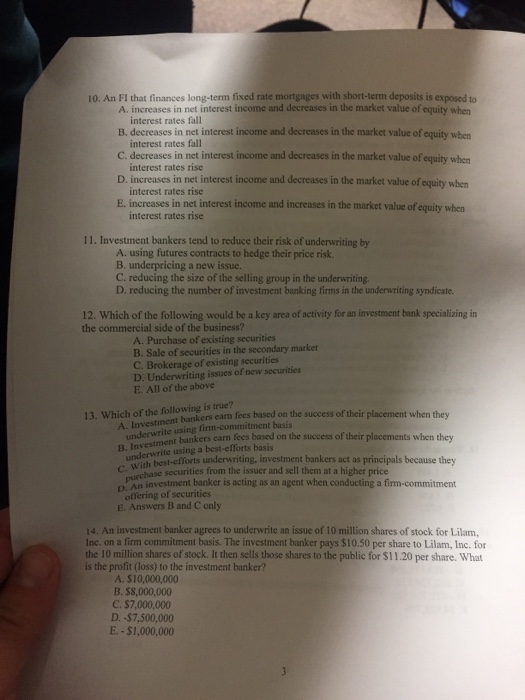

10. An FI that finances long-term fixed rate mortgages with short-term deposits is exposed to A. increases in net interest income and decreases in the market value of equity when interest rates fall B. decreases in net interest income and decreases in the market value of equity when interest rates fall C. decreases in net interest income and decreases in the market value of equity when interest rates rise D. increases in net interest income and decreases in the market value of equity when interest rates rise E. increases in net interest income and increases in the market value of equity when interest rates rise 11. Investment bankers tend to reduce their risk of underwriting by A. using futures contracts to hedge their price risk. B. underpricing a new issue. C. reducing the size of the selling group in the underwriting D reducing the number of investment banking firms in the underwriting syndicate 12. Which of the following would be a key area of activity for an investment bank specializing in the commercial side of the business? A. Purchase of existing securities B. Sale of securities in the secondary market C. Brokerage of existing securities D: Underwriting issues of new securities E. All of the above 13. Which of the following is true? ers eam fees based on the success of their placement when they te using fim-commitment basis undersment bankers carn fees based on the success of their placements when they B. Investment underwrite using a best-efforts basis deh besl-efforts underwriting, investment bankers act as principals because they C. With C. hase securities from the issuer and sell them at a higher price D. An investment banker is acting as an agent when conducting a firm-commitment offering of securities E. Answers B and C only 14. An investment banker agrees to underwrite an issue of 10 million shares of stock for Lilam, Inc. on a firm commitment basis. The investment banker pays $10.50 per share to Lilam, Inc. for the 10 million shares of stock. It then sells those shares to the public for $11.20 per share. What is the profit (loss) to the investment banker? A. $10,000,000 B. $8,000,000 C. $7,000,000 D.-$7,500,000 E. -$1,000,000