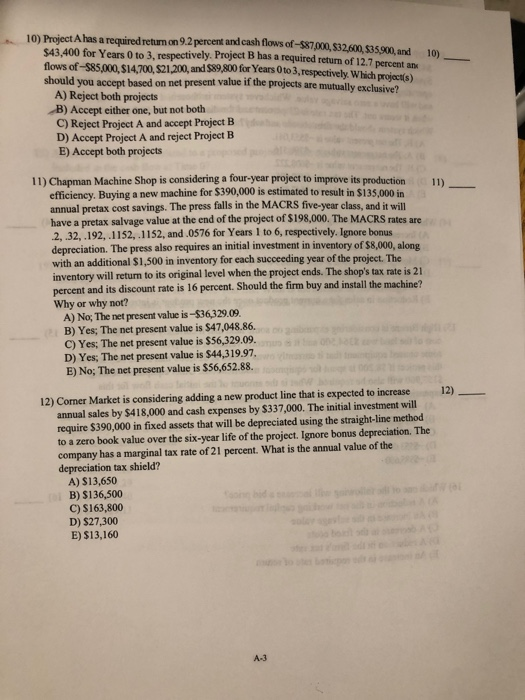

10 10) Project A has a required return on 9.2 percent and cash flows f-587/000, 532.600 $35.90 and $43.400 for Years 0 to 3. respectively. Project is has a required return of 12.7 percenta flows of $85.000 $14,700, 521,200, and $89,800 for Years 0 to 3, respectively. Which project's) should you accept based on net present value if the projects are mutually exclusive? A) Reject both projects B) Accept either one, but not both C) Reject Project A and accept Project B D) Accept Project A and reject Project B E) Accept both projects 11) 11) Chapman Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine for $390,000 is estimated to result in $135,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a pretax salvage value at the end of the project of $198,000. The MACRS rates are .2, 32, .192, 1152, 1152, and .0576 for Years 1 to 6, respectively. Ignore bonus depreciation. The press also requires an initial investment in inventory of $8,000, along with an additional $1,500 in inventory for each succeeding year of the project. The inventory will return to its original level when the project ends. The shop's tax rate is 21 percent and its discount rate is 16 percent. Should the firm buy and install the machine? Why or why not? A) No. The net present value is -$36,329.09. B) Yes; The net present value is $47,048.86. C) Yes: The net present value is $56,329.09. D) Yes: The net present value is $44,319.97. E) No: The net present value is $56,652.88. 12) 12) Corner Market is considering adding a new product line that is expected to increase annual sales by $418,000 and cash expenses by $337,000. The initial investment will require $390,000 in fixed assets that will be depreciated using the straight-line method to a zero book value over the six-year life of the project. Ignore bonus depreciation. The company has a marginal tax rate of 21 percent. What is the annual value of the depreciation tax shield? A) S13,650 B) $136,500 C) $163,800 D) $27,300 E) $13,160