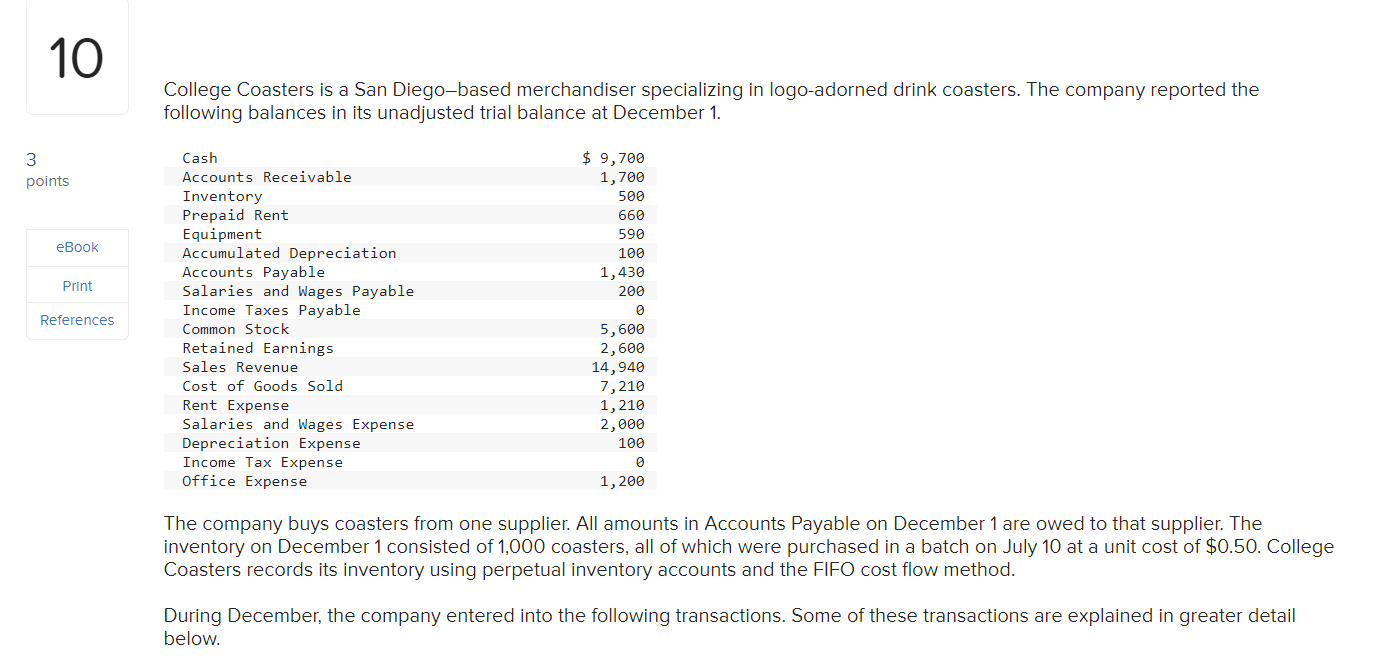

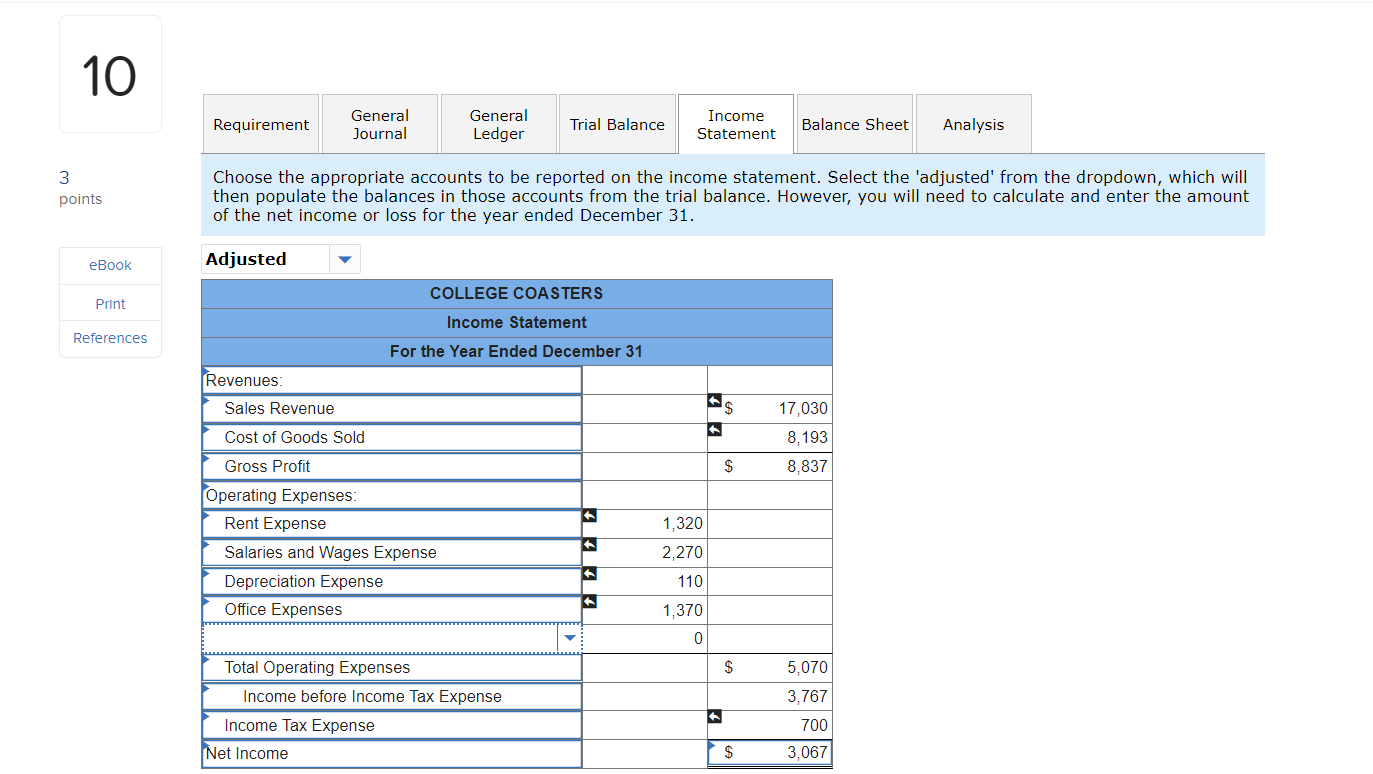

10 College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1. 3 points eBook Print References Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Salaries and Wages Expense Depreciation Expense Income Tax Expense Office Expense $ 9,700 1,700 500 660 590 100 1,430 200 0 5,600 2,600 14,940 7,210 1,210 2,000 100 0 0 1,200 The company buys coasters from one supplier. All amounts in Accounts Payable on December 1 are owed to that supplier. The inventory on December 1 consisted of 1,000 coasters, all of which were purchased in a batch on July 10 at a unit cost of $0.50. College Coasters records its inventory using perpetual inventory accounts and the FIFO cost flow method. During December, the company entered into the following transactions. Some of these transactions are explained in greater detail below. 10 Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis 3 points Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. However, you will need to calculate and enter the amount of the net income or loss for the year ended December 31. eBook Adjusted COLLEGE COASTERS Print Income Statement References For the Year Ended December 31 Revenues Sales Revenue $ 17,030 8,193 Cost of Goods Sold $ 8,837 Gross Profit Operating Expenses: Rent Expense Salaries and Wages Expense Depreciation Expense Office Expenses 1,320 2,270 110 1,370 0 $ Total Operating Expenses Income before Income Tax Expense Income Tax Expense Net Income 5,070 3,767 700 3,067 $ 10 College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1. 3 points eBook Print References Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Salaries and Wages Expense Depreciation Expense Income Tax Expense Office Expense $ 9,700 1,700 500 660 590 100 1,430 200 0 5,600 2,600 14,940 7,210 1,210 2,000 100 0 0 1,200 The company buys coasters from one supplier. All amounts in Accounts Payable on December 1 are owed to that supplier. The inventory on December 1 consisted of 1,000 coasters, all of which were purchased in a batch on July 10 at a unit cost of $0.50. College Coasters records its inventory using perpetual inventory accounts and the FIFO cost flow method. During December, the company entered into the following transactions. Some of these transactions are explained in greater detail below. 10 Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis 3 points Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. However, you will need to calculate and enter the amount of the net income or loss for the year ended December 31. eBook Adjusted COLLEGE COASTERS Print Income Statement References For the Year Ended December 31 Revenues Sales Revenue $ 17,030 8,193 Cost of Goods Sold $ 8,837 Gross Profit Operating Expenses: Rent Expense Salaries and Wages Expense Depreciation Expense Office Expenses 1,320 2,270 110 1,370 0 $ Total Operating Expenses Income before Income Tax Expense Income Tax Expense Net Income 5,070 3,767 700 3,067 $