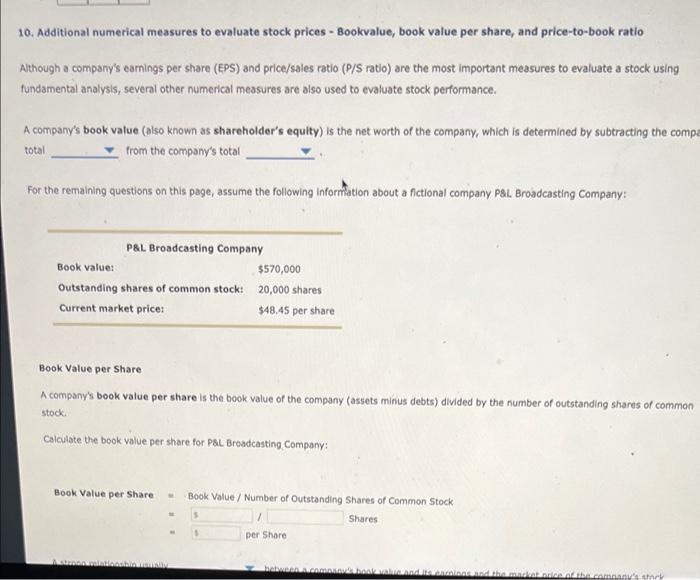

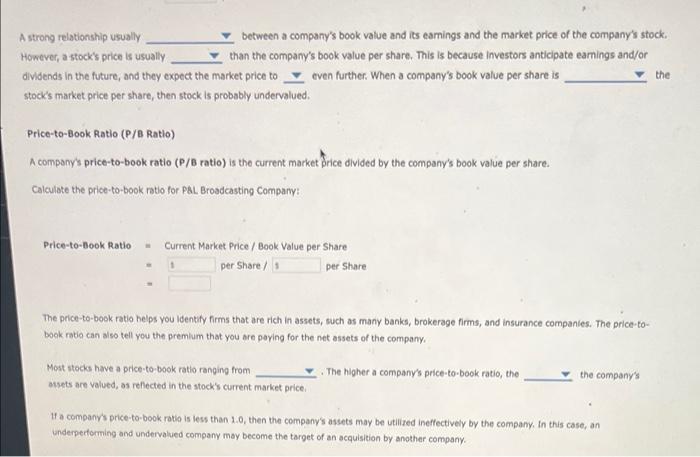

10. Additional numerical measures to evaluate stock prices - Bookvalue, book value per share, and price-to-book ratio Although a company's earnings per share (EPS) and price/sales ratio (P/S ratio) are the most important measures to evaluate a stock using fundamental analysis, several other numerical measures are also used to evaluate stock performance. A company's book value (also known as shareholder's equity) is the net worth of the company, which is determined by subtracting the compe total from the company's total For the remaining questions on this page, assume the following information about a fictional company P&L Broadcasting Company: P&L Broadcasting Company Book value: $570,000 Outstanding shares of common stock: 20,000 shares Current market price: $48.45 per share Book Value per Share A company's book value per share is the book value of the company (assets minus debts) divided by the number of outstanding shares of common stock Calculate the book value per share for Pal Broadcasting Company: Book Value per Share Book Value / Number of Outstanding Shares of Common Stock Shares per Share bonboala bed ry A strong relationship usually between a company's book value and its earnings and the market price of the company's stock. However, a stock's price is usually than the company's book value per share. This is because Investors anticipate earnings and/or dividends in the future, and they expect the market price to even further. When a company's book value per share is the stock's market price per share, then stock is probably undervalued. Price-to-Book Ratio (P/6 Ratio) A company's price-to-book ratio (P/B ratio) is the current market orice divided by the company's book value per share. Calculate the price-to-book ratio for P&L. Broadcasting Company Price-to-Book Ratio Current Market Price / Book Value per Share per Share / per Share The price-to-book ratio helps you Identity firms that are rich in assets, such as many banks, brokerage firms, and insurance companies. The price-to- book ratio can also tell you the premium that you are paying for the net assets of the company Most stocks have a price to book ratio ranging from The higher a company's price-to-book ratlo, the the company's assets are valued, as reflected in the stock's current market price a company's price-to-book ratio is less than 2.0, then the company's assets may be tired ineffectively by the company. In this case, an underperforming and undervalued company may become the target of an acquisition by another company