Answered step by step

Verified Expert Solution

Question

1 Approved Answer

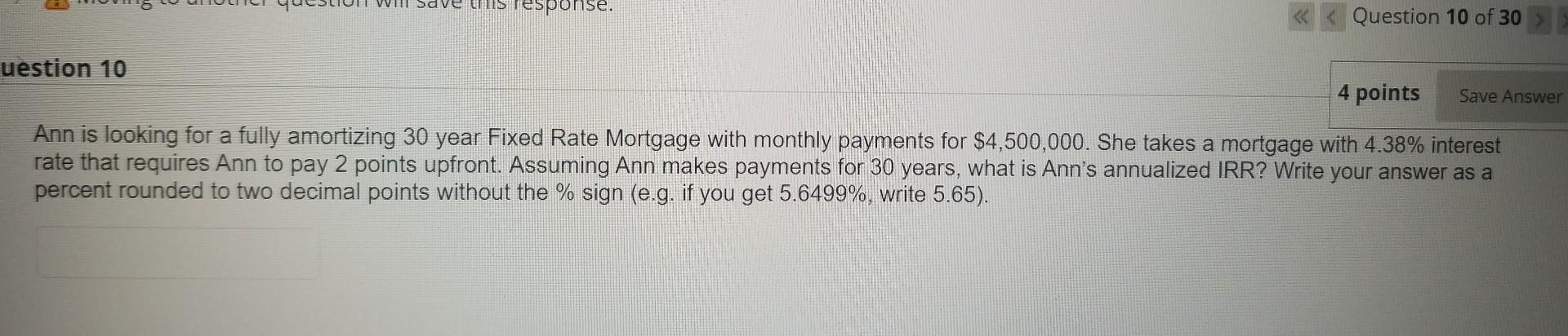

10 13 Ann is looking for a fully amortizing 30 year Fixed Rate Mortgage with monthly payments for $4,500,000. She takes a mortgage with 4.38%

10

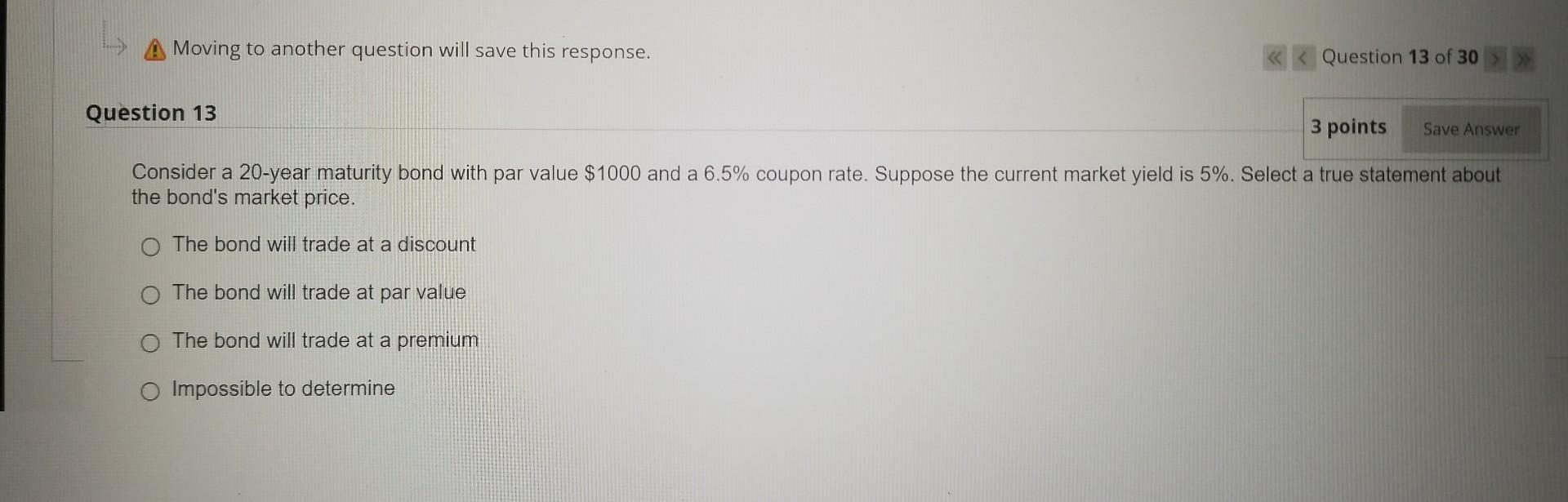

13

Ann is looking for a fully amortizing 30 year Fixed Rate Mortgage with monthly payments for $4,500,000. She takes a mortgage with 4.38% interest rate that requires Ann to pay 2 points upfront. Assuming Ann makes payments for 30 years, what is Ann's annualized IRR? Write your answer as a percent rounded to two decimal points without the \% sign (e.g. if you get 5.6499%, write 5.65 ). A Moving to another question will save this response. Question 13 of 30 Question 13 Consider a 20 -year maturity bond with par value $1000 and a 6.5% coupon rate. Suppose the current market yield is 5%. Select a true statement about the bond's market price. The bond will trade at a discount The bond will trade at par value The bond will trade at a premium Impossible to determine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started