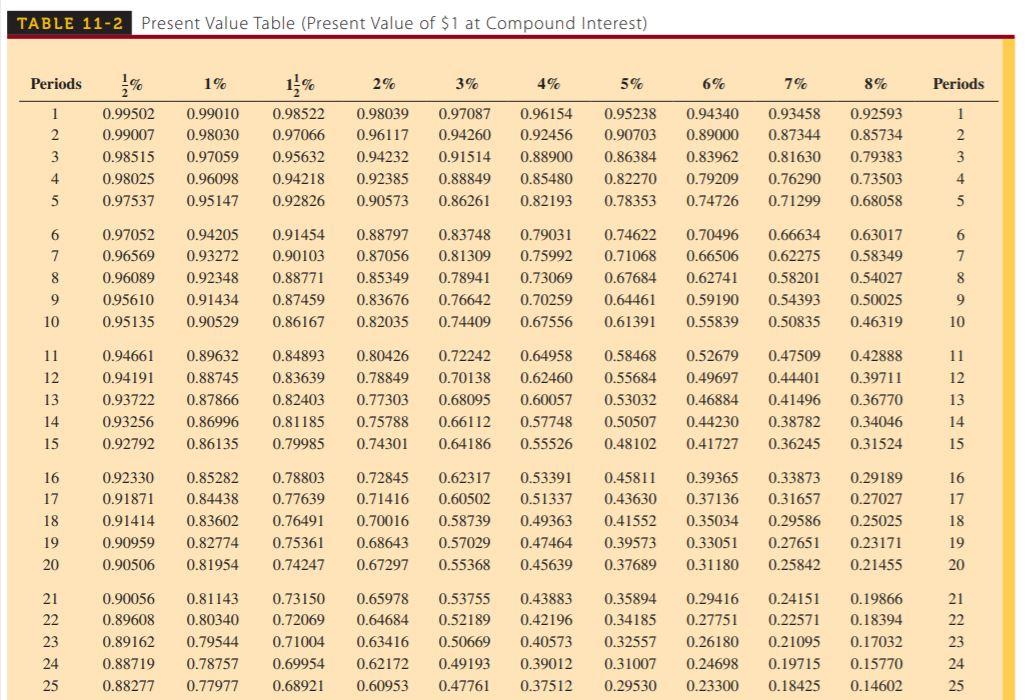

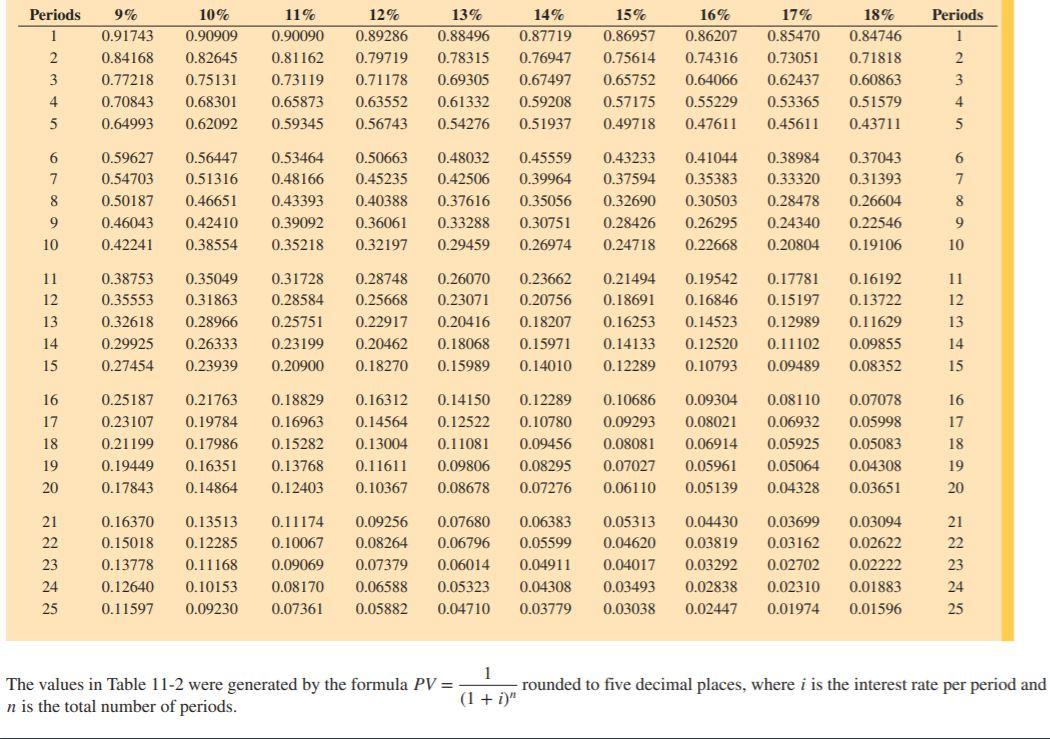

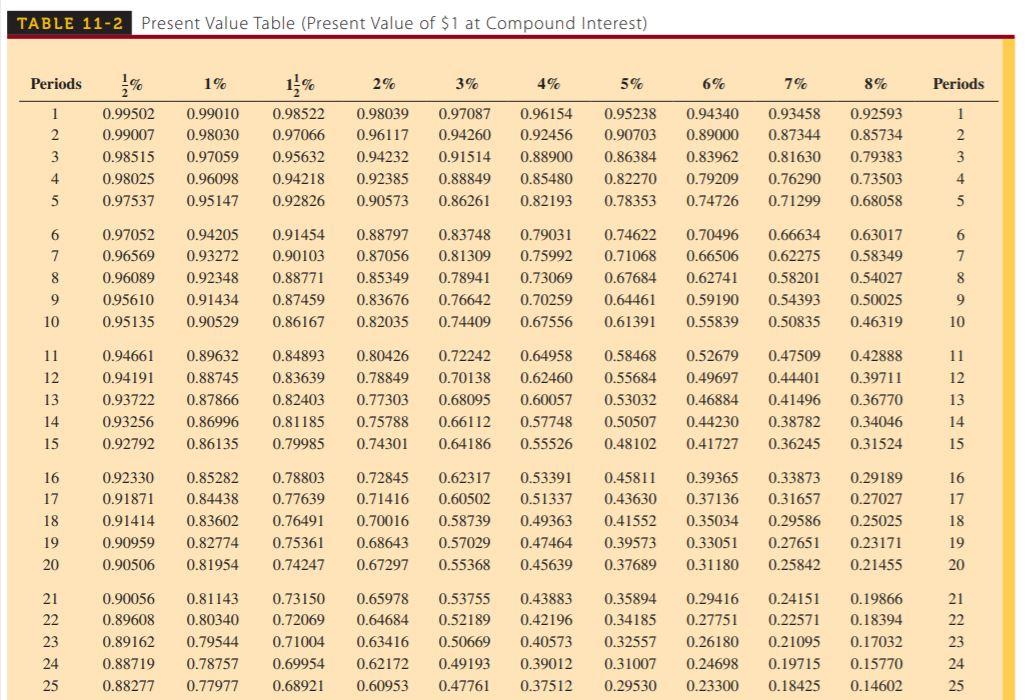

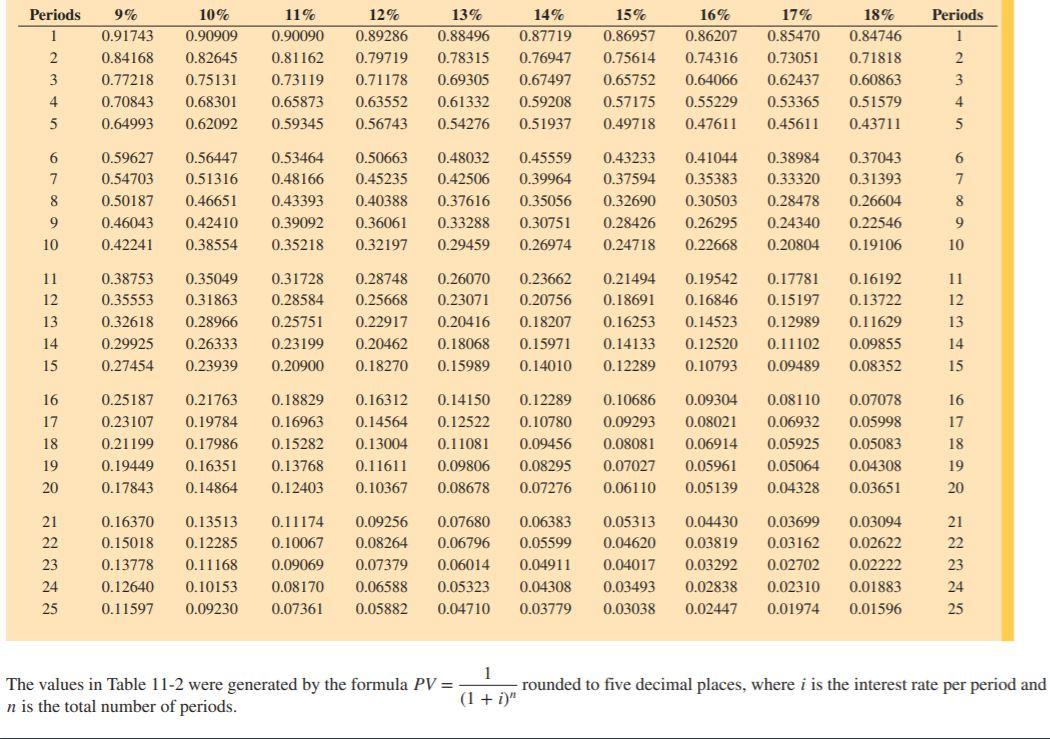

10. [0/2 points] DETAILS PREVIOUS ANSWERS BRECMBC9 11.11.004. Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round your answers to the nearest cent. Compound Amount Term of Investment Nominal Rate (%) Interest Compounded Present Value Compound Interest $9,000 12 years 6 semiannually $ $ X TABLE 11-2 Present Value Table (Present Value of $1 at Compound Interest) Periods 1% 2% 3% 4% 5% 6% 7% 8% Periods 1 2 3 0.99502 0.99007 0.98515 0.98025 0.97537 0.99010 0.98030 0.97059 0.96098 0.95147 0.98522 0.97066 0.95632 0.94218 0.92826 0.98039 0.96117 0.94232 0.92385 0.90573 0.97087 0.94260 0.91514 0.88849 0.86261 0.96154 0.92456 0.88900 0.85480 0.82193 0.95238 0.90703 0.86384 0.82270 0.78353 0.94340 0.89000 0.83962 0.79209 0.74726 0.93458 0.87344 0.81630 0.76290 0.71299 0.92593 0.85734 0.79383 0.73503 0.68058 1 2 3 4 5 4 5 6 7 8 0.97052 0.96569 0.96089 0.95610 0.95135 0.94205 0.93272 0.92348 0.91434 0.90529 0.91454 0.90103 0.88771 0.87459 0.86167 0.88797 0.87056 0.85349 0.83676 0.82035 0.83748 0.81309 0.78941 0.76642 0.74409 0.79031 0.75992 0.73069 0.70259 0.67556 0.74622 0.71068 0.67684 0.64461 0.61391 0.70496 0.66506 0.62741 0.59190 0.55839 0.66634 0.62275 0.58201 0.54393 0.50835 0.63017 0.58349 0.54027 0.50025 0.46319 6 7 8 9 10 9 10 11 11 12 12 13 0.94661 0.94191 0.93722 0.93256 0.92792 0.89632 0.88745 0.87866 0.86996 0.86135 0.84893 0.83639 0.82403 0.81185 0.79985 0.80426 0.78849 0.77303 0.75788 0.74301 0.72242 0.70138 0.68095 0.66112 0.64186 0.64958 0.62460 0.60057 0.57748 0.55526 0.58468 0.55684 0.53032 0.50507 0.48102 0.52679 0.49697 0.46884 0.44230 0.41727 0.47509 0.44401 0.41496 0.38782 0.36245 0.42888 0.39711 0.36770 0.34046 0.31524 13 14 14 15 15 16 17 18 19 20 0.92330 0.91871 0.91414 0.90959 0.90506 0.85282 0.84438 0.83602 0.82774 0.81954 0.78803 0.77639 0.76491 0.75361 0.74247 0.72845 0.71416 0.70016 0.68643 0.67297 0.62317 0.60502 0.58739 0.57029 0.55368 0.53391 0.51337 0.49363 0.47464 0.45639 0.45811 0.43630 0.41552 0.39573 0.37689 0.39365 0.37136 0.35034 0.33051 0.31180 0.33873 0.31657 0.29586 0.27651 0.25842 0.29189 0.27027 0.25025 0.23171 0.21455 16 17 18 19 20 21 22 23 24 25 0.90056 0.89608 0.89162 0.88719 0.88277 0.81143 0.80340 0.79544 0.78757 0.77977 0.73150 0.72069 0.71004 0.69954 0.68921 0.65978 0.64684 0.63416 0.62172 0.60953 0.53755 0.52189 0.50669 0.49193 0.47761 0.43883 0.42196 0.40573 0.39012 0.37512 0.35894 0.34185 0.32557 0.31007 0.29530 0.29416 0.27751 0.26180 0.24698 0.23300 0.24151 0.22571 0.21095 0.19715 0.18425 0.19866 0.18394 0.17032 0.15770 0.14602 21 22 23 24 25 Periods 1 2 Periods 1 2 3 4 5 9% 0.91743 0.84168 0.77218 0.70843 0.64993 10% 0.90909 0.82645 0.75131 0.68301 0.62092 11% 0.90090 0.81162 0.73119 0.65873 0.59345 12% 0.89286 0.79719 0.71178 0.63552 0.56743 13% 0.88496 0.78315 0.69305 0.61332 0.54276 14% 0.87719 0.76947 0.67497 0.59208 0.51937 15% 0.86957 0.75614 0.65752 0.57175 0.49718 16% 0.86207 0.74316 0.64066 0.55229 0.47611 17% 0.85470 0.73051 0.62437 0.53365 0.45611 18% 0.84746 0.71818 0.60863 0.51579 0.43711 3 4 5 6 6 7 8 9 0.59627 0.54703 0.50187 0.46043 0.42241 0.56447 0.51316 0.46651 0.42410 0.38554 0.53464 0.48166 0.43393 0.39092 0.35218 0.50663 0.45235 0.40388 0.36061 0.32197 0.48032 0.42506 0.37616 0.33288 0.29459 0.45559 0.39964 0.35056 0.30751 0.26974 0.43233 0.37594 0.32690 0.28426 0.24718 0.41044 0.35383 0.30503 0.26295 0.22668 0.38984 0.33320 0.28478 0.24340 0.20804 0.37043 0.31393 0.26604 0.22546 0.19106 7 8 9 10 10 11 11 12 12 13 0.38753 0.35553 0.32618 0.29925 0.27454 0.35049 0.31863 0.28966 0.26333 0.23939 0.31728 0.28584 0.25751 0.23199 0.20900 0.28748 0.25668 0.22917 0.20462 0.18270 0.26070 0.23071 0.20416 0.18068 0.15989 0.23662 0.20756 0.18207 0.15971 0.14010 0.21494 0.18691 0.16253 0.14133 0.12289 0.19542 0.16846 0.14523 0.12520 0.10793 0.17781 0.15197 0.12989 0.11102 0.09489 0.16192 0.13722 0.11629 0.09855 0.08352 13 14 14 15 15 16 17 16 17 18 0.25187 0.23107 0.21199 0.19449 0.17843 0.21763 0.19784 0.17986 0.16351 0.14864 0.18829 0.16963 0.15282 0.13768 0.12403 0.16312 0.14564 0.13004 0.11611 0.10367 0.14150 0.12522 0.11081 0.09806 0.08678 0.12289 0.10780 0.09456 0.08295 0.07276 0.10686 0.09293 0.08081 0.07027 0.06110 0.09304 0.08021 0.06914 0.05961 0.05139 0.08110 0.06932 0.05925 0.05064 0.04328 0.07078 0.05998 0.05083 0.04308 0.03651 18 19 19 20 20 0.11174 0.10067 21 22 23 24 25 0.16370 0.15018 0.13778 0.12640 0.11597 0.13513 0.12285 0.11168 0.10153 0.09230 0.09256 0.08264 0.07379 0.06588 0.05882 0.09069 0.08170 0.07361 0.07680 0.06796 0.06014 0.05323 0.04710 0.06383 0.05599 0.04911 0.04308 0.03779 0.05313 0.04620 0.04017 0.03493 0.03038 0.04430 0.03819 0.03292 0.02838 0.02447 0.03699 0.03162 0.02702 0.02310 0.01974 0.03094 0.02622 0.02222 0.01883 0.01596 21 22 23 24 25 1 The values in Table 11-2 were generated by the formula PV = rounded to five decimal places, where i is the interest rate per period and n is the total number of periods. (1 + i)