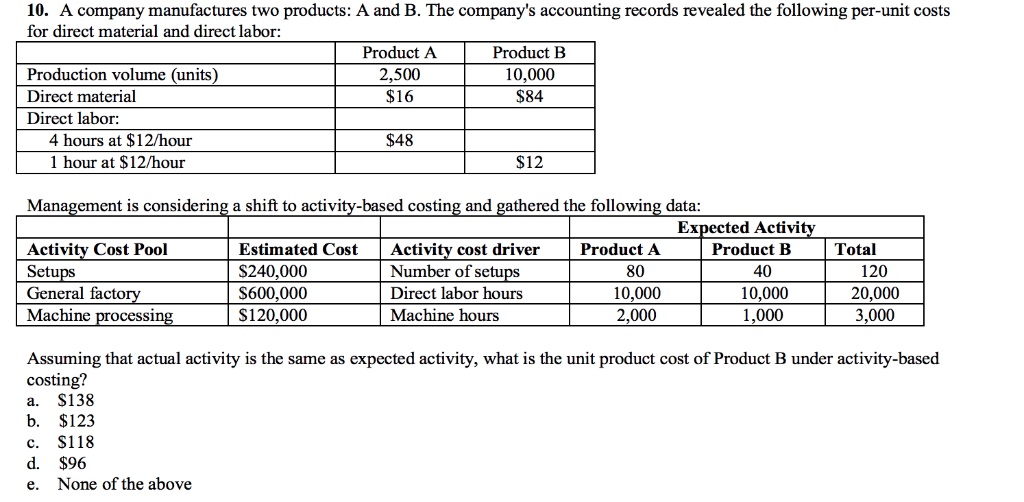

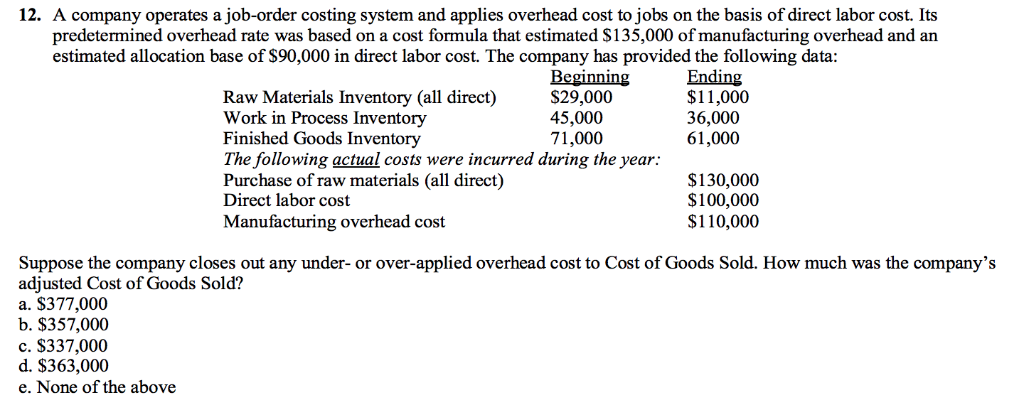

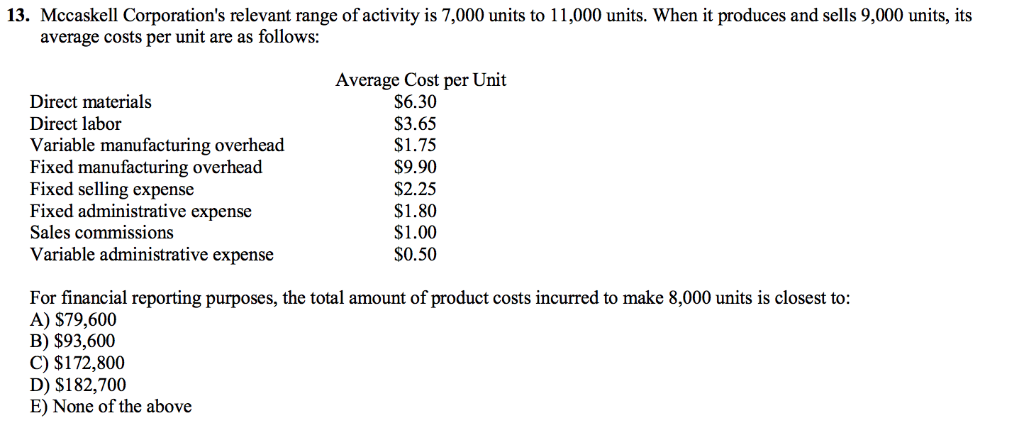

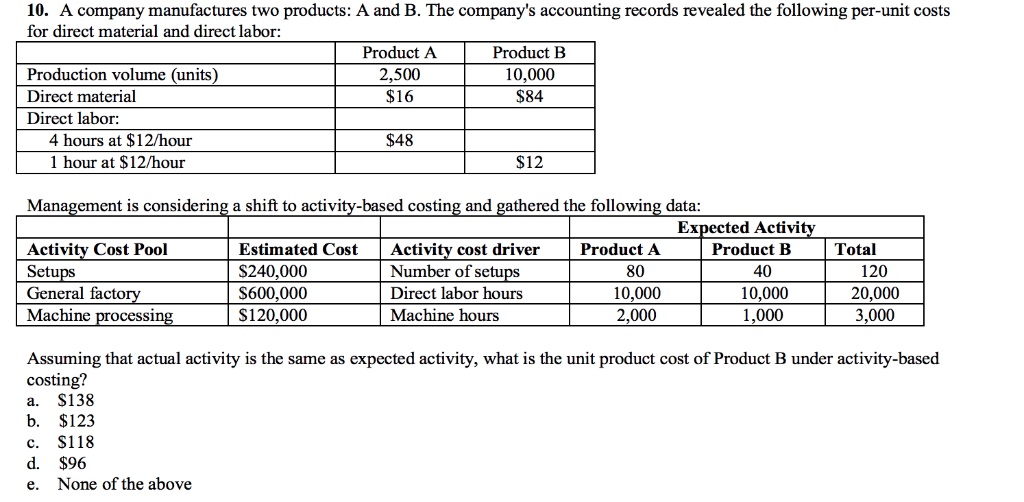

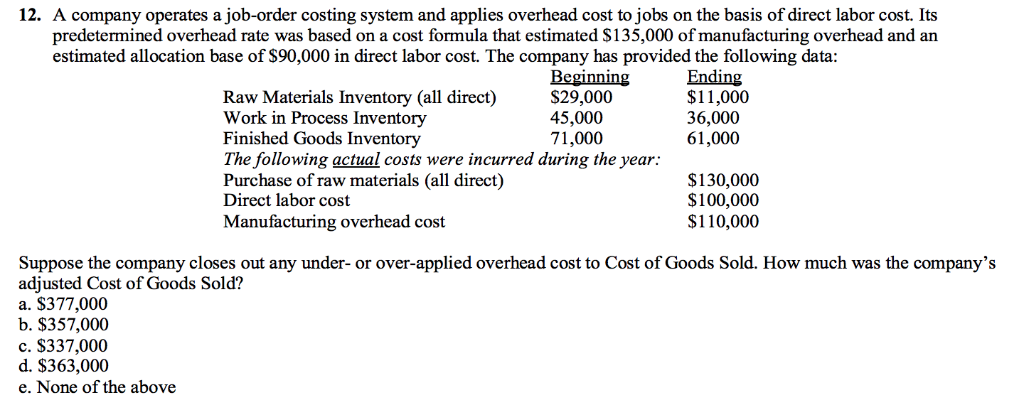

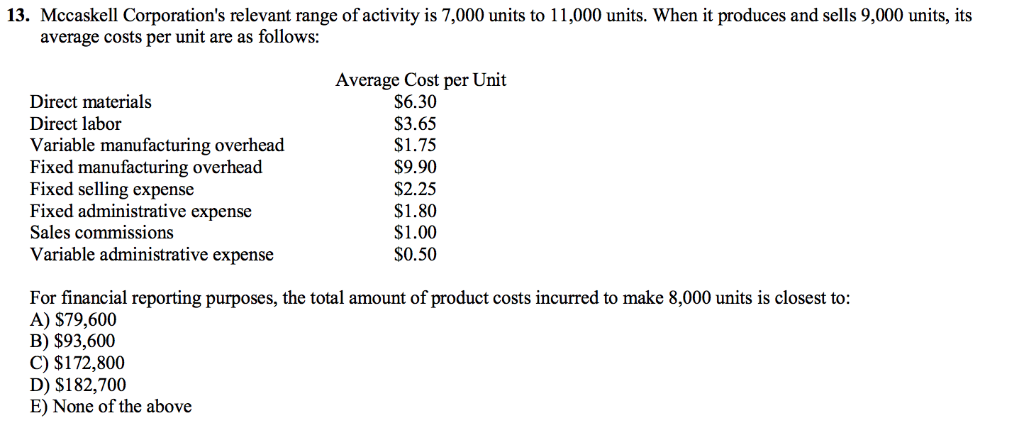

10. A company manufactures two products: A and B. The company's accounting records revealed the following per-unit costs for direct material and direct labor Production volume (units Direct material Direct labor: Product A 2,500 $16 Product B 10,000 $84 4 hours at $12/hour 1 hour at $12/hour $48 $12 Management is considering a shift to activity-based costing and gathered the following data: Expected Activi Activity Cost Pool Setu General facto Machine processin Estimated Cost Activitv cost driver S240,000 S600,000 S120,000 Product A Product B Total Number of setu Direct labor hours Machine hours 80 10,000 2,000 40 10,000 1,000 120 20,000 3,000 Assuming that actual activity is the same as expected activity, what is the unit product cost of Product B under activity-based costing? a. S138 b. $123 c. S118 d. $96 e. None of the above 12. A company operates a job-order costing system and applies overhead cost to jobs on the basis of direct labor cost. Its predetermined overhead rate was based on a cost formula that estimated $135,000 of manufacturing overhead and an estimated allocation base of S90,000 in direct labor cost. The company has provided the following data S29,000 45,000 71,000 Ending $11,000 36,000 61,000 Raw Materials Inventory (all direct) Work in Process Inventory Finished Goods Inventory The following actual costs were incurred during the year: Purchase of raw materials (all direct) Direct labor cost Manufacturing overhead cost $130,000 $100,000 $110,000 Suppose the company closes out any under- or over-applied overhead cost to Cost of Goods Sold. How much was the company's adjusted Cost of Goods Sold? a. $377,000 b. $357,000 c. S337,000 d. $363,000 e. None of the above 13. Mccaskell Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $6.30 $3.65 $1.75 $9.90 $2.25 $1.80 $1.00 S0.50 For financial reporting purposes, the total amount of product costs incurred to make 8,000 units is closest to A) $79,600 B) $93,600 C) $172,800 D) S182,700 E) None of the above