Question

10 30/30 Gynriostsehet! Company makes two types of beauty products - Pure-Active and Premier-Active. Data concerning these two product lines appear below: Selling Price

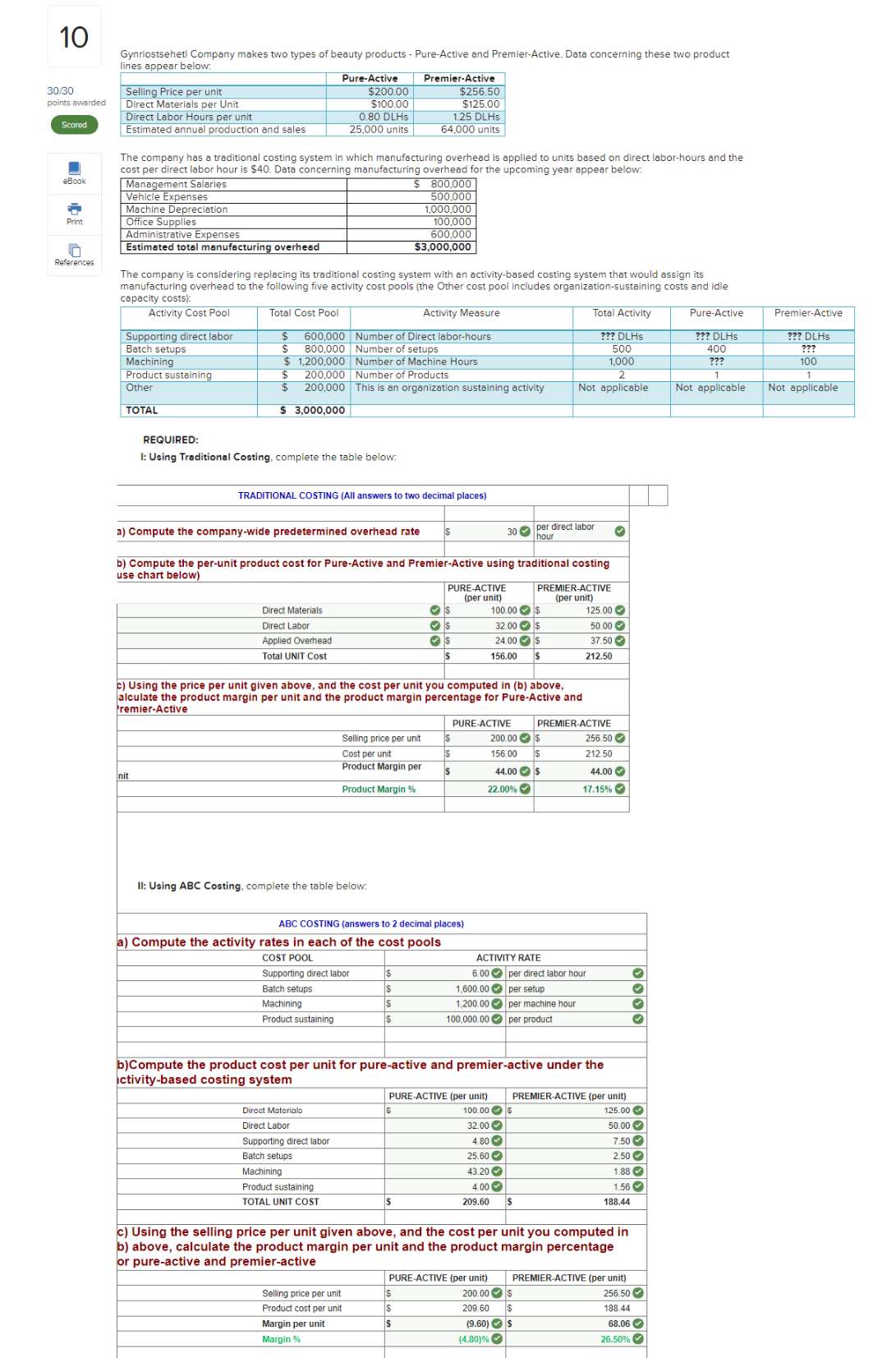

10 30/30 Gynriostsehet! Company makes two types of beauty products - Pure-Active and Premier-Active. Data concerning these two product lines appear below: Selling Price per unit Direct Materials per Unit points awarded Direct Labor Hours per unit Scored Estimated annual production and sales Premier-Active $256.50 Pure-Active $200.00 $100.00 0.80 DLHS $125.00 1.25 DLHs 25,000 units 64,000 units eBook Print References The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours and the cost per direct labor hour is $40. Data concerning manufacturing overhead for the upcoming year appear below: Vehicle Expenses Management Salaries Machine Depreciation Office Supplies Administrative Expenses Estimated total manufacturing overhead $ 800,000 500,000 1,000,000 100,000 600,000 $3,000,000 The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following five activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Activity Measure Premier-Active Activity Cost Pool Supporting direct labor Total Cost Pool Total Activity Pure-Active $ 600,000 Number of Direct labor-hours. ??? DLHS Batch setups $ 800,000 Number of setups 500 ??? DLHS 400 ??? DLHS ??? Machining $ 1,200,000 Product sustaining $ 200,000 Number of Machine Hours Number of Products 1,000 ??? 100 2 1 Other TOTAL $ 200,000 This is an organization sustaining activity $ 3,000,000 Not applicable Not applicable Not applicable REQUIRED: I: Using Traditional Costing, complete the table below. TRADITIONAL COSTING (All answers to two decimal places) a) Compute the company-wide predetermined overhead rate 30 per direct labor hour b) Compute the per-unit product cost for Pure-Active and Premier-Active using traditional costing use chart below) Direct Materials Direct Labor Applied Overhead Total UNIT Cost S PURE-ACTIVE (per unit) 100.00 PREMIER-ACTIVE (per unit) $ 125.00 S 32.00 5 50.00 S 24.00 $ 37.50 S 156.00 S 212.50 c) Using the price per unit given above, and the cost per unit you computed in (b) above, alculate the product margin per unit and the product margin percentage for Pure-Active and Premier-Active nit PURE-ACTIVE PREMIER ACTIVE Selling price per unit Cost per unit S 200.00 $ 156.00 256.50 212.50 Product Margin per Product Margin % S 44.00 $ 44.00 22.00% 17.15% II: Using ABC Costing, complete the table below: ABC COSTING (answers to 2 decimal places) a) Compute the activity rates in each of the cost pools COST POOL Supporting direct labor S Batch setups: S Machining S Product sustaining s ACTIVITY RATE 6.00 1,600.00 1,200.00 100,000.00 per setup per direct labor hour per machine hour per product 0000 b)Compute the product cost per unit for pure-active and premier-active under the activity-based costing system Direct Materialo Direct Labor Supporting direct labor Batch setups Machining Product sustaining TOTAL UNIT COST PURE-ACTIVE (per unit) 100.00 $ 32.00 PREMIER-ACTIVE (per unit) 125.00 50.00 4.80 7.50 25.60 2.50 43.20 1.88 4.00- 1.56 S 209.60 S 188.44 c) Using the selling price per unit given above, and the cost per unit you computed in b) above, calculate the product margin per unit and the product margin percentage or pure-active and premier-active PURE-ACTIVE (per unit) PREMIER-ACTIVE (per unit) Selling price per unit S Product cost per unit s Margin per unit S 200.00 $ 209.60 (9.60) $ 256.50 188.44 68.06 Margin % (4.80)% 26.50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started