Answered step by step

Verified Expert Solution

Question

1 Approved Answer

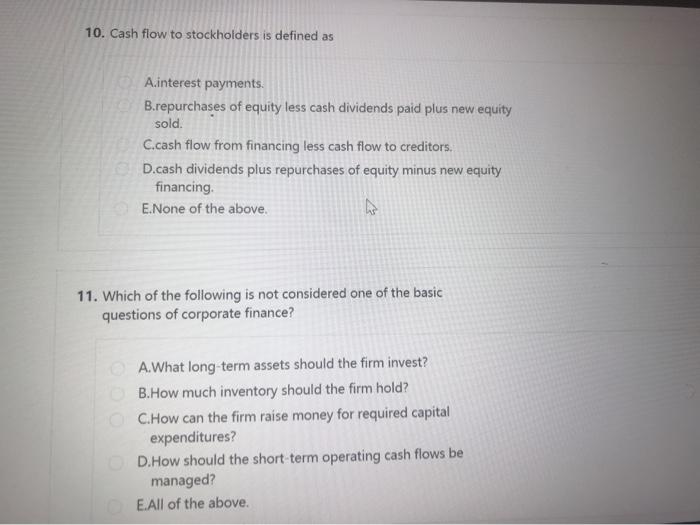

10. Cash flow to stockholders is defined as A.interest payments. B.repurchases of equity less cash dividends paid plus new equity sold. C.cash flow from

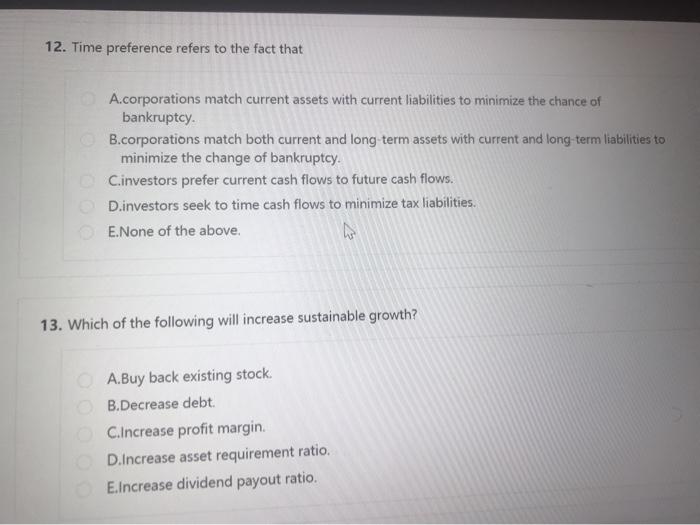

10. Cash flow to stockholders is defined as A.interest payments. B.repurchases of equity less cash dividends paid plus new equity sold. C.cash flow from financing less cash flow to creditors. D.cash dividends plus repurchases of equity minus new equity financing. E.None of the above. A 11. Which of the following is not considered one of the basic questions of corporate finance? A.What long-term assets should the firm invest? B.How much inventory should the firm hold? OC.How can the firm raise money for required capital expenditures? D.How should the short-term operating cash flows be managed? E.All of the above. 12. Time preference refers to the fact that A.corporations match current assets with current liabilities to minimize the chance of bankruptcy. B.corporations match both current and long-term assets with current and long-term liabilities to minimize the change of bankruptcy. C.investors prefer current cash flows to future cash flows. D.investors seek to time cash flows to minimize tax liabilities. E.None of the above. 13. Which of the following will increase sustainable growth? OA.Buy back existing stock. OB.Decrease debt. C.Increase profit margin. OD.Increase asset requirement ratio. E.Increase dividend payout ratio.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

10The amount of money a corporation distributes to its shareholders is known as cash flow to stockho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started