Answered step by step

Verified Expert Solution

Question

1 Approved Answer

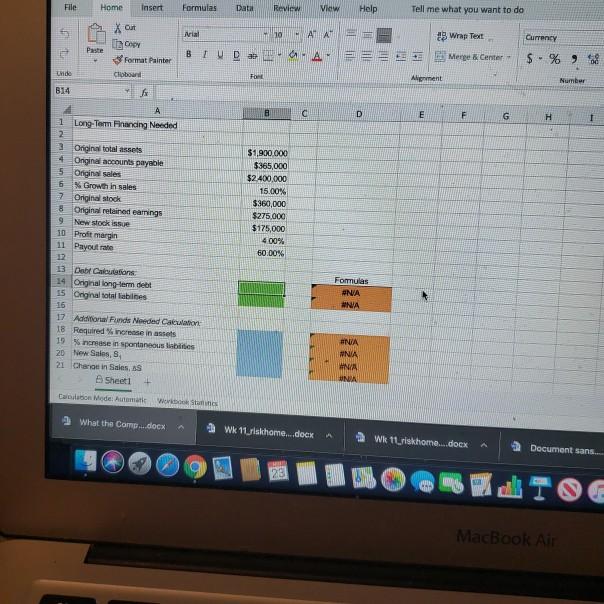

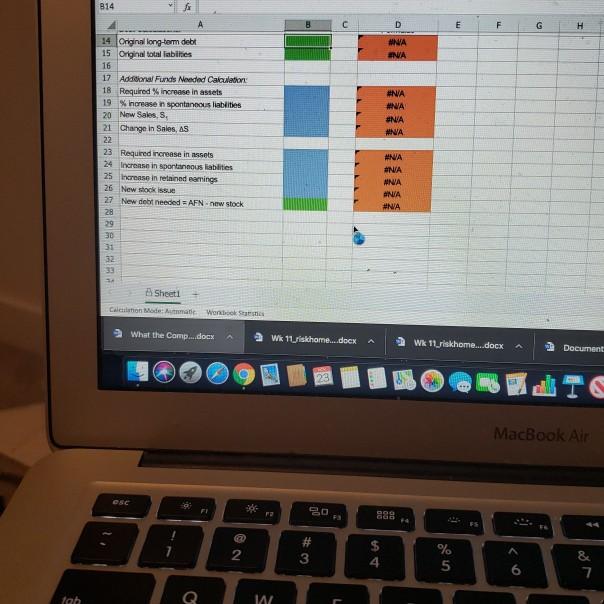

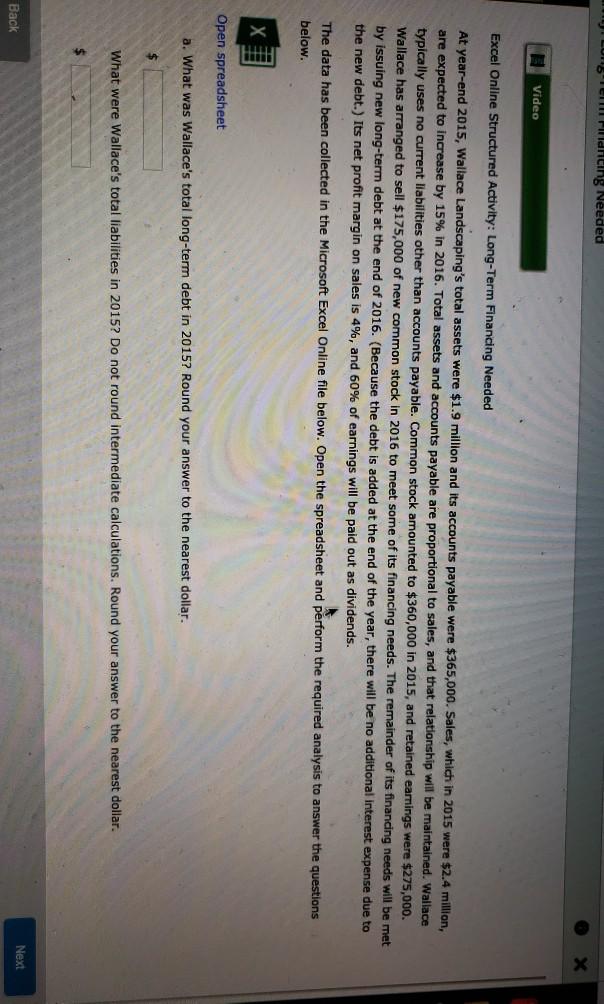

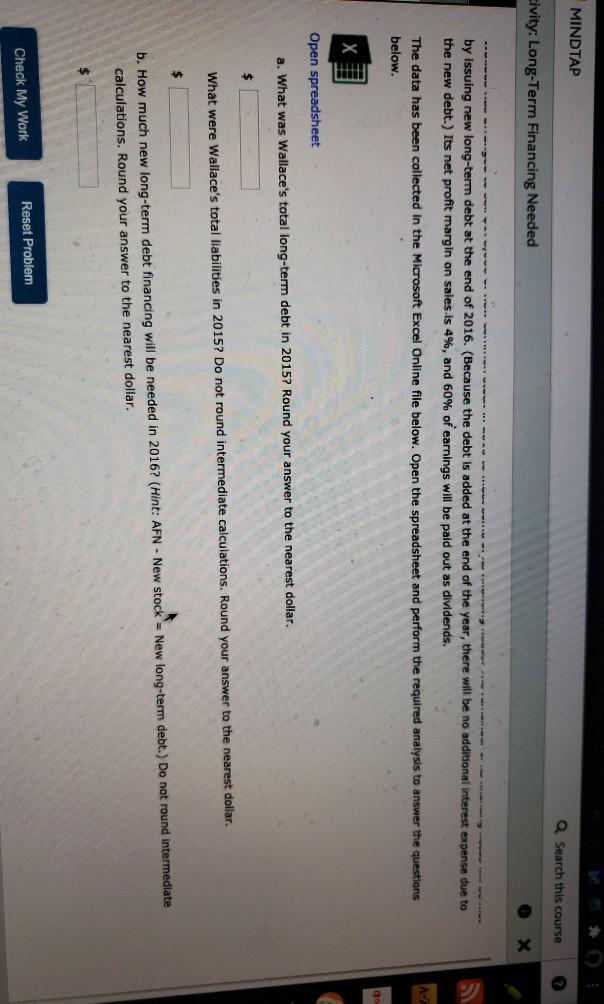

10 A year-end 2015, Wallace Landscaping's total assets were $1.9 million and its accounts payable were $365,000 Sales, which in 2015 were $2.4 million, are

10 A year-end 2015, Wallace Landscaping's total assets were $1.9 million and its accounts payable were $365,000 Sales, which in 2015 were $2.4 million, are expected to increase by 15% in 2016. Total assets and accounts payable we proportional to sales, and that relationship will be maintained Wallace typically uses no current liabilities other than accounts payable Commen stock mounted to $360,000 in 2015, and retained earnings were $225.000 Wallace has arranged to sell $175,000 of new common stock in 2016 to meet some of its financng needs. The remainder of its firanding needs will be met by issuing new long-term debt at the end of 2016 (ecause the debt is added at the end of the year, there will be no additional interesador to the new debt.) Is net profit margin on sales, and 50% of earnings will be paid out as dividends The data e been collected in the Microsoft Excel Online Niebelow. Open the spreadsheet and perform the required snalysis to answer the questions below DASH 2. What was Wallice's total bong-term dat in 2017 Round your answer to the nearest Gallar What were Wallace's total liabilities in 2015? Do not found intermediate calculations, Round your answer to the nearest dollar $ b How much new long-term det financing will be needed in 20167 (Mint: AFY-New stock New long-term diebt) Do not found intermediate calculations, Round your answer to the nearest dollar. Buck Net Show Wk 11 riskhome....docx Wk 11khome...docx - Document sans dock Prensreadsher a. What was Wallace's total long-term debt in 20157 Round your answer to the nearest dolar. What were Wallace's total liabilities in 20157 Do not round intermediate calculations. Round your answer to the nearest dollar $ b. How much new long-term debt financing will be needed in 2016? (Hint: AFN New stock - New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dollar File Home Insert Formulas Data Review View Help Tell me what you want to do Arial 110 M All Wrap Text Currency Paste X Out Copy Format Painter Choboard Merge Center $ - %08 For Aliment Number 814 fx B D E F G H A 31 Long-Term Financing Needed 2 Original total assets 4 Ongina accounts payable 5 Original sales 5 * Growth in sales 7 Original stock 8 Original retained eamings 9 New stock issue 10 Profit margin 11 Payout rate 12 13 Debt Calculations 14 Original long-term debt 15 Original total liabilities 16 17 Additional Funds Needed Calculation 18 Required increase in assets 19 case in spontaneous les 20 New Sales, 21 Chaos in Sales, as Sheet1 + Colon Mode: Automat Web States $1.900.000 $365,000 $2400,000 15.00% $360,000 $275,000 $175,000 400% 60.00% Fomulas PNA NA ANUA WNA NA UNA 2 What the Como.docx Wk 11 iskhome....docx Wie iskhome....docx A Document sans w MacBook Air 814 E F G H #NA ANA #NA #NA ANA #NA 14 Orginal long-term debt 15 Original total abilities 16 17 Addonial Funds Needed Calculator 18 Required increase in stets 19 % Increase in spontaneous liabilities 20 New Sales, S, 21 Change in Sales, as 22 23 Required increase in assets 24 Increase in spontaneous ablities 25 increase in retained earrings 26 New stock issue 27 New debt needed = AFN - new stock 28 29 30 31 32 NA #NA NNA ANA #NA Sheet Calculation de mate Works What the Comp...docx 2 Wikishome....docx A Wk 11riskhome....docx Document IC MacBook Air O 09 G ** 2 3 $ 4 % 5 & tab 1A Tem Pidhcing Needed Video Excel Online Structured Activity: Long-Term Financing Needed At year-end 2015, Wallace Landscaping's total assets were $1.9 million and its accounts payable were $365,000. Sales, which in 2015 were $2.4 million, are expected to increase by 15% in 2016. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $360,000 in 2015, and retained earnings were $275,000. Wallace has arranged to sell $175,000 of new common stock in 2016 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 4%, and 60% of earnings will be paid out as dividends. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What was Wallace's total long-term debt in 2015? Round your answer to the nearest dollar. $ What were Wallace's total liabilities in 2015? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Next Back MINDTAP Q Search this course civity: Long-Term Financing Needed by issuing new long-term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales.is 4%, and 60% of earnings will be paid out as dividends. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. go Open spreadsheet a. What was Wallace's total long-term debt in 20157 Round your answer to the nearest dollar. $ What were Wallace's total liabilities in 2015? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. How much new long-term debt financing will be needed in 20167 (Hint: AFN - New stock = New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dollar. Check My Work Reset Problem 10 A year-end 2015, Wallace Landscaping's total assets were $1.9 million and its accounts payable were $365,000 Sales, which in 2015 were $2.4 million, are expected to increase by 15% in 2016. Total assets and accounts payable we proportional to sales, and that relationship will be maintained Wallace typically uses no current liabilities other than accounts payable Commen stock mounted to $360,000 in 2015, and retained earnings were $225.000 Wallace has arranged to sell $175,000 of new common stock in 2016 to meet some of its financng needs. The remainder of its firanding needs will be met by issuing new long-term debt at the end of 2016 (ecause the debt is added at the end of the year, there will be no additional interesador to the new debt.) Is net profit margin on sales, and 50% of earnings will be paid out as dividends The data e been collected in the Microsoft Excel Online Niebelow. Open the spreadsheet and perform the required snalysis to answer the questions below DASH 2. What was Wallice's total bong-term dat in 2017 Round your answer to the nearest Gallar What were Wallace's total liabilities in 2015? Do not found intermediate calculations, Round your answer to the nearest dollar $ b How much new long-term det financing will be needed in 20167 (Mint: AFY-New stock New long-term diebt) Do not found intermediate calculations, Round your answer to the nearest dollar. Buck Net Show Wk 11 riskhome....docx Wk 11khome...docx - Document sans dock Prensreadsher a. What was Wallace's total long-term debt in 20157 Round your answer to the nearest dolar. What were Wallace's total liabilities in 20157 Do not round intermediate calculations. Round your answer to the nearest dollar $ b. How much new long-term debt financing will be needed in 2016? (Hint: AFN New stock - New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dollar File Home Insert Formulas Data Review View Help Tell me what you want to do Arial 110 M All Wrap Text Currency Paste X Out Copy Format Painter Choboard Merge Center $ - %08 For Aliment Number 814 fx B D E F G H A 31 Long-Term Financing Needed 2 Original total assets 4 Ongina accounts payable 5 Original sales 5 * Growth in sales 7 Original stock 8 Original retained eamings 9 New stock issue 10 Profit margin 11 Payout rate 12 13 Debt Calculations 14 Original long-term debt 15 Original total liabilities 16 17 Additional Funds Needed Calculation 18 Required increase in assets 19 case in spontaneous les 20 New Sales, 21 Chaos in Sales, as Sheet1 + Colon Mode: Automat Web States $1.900.000 $365,000 $2400,000 15.00% $360,000 $275,000 $175,000 400% 60.00% Fomulas PNA NA ANUA WNA NA UNA 2 What the Como.docx Wk 11 iskhome....docx Wie iskhome....docx A Document sans w MacBook Air 814 E F G H #NA ANA #NA #NA ANA #NA 14 Orginal long-term debt 15 Original total abilities 16 17 Addonial Funds Needed Calculator 18 Required increase in stets 19 % Increase in spontaneous liabilities 20 New Sales, S, 21 Change in Sales, as 22 23 Required increase in assets 24 Increase in spontaneous ablities 25 increase in retained earrings 26 New stock issue 27 New debt needed = AFN - new stock 28 29 30 31 32 NA #NA NNA ANA #NA Sheet Calculation de mate Works What the Comp...docx 2 Wikishome....docx A Wk 11riskhome....docx Document IC MacBook Air O 09 G ** 2 3 $ 4 % 5 & tab 1A Tem Pidhcing Needed Video Excel Online Structured Activity: Long-Term Financing Needed At year-end 2015, Wallace Landscaping's total assets were $1.9 million and its accounts payable were $365,000. Sales, which in 2015 were $2.4 million, are expected to increase by 15% in 2016. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $360,000 in 2015, and retained earnings were $275,000. Wallace has arranged to sell $175,000 of new common stock in 2016 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 4%, and 60% of earnings will be paid out as dividends. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What was Wallace's total long-term debt in 2015? Round your answer to the nearest dollar. $ What were Wallace's total liabilities in 2015? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Next Back MINDTAP Q Search this course civity: Long-Term Financing Needed by issuing new long-term debt at the end of 2016. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales.is 4%, and 60% of earnings will be paid out as dividends. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. go Open spreadsheet a. What was Wallace's total long-term debt in 20157 Round your answer to the nearest dollar. $ What were Wallace's total liabilities in 2015? Do not round intermediate calculations. Round your answer to the nearest dollar. $ b. How much new long-term debt financing will be needed in 20167 (Hint: AFN - New stock = New long-term debt.) Do not round intermediate calculations. Round your answer to the nearest dollar. Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started