Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10 = 19 23ITIUT39839 15. (1pt) Christie, Inc. has identified an investment project with the following cash flows. If the interest rate is 6%

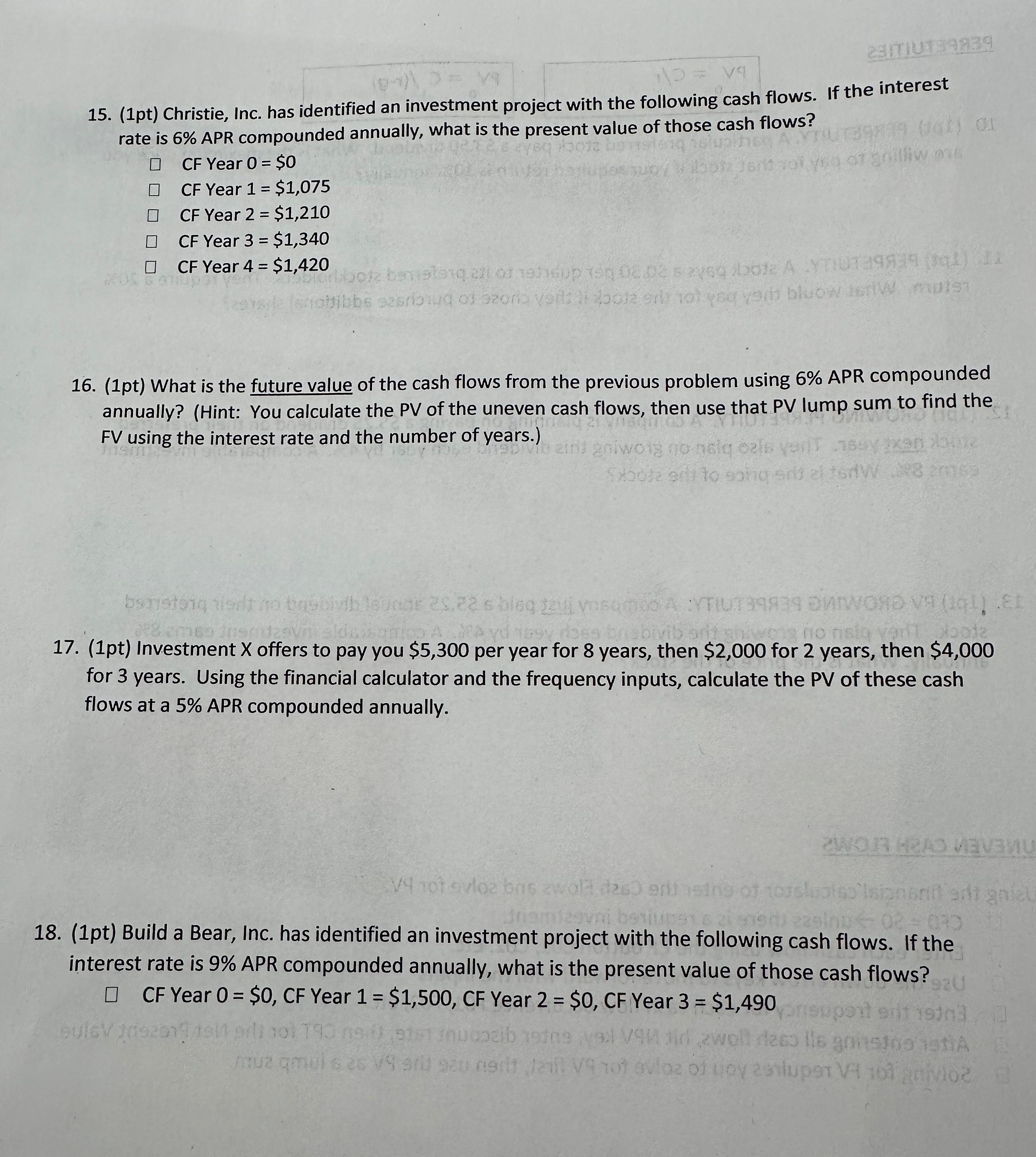

10 = 19 23ITIUT39839 15. (1pt) Christie, Inc. has identified an investment project with the following cash flows. If the interest rate is 6% APR compounded annually, what is the present value of those cash flows? 73032 CF Year 0 = $0 CF Year 1 = $1,075 CF Year 2 = $1,210 CF Year 3 = $1,340 CF Year 4 $1,420 = bozbanistaq 2 0.02s zve bo12 A gailliw ang (1) 1 shohibbs seribug of zon voit oozer not you vers blow ter muis 16. (1pt) What is the future value of the cash flows from the previous problem using 6% APR compounded annually? (Hint: You calculate the PV of the uneven cash flows, then use that PV lump sum to find the FV using the interest rate and the number of years.) zinaniwoi no naiq zis van say an DI baisten tant no basbivib lunar 29.22 s bleq 12ui vnsumos A :YTUTE DWORD VA (q).Et EL mes insodasvmsidsisqnin Ayd 169 ross brisbivib arit no nsig vant boo 17. (1pt) Investment X offers to pay you $5,300 per year for 8 years, then $2,000 for 2 years, then $4,000 for 3 years. Using the financial calculator and the frequency inputs, calculate the PV of these cash flows at a 5% APR compounded annually. 2WOUR HEAD MOVEM V4101 vloz bns zwol des ed sing of 1075 ensd o'lsionarii edi gniau 010 18. (1pt) Build a Bear, Inc. has identified an investment project with the following cash flows. If the interest rate is 9% APR compounded annually, what is the present value of those cash flows? 920 CF Year 0 = $0, CF Year 1 = $1,500, CF Year 2 = $0, CF Year 3 = $1,490 suport shit 193 Dozib 1919 vel V9M Jid zwolt deco lle gnistogastiA E uz qmuls as V9 ar sau neilt til V9 not svoz of Loy 2sluper V10 voz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started